ADF Group

I’ll keep this one short, given its simplicity. I recently tweeted about ADF Group, a company that has been performing very well, with the share price hitting multi-year highs. Despite that, I believe a LOT more is yet to come for ADF, and the shares continue to have multi-bagger potential over the next few years.

A short housekeeping note. We won’t publish ToffCap's Monday Monitor next week, as the team will be taking a few much deserved days off.

ADF Group (DRX Canada – CAD 95m) is a North American company specialised in designing, engineering and installing complex steel structures, heavy steel built-ups, as well as miscellaneous architectural metalwork. The company is a classic family-owned business, founded in 1956 by the Paschini family as a blacksmith shop, and currently owned (~45%) and managed by the second generation.

ADF’s products and services are generally focused on the complex segment of steel superstructures. This segment generally commands better pricing (and thus margins) vs the more standardised large steel structure production given a higher need for specialised skills and manufacturing to address the more customised product offering. Complex steel structures often require special equipment, specialised employees and manufacturing plants able to handle varying types of large steel superstructures (think flexible lifting capacity and transportation).

The company operates two fabrication plants, one in Quebec Canada (630k square feet) and one in the US (100k square feet). From these plants, ADF serves a diversified client base in the non-residential construction market in Canada and (mainly) the US, including general contractors, project owners, engineering firms, project architects and steel structure fabricators. The steel structures are generally intended for office towers and high-rises, commercial and recreational buildings, airport facilities, industrial complexes and transport infrastructure.

Importantly, and we’ll discuss later why, ADF’s operations are centred around two specialized market niches: the fabrication of steel superstructures with a high level of architectural and geometric complexity, and projects subject to fast-track schedules. These segments have varying levels of pricing and margins. As can be imagined, the higher the level of complexity and customisation of a steel superstructure project, the better the margins. However, these projects tend to last longer. As such, there’s a trade-off between the two kinds of projects: higher profitability for complex steel superstructure projects, but more revenue (though at lower margins) for more standardised projects.

Before jumping into the opportunity, it is important to highlight a few key dynamics of ADF and its industry, which might explain why this sector should not command high multiples, even in good times:

Demand in the non-residential construction industry tends to be strongly cyclical. There are generally more private projects in a bull cycle, whereas government projects take over in a bear cycle.

Interest rates (swings) obviously have an impact on the market.

Given the relatively large size of projects, earnings can be lumpy and swing wildly quarter-over-quarter.

It’s a very asset-heavy industry, with relatively low gross margins. Approximately half of the non-residential projects use structural steel as a structural component (the other half primarily concrete). Generally, structural steel accounts for about 10-20% of a project’s total cost. Given the sizable investment, fluctuations in raw material prices (mainly steel) could have a big impact on earnings. Though these fluctuations in raw material prices do not generally have a material impact on ADF's gross margins (its clients supply the steel and protection clauses with regards to price changes are usually included in contracts where ADF supplies the steel), big fluctuations could definitely impact the project chain, e.g. cause delays and/or cancellations.

In line with the previous point, inflation has clearly an impact, pressuring the cost structure.

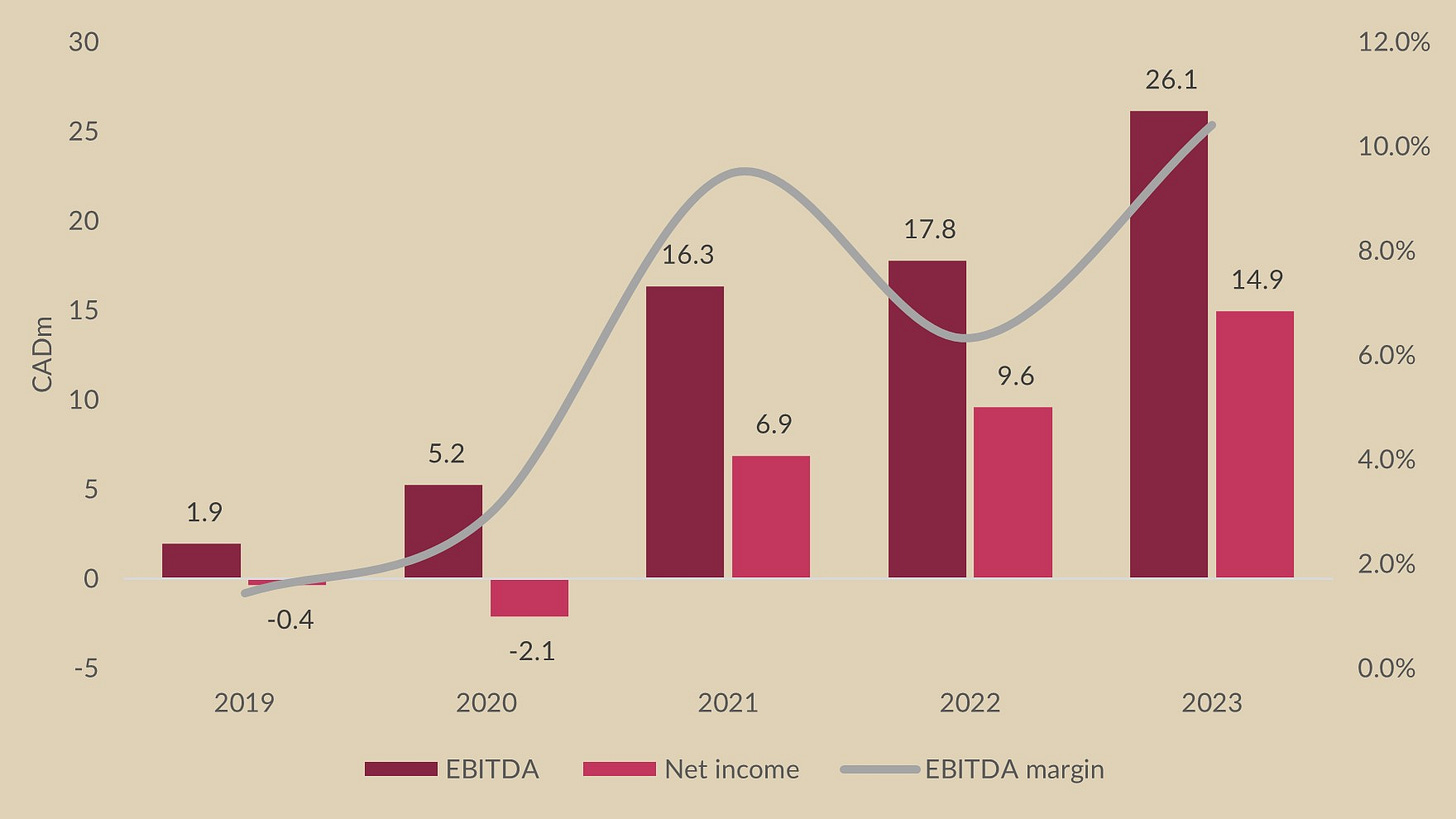

But despite all the previous points, which are impacting the company and the market at the moment, ADF has performed well over the past years, achieving very strong earnings over FY23 (fiscal year ending in January).

This performance, in combination with a few recent developments and a resilient market, bodes well for the next few years, and provides a pathway for continued strong growth.

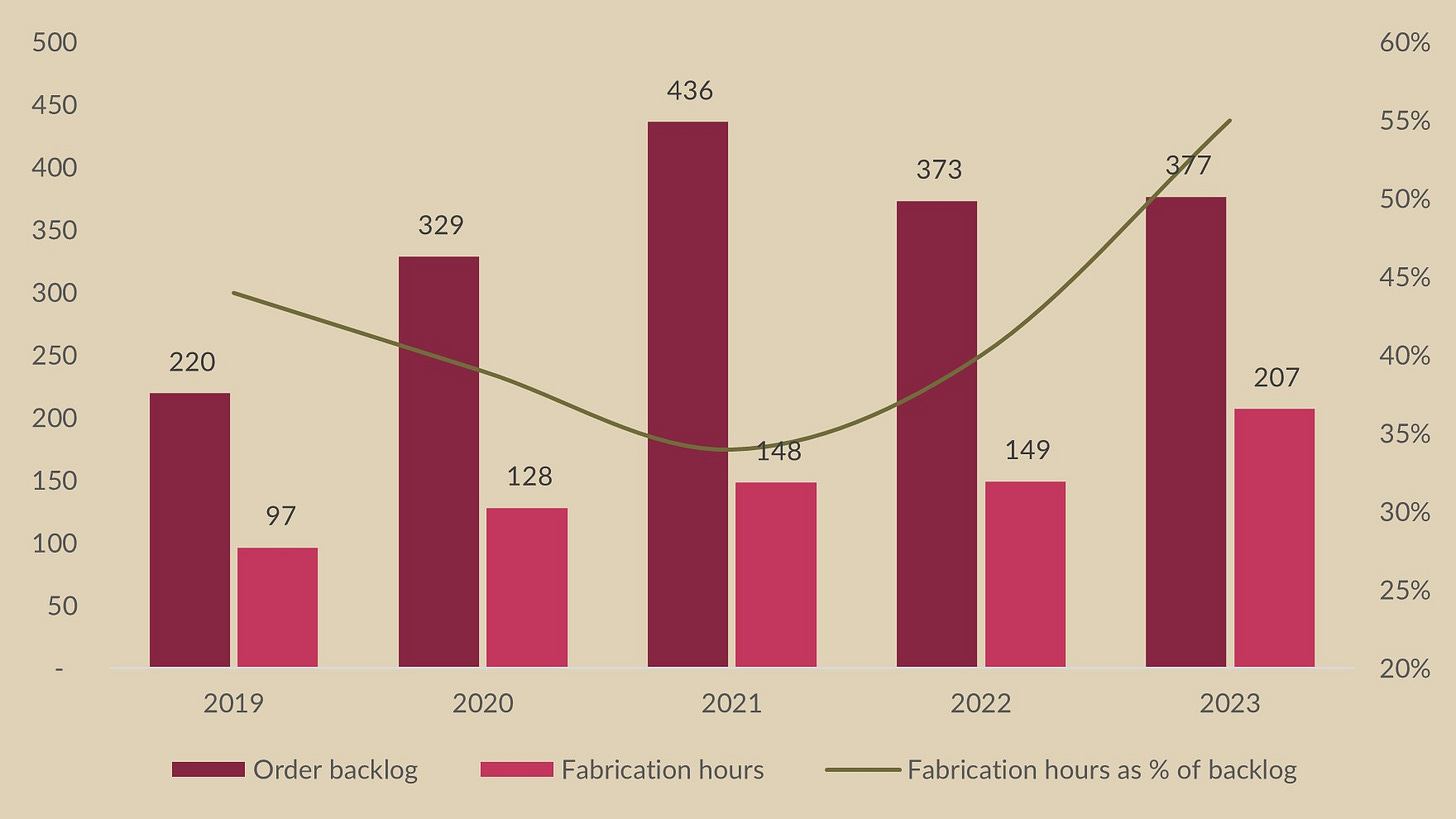

For starters, looking at the order backlog, remember the previously discussed trade-off in projects? If you look at the P&L above, you’ll notice that the company entered FY22 with a massive backlog ($436m), and generated strong revenue growth. However, FY22 gross margins were much lower yoy – this is because a lot of the backlog was in the more standardised, fast-track projects at lower margins.

But recently ADF entered FY24 with 55% of the backlog value in fabrication hours, up from 40% in the year prior. This is important because fabrication hours are ADF’s most value-added activity, and a strong driver of earnings generation.

The company's backlog Fabrication hours are c.40% higher than a year ago, with $207m in Fabrication hours out of a $377m total backlog. We don’t know the exact split in margins, but a good guess would be that this backlog alone could bring ADF’s ebitda in the $30-35m range for FY24. This has been reflected by the company in its latest annual report:

"Given the order backlog in hand to begin this new fiscal year, ADF's management expects its revenues for the fiscal year ending January 31, 2024 to increase. Although our cost structure is under pressure, given the impact of inflation on our inputs, including the cost of labor, the Corporation is confident it will remain competitive and will generate higher margins …”

Even more interestingly, ADF recently finished a two-year $30m investment project in order to acquire and install a brand-new robotic fabrication line and to strongly increase cost efficiencies at its complex in Quebec. This is exciting in itself, not only because it will bring down costs, but also because utilisation will be boosted.

Historically, ADF’s plants operated at roughly 50% capacity. This has been an inherent consequence of the industry: large, complex steel superstructures projects are big and lumpy. The plants need to operate with a high level of flexibility. In contrast, the more standardised, fast-track projects could be ramped at higher capacity - but as explained, these are lower margins projects.

This new robotic production line, as well as other new programmable and automated equipment, will allow ADF to pursue much higher utilisation levels, pushing the margins of the fast-track part of the business higher.

According to the company, with these investments ADF has now the capacity to ‘more than double’ revenues.

Indeed, ADF recently announced new orders worth a massive $140m, bringing the backlog to record-high levels. These are mostly fast-track projects, of which the largest will be carried out with the company’s new automation line.

Bottom line, the company is firing on all cylinders, and the next 18-24 months look to be very good in terms of earnings and free cash flow generation.

Regarding the latter, keep in mind that while capex is strongly down (ADF is guiding for c. $5m for FY24), the working capital needs in this industry are high. Free cash flow is generally earned when projects fade and growth stabilises. Given the massive growth ahead, you should expect quite some working capital investments (and releases) over the next few years.

Overall, looking out a few years, and assuming a more normalised growth as of let’s say FY25, it wouldn’t be a surprise to see ADF generate >$50m ebitda – and this is conservative given the current backlog and efficiency measures. At a very reasonable multiple of 7x, that’s at least 3x on the current share price (on the current relatively clean balance sheet, excluding any cash generation).

But again, $50m ebitda seems conservative based on the current progress. What’s more, the company is not seeing a slowdown in growth anytime soon:

“…well, the markets are really active. We see a lot of projects out there. We're starting to see some of the impact from all the infrastructure package, mainly in the U.S. There's still a lot of volume out west in the U.S., California with the 2028 Olympics coming, a lot of investments still coming… And in spite of the raise in interest rates and the inflationary pressure, we still see the bidding pipeline really positive, active. And bearing something unknown as we stand, and we know that things could change, but what we see now, we definitely see growth for the coming 3, 4, 5 years." - Jean-François Boursier

Hi

many thanks for the write-up.

The only hair on the situation that I can find for now is the customer concentration risk. It seems (as per FY2023 1H report, the top customer accounted for > 50% of revenue, and "65% of the Corporation’s revenues was realized with three (3) clients". Do you have any thoughts / view on that aspect? Is it normal for them?

Kind regards