Revisiting ADF Group

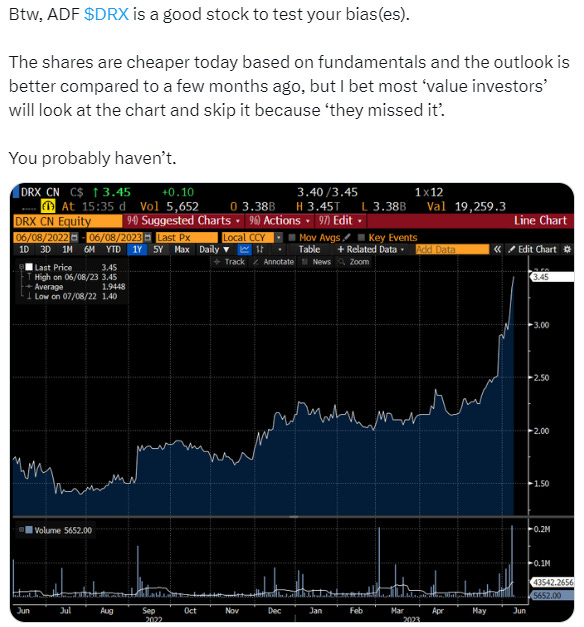

It’s time to revisit the ADF Group investment case after the strong run and assess a bit what we can expect for this year.

I’ve highlighted the company frequently over the past year and summarized the base case back in June in a longer blog post. If you’re not familiar with the company, I suggest to go back and read that first piece to get a better understanding of the company.

Looking back, my first estimate for FY24 (the year ending Jan. 2024) was that ADF could generate $30-35m ebitda in FY24 and >$50m in FY25. These estimates turned out to be much more conservative that I could ever have imagined, mainly due to a strong market environment (good for volumes and pricing), and the completion and ramp-up of the company’s new robotic automation line, the impact of which I’ve apparently underestimated big time.

This impact was already visible in the Q1 24 and Q2 24 results, with ADF able to increase its gross margin in an impressive manner. But the Q3 results were particularly impressive: on roughly +$17m revenues vs Q3 23 (and roughly stable revenues compared to the first two quarters of the year) ADF generated ~$18m ebitda for the quarter, c. +$10m yoy and +$5m vs the previous quarter.

Clearly there has been a learning curve with respect to the new automation equipment, and we can expect continued benefits over the next few quarters. Indeed, I’m very curious about Q4 24 results as Q4 and Q1 are generally the slowest quarters. But overall, assuming Q4 = Q1, ADF is on track to generate $50m ebitda for FY24 – a year earlier vs my initial expectations.

This bodes very well for this year (FY25), as we can expect a relatively good first half simply due to the continued improvements of the automation process (the latter mentioned by the CFO on the latest earnings call).

Though what makes this year even more interesting is the very strong order book. ADF had already a solid order book of $339m as at Q3, but the company announced additional new orders worth $234m in December, bringing the total to $573m – an extremely high level.

Even better perhaps, based on the CEO’s comments in the press release, given their new automation equipment ADF now seems to be able to bid on (and win) larger, higher throughput projects. The company’s operations are basically shifting to a new level, opening up a whole new set of opportunities.

And the opportunities are plenty. I already discussed the industry tailwinds from necessary infrastructure investments, the 2028 Olympics and the various infrastructure packages. Remember, less than a year ago the CEO commented to “definitely see growth for the coming 3, 4, 5 years”. That bodes very well for the medium-term. But ADF is also benefitting from a strong onshoring trend:

“…what we do see as a lot of overseas manufacturing that is being brought back to the states. So these are not, well, they might be in some instances financed by some of those subsidies, but a lot are coming just by the fact that there's a push from the U.S. Administration to bring back manufacturing... So it's good news for us and actually for the entire industry”- Jean-Francois Boursier, Q3 24 call.

Now lets look at some estimates for FY25 (the year ending January 2025, so this year).

It’s hard to translate the order book into earnings given the lumpiness of the business on a quarterly basis and no information on volumes, pricing and raw materials. Nonetheless, lets look at this conservatively, keeping in mind that directionality is more important here than precision. I’ll also be using $308m revenues and $49m ebitda as a base for FY24.

Taking the order book as at Q3 24, assuming 20% run-off for Q4 and adding the new orders, gets us to $506m for FY25. A sales / backlog ratio of 0.75 is $377m revenues (22% growth), and 35% gross margins on marginal revenues + $20m opex = $69m ebitda. That’s >40% growth – on rather conservative estimates.

Now, you might think ‘how the heck is that conservative?’. Keep in mind that in this back-of-the-envelope estimate

I’m assuming a 20% cut on the backlog (so no new orders) and 0.75 conversion. On the latter, ADF will be around 0.82 for FY24 and we know that they’ve continued to improve on their automation production each quarter. Arguably the conversion could continue to increase.

the gross margin on the marginal FY24 revenues is ~50%, compared to my 35% assumption.

I assumed 25% growth in opex, for no reason.

This all leads to 2.5ppt ebitda margin expansion for FY25 (from 15.8% to 18.3%) – hardly much operating leverage for such growth.

Indeed, assuming no order book run-off in Q4 and a steady backlog conversion and gross margin (on the marginal revenues), gets us roughly $470m revenues and $127m ebitda. Keep in mind that ADF already generated >$100m revenue a quarter in the past – before the investments in automation.

But let’s not get ahead of ourselves. The point is that I believe that ~$70m ebitda this year is not a stretch.

At $70m ebitda ADF would still be trading at 3.8x ev/ebitda, excl. cash generated. And the strong order book and market dynamics provide plenty of runway for further growth over the next few years at the least. What’s the right multiple? Definitely not 3.8x in my view.

The bear case here, assuming continued proper execution, is of course that the cycle turns. But ignoring the strong market dynamics for a moment, we have to keep the cash generation cycle in mind. This is a very working capital heavy industry. When growth is strong, cash flow generation is relatively subdued as working capital needs to ramp. But when growth turns south, working capital releases can easily push free cash flow conversion above 100%. So let’s say ADF generates $70m ebitda this year and the next, and then zero. ADF could easily end up with $100m net cash – that’s roughly 40% of the current market cap. That’ll definitely sustain the valuation.

On the other side, there’s also a real case to be made for a bull scenario. That is, ADF continues to tap larger and higher throughput projects, keeping revenue growth strong and achieving serious operating leverage on the back of the automated production lines. Again, $500m revenues is not a stretch; $130m ebitda in 2-3 years is +160% vs today. ADF might actually accelerate from here. And we’re still paying roughly 5x FY24 ev/ebitda…

Lastly, I want to touch upon a few technicals. Besides the growth and risk profile, the multiple of a company is also dependent on the absolute size of earnings: all else equal, the higher a company’s earnings, the higher the multiple. As ADF’s earnings base increases, its multiple should reflect that. Combined with a quickly improving liquidity profile (now up to almost $500k / day average daily value traded over the past few months), and we have many ingredients for a serious multiple rerating. Despite an already strong run, ADF has still plenty to go in my opinion.

If you enjoyed this article, please like and hit the “share” button below. Thank you.

As always, this article does not constitute advice. Always do your own due diligence. Please refer to the Disclaimer page.

Here are some assumptions I've made:

- Only 75% of backlog converted to sales

- No increase in gross margin profile

- 45% of backlog converted to sales this next FY (2025), 30% converted in FY 26, other 30% in FY27

- Assuming no new projects are signed (highly highly unlikely)

- FCF Margins expanding to 15%, 14%, 13% in next 3 FY's...

... I see the PV of next 3 FY's FCF (from Backlog ONLY) worth ~70% of current Market cap's valuation!! It's still dirt cheap... Thoughts?!

It sounds as a bit lower conversion of backlog no?