On boring businesses

Cinema projectors, Daktronics and ADF Group

Did you know that we are in a cinema projector super-cycle?

It’s true, even though I bet many wouldn’t believe this at first. Isn’t cinema hurting? Aren’t people watching more often at home? Why would cinemas do expensive capital investments while business is suffering?

Indeed, whatever projections you see out there for the number of cinema screens, it isn’t screaming growth, particularly in the more developed part of the world. The numbers are stable at best – on a global level. But we are in a cinema projector super-cycle nonetheless.

The main reason for this is new technology, in this case the advent of the laser projector. A large and important development in projection technology is the shift from lamp-based to laser projection technology. Despite the much higher sales price of a laser projector compared to a lamp-based projector (roughly $45k versus $25/30k on average), the benefits of laser projectors vastly outweigh the higher initial investment. To name a few:

Laser projectors have a superior image quality.

They also allow for much greater flexibility in image projection.

Laser projectors have a much longer useful life (in theory; we don’t yet know for sure as the installed base is so new).

The newest generation of laser projectors enable the possibility for remote operation and remote maintenance, saving labor hours.

Overall, the total cost of ownership of a laser projector is lower than a comparable lamp-based projector, as the latter needs to replace the lamp source two to three times per year, at a cost of roughly $1,200 per lamp. In addition, the amount of energy used to operate laser projectors is ~50% lower compared to lamp-based projectors.

The superiority of the new technology, combined with an aging installed base, is driving a big replacement cycle. It started a few years ago, was postponed by covid, but has been accelerating since. Companies like Barco are expecting this replacement cycle to extend to the end of the decade, providing for a long tailwind for growth.

What’s more, new technologies create new opportunities, as always. In this case, the flexibility and versatility of laser projectors is opening new markets, such as digital museums, 360-degree projections, virtual-experience simulations, new experiences at events, concerts, light-festivals and throughout cities, etc. The laser projection market is booming and we are just in the early innings.

Why do I bring this all up (besides showing a key value driver for Barco)?

Because new tech combined with boring, seemingly matured industries can create explosive dynamics. Suddenly, a company operating in a mature industry (and valued as such) has a big tailwind for several years. What investors generally dismiss as a low growth, commoditized and perhaps boring business is now suddenly vibrant and exciting.

I’ve found that, while this new growth spurt is not everlasting, the market tends to underestimate (or ignore) the full impact of new technological developments on the business. More specifically, in my experience investors often underestimate:

the longevity of the tailwinds. The larger and older the installed base, the longer the tailwind. Investors are often anchored to the (cyclical) past, and tend to underestimate how long the company might benefit from the new developments.

the relative impact on fundamentals, which is once again anchored to what has been achieved by the company in the past. New technology could strongly raise margins, particularly as software becomes increasingly important (and particularly in asset heavy industries).

the cash flow generated in this period. Investors often (correctly) assume that the impact is temporary, but don’t take into account just how much the company could earn in the meantime. Even if all reverts back to the same after a few years (which it generally doesn’t), the cash flow generation could be significant, particularly given working capital releases and much reduced capex levels during this expansion period.

This underestimation creates opportunities. With small- and micro-caps, you can often even actually wait for the initial impact of the new tech to show in the fundamentals before building a position.

This ties well to two other companies I’ve regularly addressed: Daktronics and ADF Group. Both companies are experiencing the impact of a new tech, which is starting to have a significant impact on results, and perhaps even indefinitely in ADF’s case, hence changing the business forever.

Daktronics

Let’s start with Daktronics (ticker DAKT), which produces and sells digital boards and large (LED) display systems for a variety of purposes, such as live events, outdoor billboards, road navigation, high schools, control rooms, etc. Daktronics is not the cheapest on the market, but the company has nonetheless been able to command a roughly 45% market share in North America, as quality, customization and service are very important factors in this business. If you’re going to hang a new board in a stadium or high school for a long time, pricing is important, but not the main factor.

In Daktronics’ case, the market is experiencing tailwinds on the back of digitization, the penetration of LED and replacement, all driving renewed growth in the industry. Similarly to Barco (on the projector side), the onset of new tech is driving a replacement cycle, given higher quality, versatility and flexibility of digital (LED) boards and screens. Though in contrast to Barco, there is less pressure on Daktronics’ clients for replacement and I expect the cycle to be relatively less fierce, but more prolonged. Nonetheless, it promises healthy growth for years to come. This appears in line with Daktronics, at least for the medium-term, with the company projecting the market to grow at ~20% p.a. through 2026.

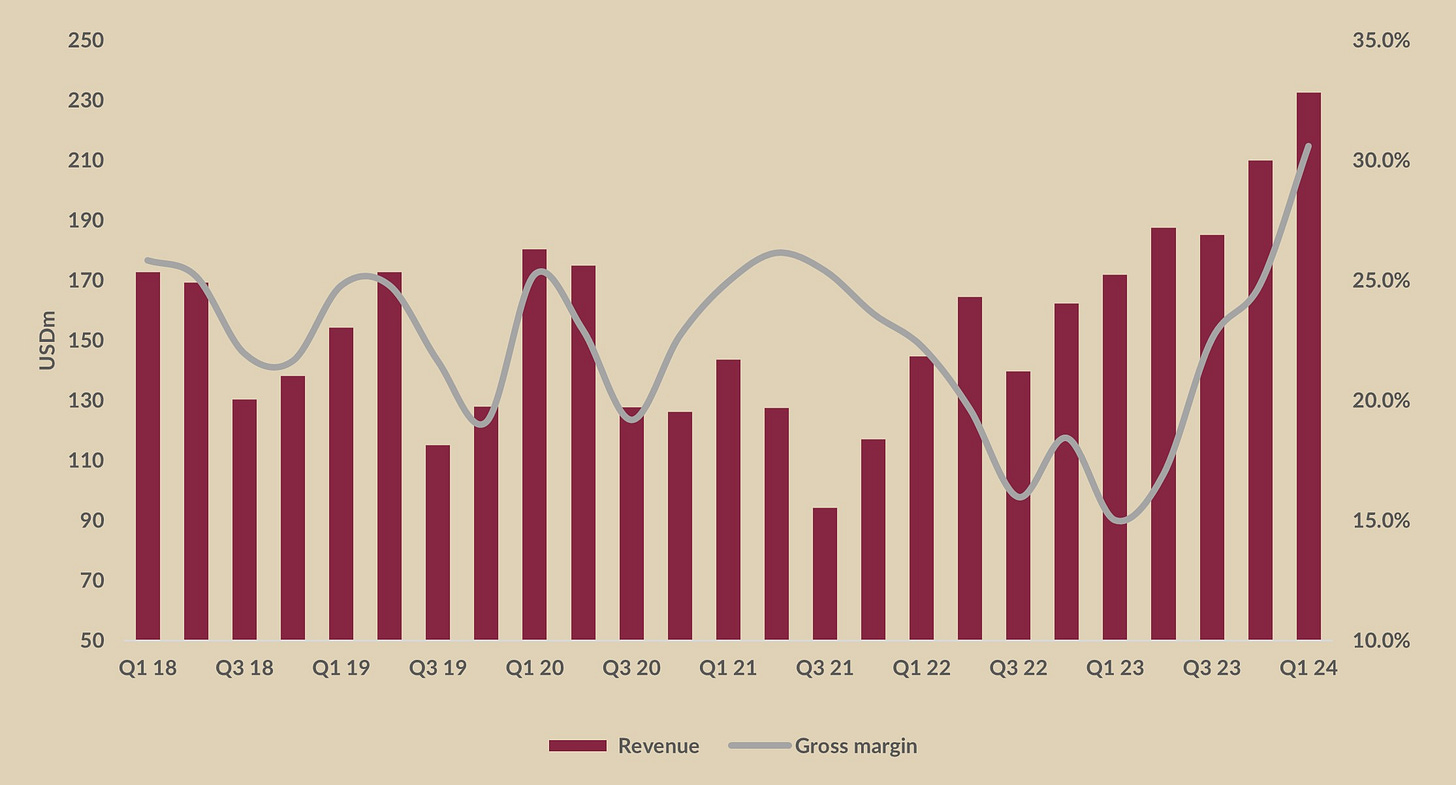

With respect to Daktronics, for the first time in almost a decade, the company seems to have all going in the right direction; no (more) company specific issues that compress margins, no relatively higher costs from investment programs, easing supply chains issues, overall market environment headwinds turning into tailwinds, etc. Growth started to show in H2 23 (ending April 2023), but accelerated into the strong season as the market tailwinds and investments in efficiency started to bear fruit.

The company’s recent Q1 23/24 performance (April - July 2023) was very promising. Daktronics is growing more rapidly than the market (which is thus expected to grow >20% p.a. over the next few years) given strong demand and price increases. The gross margin showed an impressive expansion, driven by new product offering, economies of scale and investments in automation over the past 18 months.

I previously estimated that Daktronics could earn >$90m ebitda this year, but that now seems to conservative, with ~$45m already in Q1 (though keep in mind that H1 >> H2). But let's say they'll generate $100m (I believe more); that implies that the company is currently trading at ~4x forward ev/ebitda, excl. cash generated, despite continued strong growth to be expected over the next years.

Not cheap at all imo for such a growth profile. But it’s much more interesting to see where earnings could go. There's a lot of operating leverage in this type of business, as we have seen in the recent results with the company able to maintain opex stable yoy.

What could Daktronics earn in a few years? Simplistically (and you know I like to focus on directionality rather than numerical precision), let’s say yoy revenue growth in Q2 is roughly the same as in Q1 (35%), and that H2 growth is 20%. Let’s also assume that FY25 / FY26 growth is 20% / 15% (FY26 ends in April, so we’re looking out roughly 2.5 years – not that long). This results in roughly $1.3bn FY26 revenues. The gross margin in Q1 was >30%, perhaps the highest ever. But let’s be conservative, and take 28% for FY26. Finally, even though opex (excl. D&A) was stable yoy for the recent quarter, we’ll assume 5% growth for this year and 10% p.a. until FY26.

This back-of-the-envelope exercise gets us to ~$230m ebitda for FY26, or <2x ev/ebitda on today’s enterprise value.

That’s not particularly demanding. Sure, growth will slow at some point, and perhaps grind to a halt, or become even negative. But <2x is still pretty low. And what’s more, a conservative (imo) 60% free cash flow conversion gets us roughly $330m free cash flow over FY24 - FY26, or c. 75% of the current enterprise value.

Bottom line, IF Daktronics is able to reap the current market tailwinds and continue on its current growth trajectory, we have a growing company trading at low-single digit ev/ebitda looking out a few years, on pretty conservative assumptions. And cash flow generation should be pretty solid over the next few years.

Of course a lot can happen and the company needs to stay focused and execute, but this looks like a pretty large margin of safety to me.

ADF Group

I've written about ADF Group (ticker DRX) here, but I wanted to come back on this story as the results keep surprising to the upside, and the valuation remains compelling. What's more, while I believe that Daktronics’ growth and margin profile will somewhat ‘revert to the mean’ at some point in the future, ADF is poised to have structurally higher margins going forward.

As a reminder, ADF engineers, produces and installs large complex steel structures for the non-residential construction industry. This has historically been an asset heavy, lumpy business, where utilization could swing wildly from quarter to quarter. Inherently, once established, these companies tend to be local monopolies.

After a period of relatively little growth, ADF's outlook is now better than ever for a few reasons.

First of all, aging infrastructure is a big tailwind. It is well known that North American infrastructure is old and much at risk, requiring significant investments over the next decades. In 2021, the U.S. passed the Infrastructure Investment and Jobs Act, committing $1.2tn in infrastructure spending. This alone is a big tailwind and bodes well for the future.

Indeed, management is very optimistic on the market outlook, recently commenting that “… the opportunities in our markets remain more than attractive”.

This is also reflected in ADF's backlog which remains at elevated levels, and largely comprised of Fabrication Hours, ADF’s most value-added activity. But importantly, a big chunk of the backlog is to be processed with the company’s new robotic automation line.

And this is the second growth driver. ADF recently finished a two-year $30m investment project in order to acquire and install a brand-new robotic fabrication line. This will strongly increase cost efficiencies and throughput.

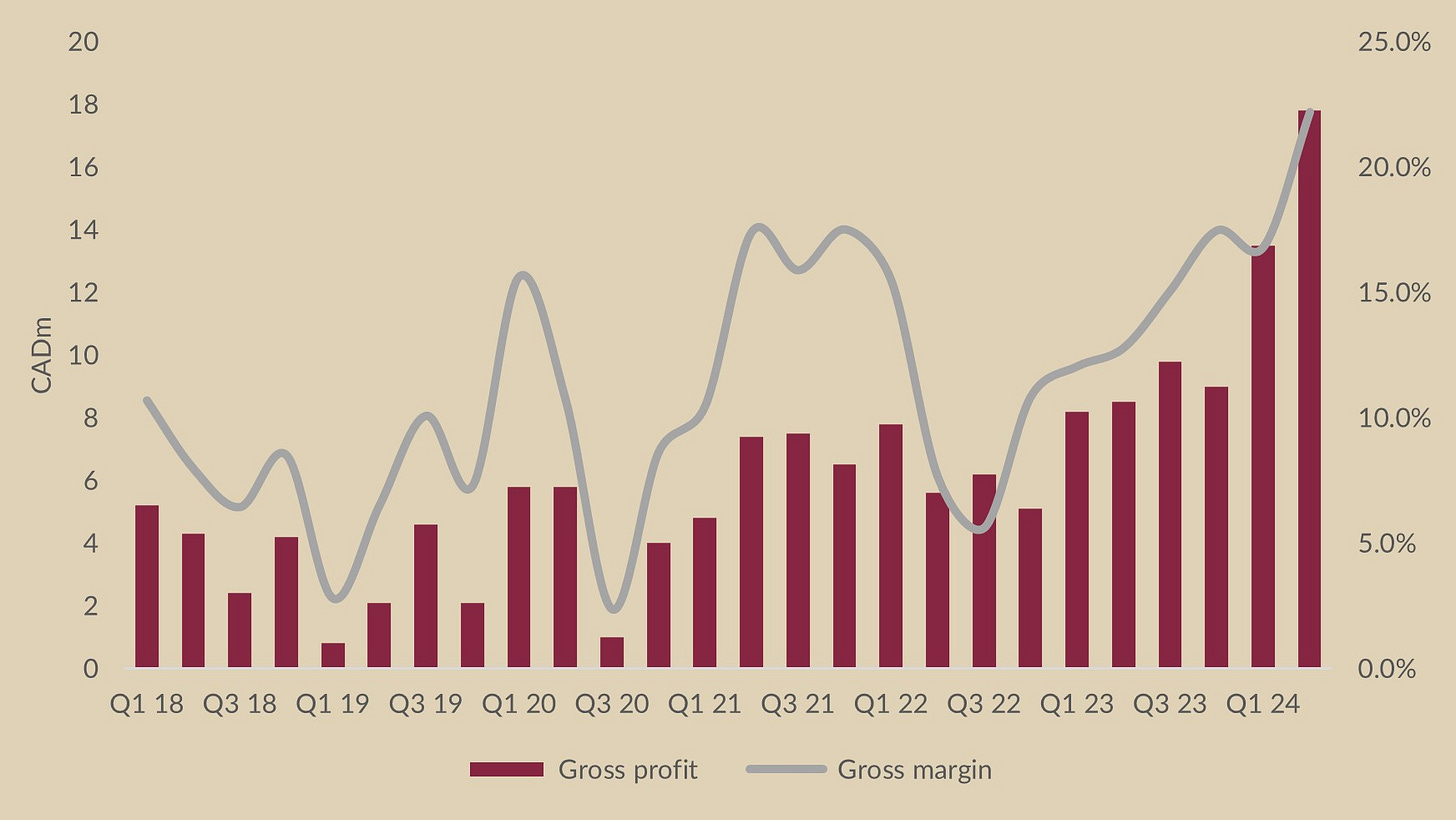

ADF is ramping up as we speak, and the first results are already visible. After a very strong Q1 24, ADF was able to increase its gross margin in Q2 to c. 22%, almost 10ppt higher than last year and the highest level in almost a decade. And continued improvements are expected as the new robotic line will take on a more significant workload.

These (initial) results far surpassed my expectations. In my original write-up, I estimated that ADF could generate $50m ebitda in FY25 (ending in January 2025). But the company is on pace to achieve such a level of earnings this year already - almost 100% growth yoy, on top of the >60% ebitda growth last year. Pretty impressive for a company with a healthy balance sheet, trading at roughly 3x ev/ebitda on my estimates for this year, excl. generated cash.

But let's look at where the puck is going to be with some basic assumptions. Based on the current market tailwinds and the efficiencies from the new robotic line, let's assume H2 24 = H1 24 (so roughly $320m revenues for FY24), 15% revenue growth p.a. until FY26 (January 2026, or < 2.5 years out), and 25% gross margins plus $20m opex in FY26.

This results in ~$85m ebitda in FY26, on (imo) relatively conservative assumptions.

So again, ADF is another rapidly growing company trading at <2x ev/ebitda looking out a few years. This excludes any generated cash, which should be meaningful; while working capital demand is generally high given the nature of the business, the new robotic line drastically increases throughput. In addition, there won’t be new large investment programs given the recent investments in automation.

I remain bullish on ADF, where earnings seem to continue to grow more rapidly than the share price. Could they generate their entire market cap in free cash flow over FY24 - FY26? Why not… everything seems to line up for this one. And in contrast to Daktronics, I believe the benefits from the new tech will be far more lasting for ADF.

As always, this is not to be considered a recommendation. Do your own due diligence!

This is a great write up--I wasn’t exposed at all to this market. Thanks for the post!

Hey Toff, just rediscovered this post while reading up on DAKT & ADF Group.

Do you still have any interest in Barco? Would love to read an update