ToffCap’s Monday Monitor provides a snapshot of interesting potential investments and event-driven trades we find while turning over many rocks, with a special focus on companies that screen cheaply and catalyst trades. The list is dynamic; it continues to grow and change. If you have interesting additions to the list, feel free to contact us at contact@toffcap.com or on Twitter.

Enjoy!

Disclaimer. ToffCap’s Monday Monitor is provided for informative purposes only. No due diligence has (yet) been performed on the names on this list. The list might change strongly on a regular basis. This overview does not constitute advice; always do your own due diligence.

Overview

I. Company watchlist

II. Catalyst trades

I. COMPANY WATCHLIST

Annotations for a selection of interesting companies with seemingly strong upside potential.

Additions this week:

Basket of FCF generators with leveraged b/s. We recently tweeted that we’re currently focusing on companies with relatively high leverage and good FCF generation, where operating earnings are stable / growing but eps is declining due to higher interest rates. We notice that the share price of such companies might be experiencing pressure in the current rate environment while they easily could (and probably will) reduce leverage given their high cash flow generation. This means that 2023 / 2024 eps might be under pressure, but could return to strong growth as of 2024 / 2025. Twitter was once again kind, with many providing interesting ideas. We’ve not vetted all suggestions, but this list includes some very interesting names: DNTL, AZE, IMCD, INPST, ALE (Poland), NOA, JBI, FTT, BERY, DLHC, DND, Lotte Chilsung, ABG, GEO, WBD, APPS, ADEA, HBI, SSNC, IIIV, HCA, AT1.

FitLife Brands (FTLF US – $ 81m). Supplier of (mainly) nutritional supplements. Management with a strong track record of value creation, aligned. Good progress on ecommerce transition, not yet reflected in shared price. Acquisition of Mimi’s Rock at attractive valuation. Potentially transformative. Trading at <7x FCF 2023e for >20% growth of ecommerce channel. Recently acquired assets of bankrupt MusclePharm for $18.5m; MS has been generating $ 1.2-1.5m revenue / month, at 25-30% gross margins. Management keeps acquiring interesting assets to leverage at very decent prices. Should start trading on Nasdaq soon.

InPost (INPST Netherlands – PNL 25bn). We have done some more work on Inpost, and the story keeps getting more interesting. Inpost is a Polish operator of Automated Parcel Machine lockers (trading in Amsterdam). Unique proposition; high-growth company in a generally very sleepy market. InPost continues to perform well and take market share from legacy postal players, who tend to be sleepy and slow. Already dominating the Polish market (‘converted’ from legacy to-door delivery), which is rapidly becoming a cash cow, the co. is currently focusing on growing in France and the UK. The latter has now uncapped capacity given the acquisition of Menzies Distribution. Reasonably cheap given growth profile (though watch for IFRS 16) and long-term ‘disruptor’ potential. In a few years’ time, Inpost could have three large cash flow generating divisions; given mgt’s history, they’ll probably continue to attack new (sleepy) markets.

Zoo Digital (ZOO UK – GBP 40m). High risk / reward. Zoo provides services for subtitling and dubbing TV content. The business is suffering (a lot) given the recent Hollywood strikes. At the current rate, Zoo’s net cash will last ~2 quarters, though management is targeting ebitda break-even by Q4. Zoo could be interesting to have on the watchlist for a trade; given the relatively low liquidity and massive share price derating, the share price reaction could be slow(ish) should a deal be announced. Caveat emptor: risky to add pre-deal.

Previous additions (excl. companies no longer on the watchlist):

Not edited since initial inclusion.

eDreams Odigeo (EDR Spain – € 830m). We highlight Andrew Walker’s excellent podcast on eDreams. eDreams is one of Europe’s largest OTA, currently transitioning from a transactional to a subscription business model with its PRIME loyalty program. This should lead to higher margins, visibility and resilience. Key metrics continue to improve. The shares are cheap due to skepticism of the model change + the company using non-standard financials metrics. Could 2-4x in a few years if the transition is successful and market valuation shifts (more) towards recurring revenue comps.

Civitanavi (CNS Italy – € 113m). Civitanavi designs and develops technology solutions of inertial navigation, geo reference and stabilization systems for both industrial and defense use. CNS IPOed in 2022, but got wrecked after reducing its 2023 guidance. The sell-off could provide an interesting entry point into a profitable company with a strong balance sheet (~26% of EV in net cash), good market and product positioning and what looks like solid growth ahead. @BerkelKip has a recent tweet on CNS.

Aplisens (APN Poland – PLN 252m). Aplisens manufactures process instrumentation (differential pressure transmitters, hydrostatic level probes, level transmitters, valves, digital indicators, gauges, etc.). Aplisens’ growth appears to have been inflecting positively over the past few years. The company recently published H1 23 results, showing ~22% revenue growth yoy and ~PLN 17m income; assuming H2 = H1 for simplicity, Aplisens is trading at roughly 7.5x 2023e p/e for >50% yoy growth in H1. Good cash flow generation and roughly 3.5% dividend, if you’re into this. No sell-side coverage.

Barco (BAR Belgium – € 1.8bn). We highlight the recent write-up. High-quality compounder. Belgian technology company with main focus on visualization technologies. Three separate divisions (i.c. no synergies) with continued strong growth potential given secular tailwinds). Continued strong qoq improvements. Barco trades at ~10x 2023e ev/ebitda for >15% ebitda growth over foreseeable future. Shares down YTD despite strong performance due to uncertainty surrounding the health of co-CEO (and major shareholder) Charles Beauduin, though shouldn’t impact the business.

ADF Group and Daktronics. We have a recent update on two of our favorite companies, who remain stubbornly cheap despite strong earnings growth (ahead).

Daktronics (DAKT US – $ 358m). Daktronics is a manufacturer of electronic scoreboards and large screen displays for sporting, commercial and transportation applications. The company has a strong market positioning and is a well-respected player. In some ways it reminds us of Barco, which also has a large screen division (though operates in other markets). Daktronics suffered during covid, but supply chain challenges have now eased and the pricing environment has improved. Fundamentals are improving, with growth returning, margins improving and NWC normalizing. DAKT is positioned for further growth, which the company expects to realize over the next quarters. Q4 (ending April 2023) was very good, which bodes well for the seasonally strong H1. Daktronics is trading at <4x ev/ebitda on our 2023 estimates of earnings and cash flow generation; continued progress should at least double this multiple, on higher earnings. Surprisingly, there’s no coverage on this company (yet). H/t AltaFoxCapital for this idea.

ADF Group (DRX Canada - CAD 115m). A ToffCap favorite. We reiterate our stance, as recently tweeted. ADF’s Q1 results were extremely strong, but have not (yet) shown the full extent of the company’s recent efficiency improvements. Going forward, ADF will double the amount of steel passing through the automation platform. This, combined with relatively more higher value-add projects on its record order backlog and a good amount of operating leverage, could lead to $40-50m ebitda in FY24 (current year). Stock could 2-3x over next ~18 months. Write-up here.

Hudson Global (HSON US – $ 61m). Hudson is a Recruitment Processing Outsourcer. Left for dead after several headwinds. Revenues are generally highly recurring in this business, creating visibility. Margins could be at the trough now that Coit acquisition mess appears to be under control. Ebitda could grow >30% pa over next few years (off low base). Trading at ~3x 2023e ev/ebitda, with $ 20m net cash on balance sheet and > $ 300m NOLs available. FCF conversion ~100% given asset light business and NOL usage.

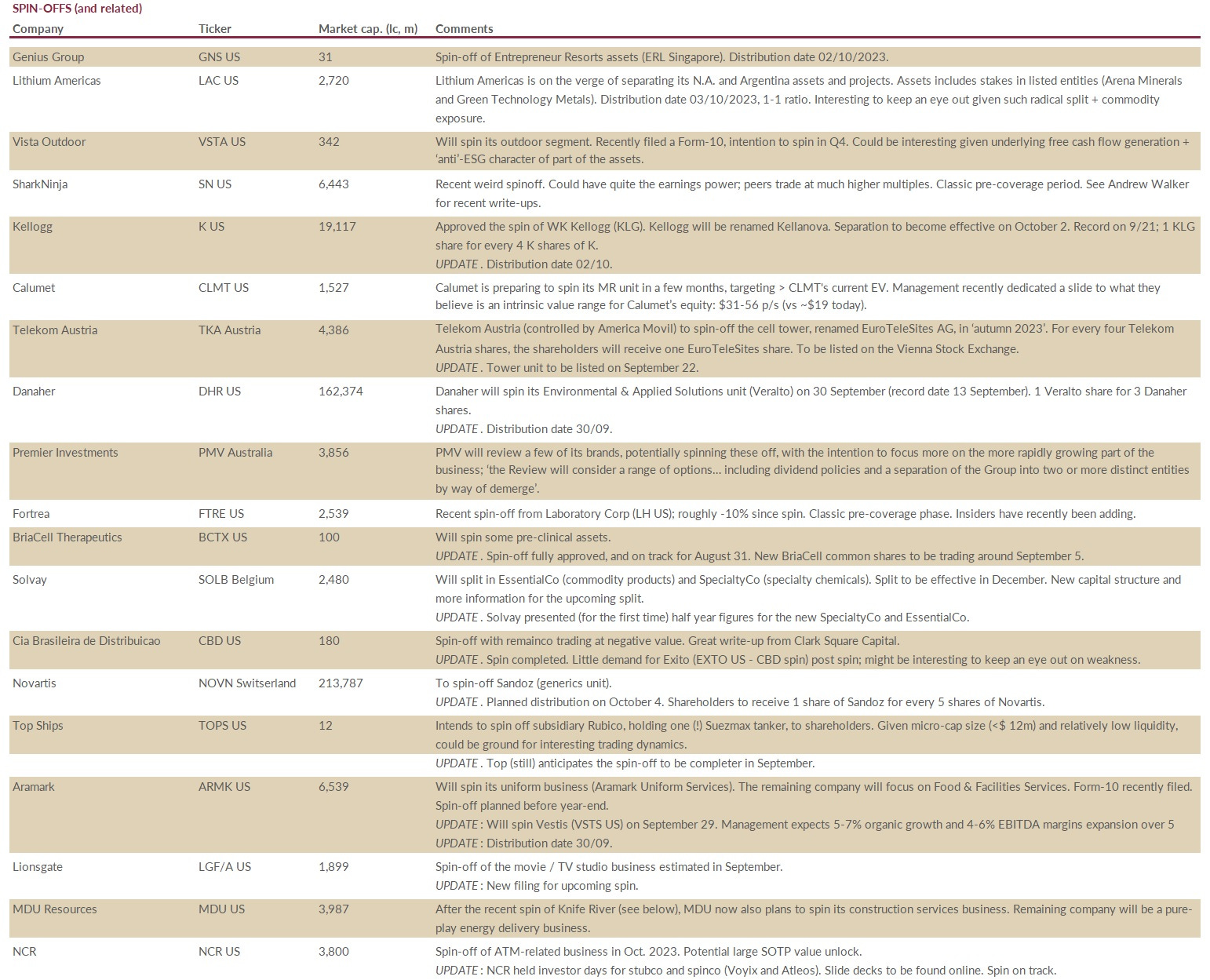

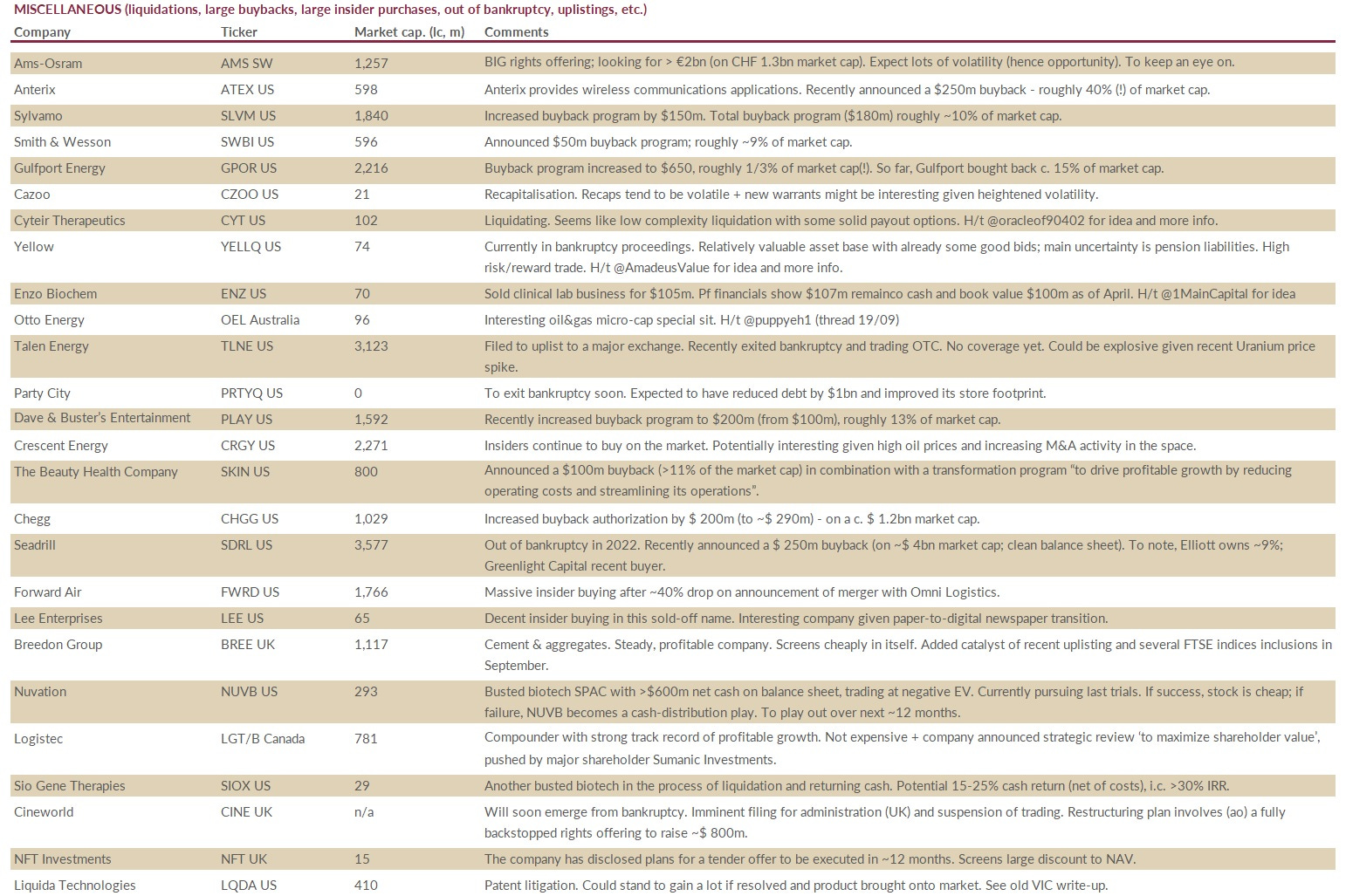

II. CATALYST TRADES

Event-driven trades and ideas.

New additions and updates

Lithium Americas (LAC US). On the verge of separating its N.A. and Argentina assets and projects. Assets includes stakes in listed entities (Arena Minerals and Green Technology Metals). Distribution date 03/10/2023, 1-1 ratio. Interesting to keep an eye out given such radical split + commodity exposure.

Genius Group (GNS US). Spin-off of Entrepreneur Resorts assets (ERL Singapore). Distribution date 02/10/2023.

Thunderbird Entertainment (TBRD Canada). Large shareholder pushing Thunderbird to review strategic alternatives; buybacks and/or liquidity event.

Cyteir Therapeutics (CYT US). Liquidation. Seems like low complexity liquidation with some solid payout options. H/t @oracleof90402 for idea and more info.

Yellow (YELLQ US). Currently in bankruptcy proceedings. Relatively valuable asset base with already some good bids; main uncertainty is pension liabilities. High risk/reward trade. H/t @AmadeusValue for idea and more info.

BlackBerry (BB US). Probable strategic review by November. Also lots of attention from Veritas Capital.

Ocean Wilson (OCN UK). Investment holdco trading at a significant discount to NAV. Announced strategic review of Wilson Sons ($PORT3) which might unlock value. Strong upside in case of liquidation.

Ams-Osram (AMS Switzerland). BIG rights offering; looking for > €2bn (on CHF 1.3bn market cap). Expect lots of volatility (hence opportunity). To keep an eye on.

Enzo Biochem (ENZ US). Sold clinical lab business for $105m. Pro-forma financials show $107m remainco cash and book value $100m as of April. H/t @1MainCapital for idea.

Arix Bioscience (ARIX UK). Investment holdco under strategic review, probably liquidation. Still seems like decent discount to NAV (10-20%) for near-term catalyst.

GAN (GAN US). Ongoing strategic process. Management already announced interest from various parties. Seems like deal might be close.

Cazoo (CZOO US). Recapitalization. Recaps tend to be volatile + new warrants might be interesting given heightened volatility.

Otto Energy (OEL Australia). Interesting oil & gas micro-cap special sit. H/t @puppyeh1 (thread 19/09).

Anterix (ATEX US). Anterix provides wireless communications applications. Recently announced a $250m buyback - roughly 40% (!) of market cap.

Sylvamo (SLVM US). Increased buyback program by $150m. Total buyback program ($180m) roughly ~10% of market cap.

Smith & Wesson (SWBI US). Announced $50m buyback program; roughly ~9% of market cap.

Gulfport Energy (GPOR US). Buyback program increased to $650, roughly 1/3 of market cap(!). So far, Gulfport bought back c. 15% of market cap.

Upcoming and recent spin-off distribution dates: ARMK 30/09, LAC 03/10, K 02/10, GNS 02/10, DHR 30/09, NVS 04/10.

MEI Pharma (MEIP US). ~$90m net cash on $50m market cap. Clinical stage biotech, attempting to merge with Infinity Pharmaceuticals (INFI US). Interesting dynamics given activists pressuring the company + potential liquidation in case of failure to merge.

UPDATE. Cable Car and Anson Advisors nominated new directors. Sounds like 'fight' is becoming more aggressive.

Which spin-off looks most compellling? Thanks for the fantastic service👌🙏

Any update on SURG?