This write-up was first published in A few micro-caps I'm looking at. We present it here separately to improve its visibility. Also, we just don’t like the old ‘lumped’ format anymore. Going forward, we’ll be publishing write-ups more separately instead of lumping them together as we have done recently. This will improve the timeliness of the ideas and the readability of the posts.

IZEA Worldwide is a company that seems on the verge of a serious inflection. And I like to keep a very close eye on potential inflections.

IZEA is a company that focuses on influencer marketing and content creation. Pretty much most of their revenues are earned from Managed Services. This is when someone (typically a brand, agency or partner) pays them to provide custom content, influencer marketing, amplification or other campaign management services. They basically connect brands with influential content creators across various social media platforms to help companies promote their products and services.

Then there’s also some revenue from fees charged to software customers on their marketplace spend within the company’s platforms (Marketplace Spend Fees), a bit of license revenue and some other stuff.

But by far most revenue is generated within Managed Services, the segment that handles influenced marketing campaigns and content creation from start to finish.

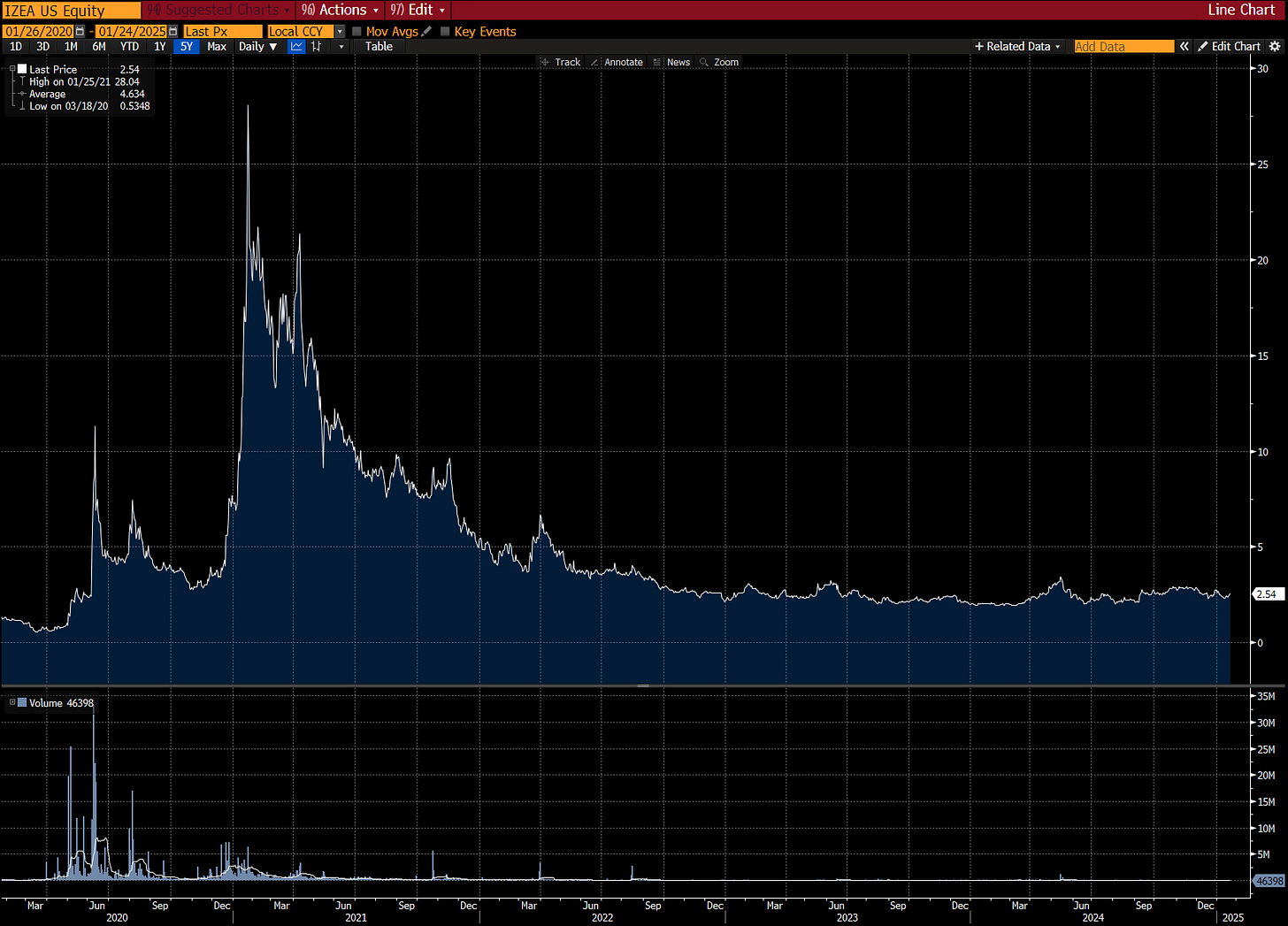

Up until 2021 IZEA has been chugging along, growing revenues at a pretty slow pace and financing losses by issuing shares and using proceeds from short-term investments. Nothing special.

This sluggish growth path completely changed in 2021 and 2022 on the back of covid induced tailwinds. At the same time that the company introduced new platforms like IZEA Flex and expanded operations abroad, the market of influencer marketing took off like crazy. Demand for IZEA’s services skyrocketed, along with its revenues.

Though while the market remained pretty healthy, mainly given the still nascent market of influencer marketing, 2023 was a tough year for IZEA. The company lost a major non-recurring customer within Managed Services which significantly impacted revenues. At roughly the same time the company transitioned away from its legacy IZEAx and Shake platforms within its SaaS Services segments to newer platforms Flex and The Creator Marketplace, which caused some churn.

The loss was a wakeup call for the company, which increased its efforts to diversify its customer base. Meanwhile the shift to new platforms promises better pricing, lower churn and lower CACs, although revenues from these platforms remain relatively small.

Importantly, in H2 24 IZEA welcomed a new CEO, Patrick Venetucci, who replaced founder Ted Murphy. This is a good development; keep in mind that IZEA has yet to deliver its first year with positive operating losses.

It’s still too early to judge his progress, but I appreciate the new CEO’s action so far. He revamped the Board and increased focus on profitable growth. And over the past few months IZEA signed several interesting large customers such as Danone, Nestle and Coursera (though details are not provided).

Without making the story unnecessary long, the bottom line is that IZEA seems to have found new elan.

But importantly, this also seems to be reflected in the numbers. Look at the development of the yoy growth in Managed Services bookings over the past ten quarters…

… which pushed yoy group revenue growth finally into serious territory for the first time in two years.

The growth is even more interesting given that Q3 still experienced the impact of the loss of the large customer. Excluding revenues from this client, the adjusted yoy revenue growth would have been +27%. IZEA guided for continued yoy growth over Q4 24.

Overall, it seems that 2024 has been a transitional year for the company, with what appears successful efforts to fill the revenue gap left by the loss of the a large customer with more (profitable) clients.

Even more, IZEA has some big plans for the future. The company is targeting $76m in annual revenue by 2026, with ‘meaningful ebitda improvements in 2025’ and positive ebitda in H2 2026. This would mark significant revenue growth, roughly 50% p.a. over the next two years.

Nonetheless, while this all looks interesting there are a few things to keep in mind.

The new CEO did not reiterate the $76m target mentioned last by old CEO Ted Murphy in the Q2 24 call. He did speak about its 2025 business plan that will soon be unveiled. Of course that doesn’t mean that these targets are off the table, but perhaps the new CEO has a few different plans.

It’s also important to understand that despite all the recent progress, IZEA operates in a very competitive market. Innovation is key and the company will have to continue invest to stay competitive.

Lastly, it appears that we’re still be facing another year of operating losses in 2025.

But I remain interested nonetheless, and or a few very good reasons.

The first one is the progress described above. IF IZEA is indeed able to return to consistent topline growth, the company screens very attractively looking out a few years…

… but even more so given the significant net cash balance - $54m net cash on a $42m market cap.

So here we have a negative EV micro-cap, which seems to have found its way back to growth and is (finally) talking about reaching operating profitability.

Also, IZEA finally started to deploy this massive cash balance. They initially announced a $5m buyback not so long ago and more recently increased it to $10m, roughly 25% of the current market cap. Not bad.

One last interesting nugget. To note that GP Investments acquired a ~18% stake in the open market less than a year ago, at average prices quite higher than today.

If you value this write-up, please like and hit the “share” button below. Thank you.