Trades and Ideas

Another inflecting small-cap, a VERY interesting liquidation, and some ugly stuff (though getting more asymmetric by the day)

The TMM – our weekly overview of actionable event-driven and special sits – often flags interesting situations, and we'll expand on some of these today.

Today we have an interesting company with clearly inflecting fundamentals, which kind of reminds me of Zedge and IZEA Worldwide, a liquidation with a limited downside and tons of optionality, and some ugly but interesting stuff (you’ll know when you see it).

Enjoy!

Illumin (ILLM Canada – C$ 104m market cap)

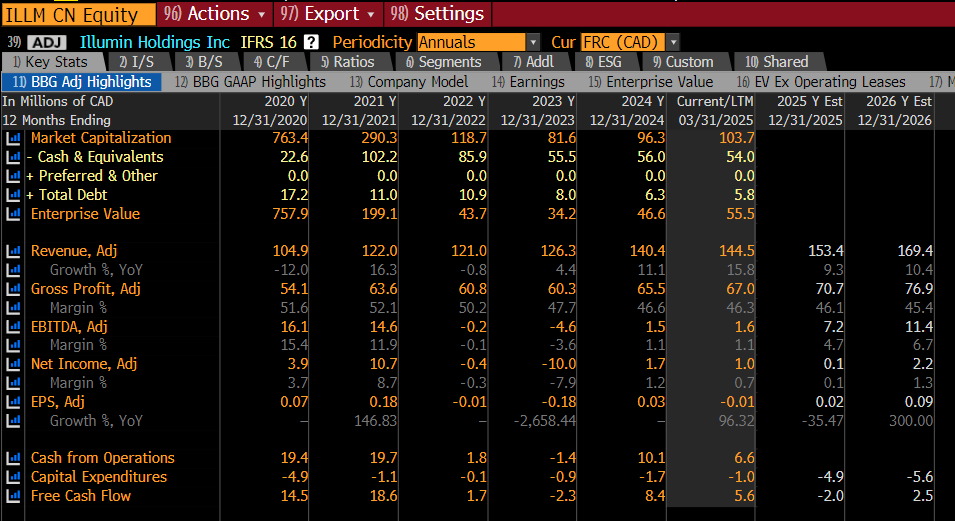

Illumin is a highlight in our recent TMM. The company popped up as insiders have been quite active on the open market. The company had a few tough years but topline growth has been returning, along with operating leverage. I’m seeing ~7.5x forward ev/ebitda for potentially >50% ebitda growth p.a. over the next few years, with 50% of the market cap in net cash – plenty of reason for me to take a look.

Adtech has been a brutal industry over the past few years. We had a privacy crackdown, then the broad tech selloff, followed by a grinding slowdown in digital ad spend, in part due to the hype during covid and the subsequent hangover. Most of the small- and mid-cap players were left in the ditch – some deservedly, others just collateral damage. Illumin, formerly AcuityAds, definitely felt the pain.

At a high level, Illumin is a programmatic ad platform focused on what’s called ‘journey advertising’ – essentially using consumer path data to serve highly contextual ads across devices. While competitors leaned heavily into volume and scale, Illumin tried to differentiate by mapping entire consumer decision flows across channels, offering brands more transparency and control. The pitch: better targeting, higher ROIs, and fewer wasted impressions.

In practice, this took time to deliver. Execution stumbles, some platform rollout delays, and broader macro headwinds weighed heavily from 2021 through 2023. Revenue growth stalled. Profitability cratered.

But 2024 has marked a shift, accelerating growth and getting back to profitability. Illumin cut costs, sharpened its go-to-market, and leaned into a more efficient sales structure – in the U.S., where they’ve struggled historically. ebitda is swinging positive again, and the company has guided toward sustained growth with expanding margins.

Now it should be a story of continued growth and operating leverage, with the shares not yet reflecting the inflection.

There are still some headwinds, with pressures from a large client reducing spending and gross margin pressures given shifts in mix. But Illumin seems to be doing a good job attracting new clients and increasing spend / client, all the while gearing up for growth. And this in a tough macro environment.

Insiders seem to indicate where this is heading. Management has been actively buying in the open market, which stands out given how bruised this name is. Add to this a 10% buyback.

As mentioned, ~7.5x forward ev/ebitda, with over half its market cap in net cash. That doesn’t seem much a business potentially growing ebitda 50%+ annually over the next few years. And unlike many of its peers, Illumin doesn’t need to burn (much) cash or raise more to hit its targets.

Is this a no-brainer? Certainly not. The adtech space is crowded and volatile, macro visibility remains murky, and Illumin is still a small player fighting for relevance. But the bar is very low, execution has improved, and there’s a non-zero chance this turns into a respectable compounder.

Not the kind of name you bet the house on – but for a small cap with accelerating fundamentals, clean financials, and strong insider alignment? Worth checking out.