ToffCap's Monday Monitor #21

Your regular monitor for interesting event-driven trades and companies

ToffCap’s Monday Monitor is our overview of interesting event-driven trades and companies we find while turning over many rocks. The list is dynamic; it continues to grow and change. If you have interesting additions to the list, feel free to contact us at contact@toffcap.com or on Twitter.

Enjoy!

Disclaimer. ToffCap’s Monday Monitor is provided for informative purposes only. No due diligence has (yet) been performed on the names on this list. The list might change strongly on a regular basis. This overview does not constitute advice; always do your own due diligence.

Important notice. We would like to publish the TMM on a weekly basis, but we need a more critical mass. If you enjoy this service, please like and hit the “share” button below. Thank you.

Overview

I. Company watchlist

II. Catalyst trades

I. COMPANY WATCHLIST

Interesting companies with seemingly strong upside potential we have looked at recently.

Additions this week

Haypp Group (HAYPP Sweden – SEK 2bn). Our friend @roojoo3 (CIO at Night Watch Investment Management) flagged the interesting case of Haypp Group.

Haypp seems seems to have a long runway for growth ahead. The company is an e-commerce platform with 80-90% market share in the online sales of Snus and Nicotine Pouches (NP) in Sweden, Norway and the US, with a slightly less dominant position in the UK and DACH region. Nicotine Pouches are better known under the brand name Zyn, which Philip Morris acquired through the Swedish Match acquisition in 2022, although every self-respecting tobacco manufacturer has its own brands: BAT sells Lyft and Velo, while Altria owns On!.

With Zyn growing ~70% per year, it is no surprise that PM has gotten a die-hard investor base that’s bid up the P/E to 14x, despite relatively elevated leverage. Given that Haypp provides pure play exposure to this growth trend, we thought it worthwhile to bring the name to your attention.

Their industry is characterized by a lack of paid advertisement. There are almost no paid search results. The key to winning is through Search Engine Optimization. Haypp’s various websites score highest on customer conversion and customer return rates. Google knows this and ranks Haypp on top. Hence the 80-90% market share. Another benefit is that there are almost no marketing costs (0.6% of revenue) and low return rates.

Haypp’s suppliers have no way to market their new Nicotine products. Paying Haypp for prime positioning on their website is therefore a good way to spend their money. Haypp also collects consumer data and sells this to the manufacturers, further improving this relation. We were skeptical to assign much value to this claim, but after talking to various industry experts we found out that the suppliers put a lot of value on this data (“big CPG companies can’t get enough of that shit”) and that PM relied on Haypp consumer data in their acquisition of Swedish Match.

In short, there are three growth levers working simultaneously:

End market growth of Nicotine Pouches: Norway and Sweden are growing ldd because sales of NP cannibalize sales of Snus. The growth markets are growing closer to 60%.

On top of this, there is an increase in digital penetration. The USA has ~2.5% digital penetration versus 30% in Sweden. Digital penetration in the US has been shown to increase whenever Haypp opens up more warehouses and offers 2-day delivery.

Margin expansion. Haypp guides to 5-7% EBIT margins in 2025 – excluding 1-2ppt of growth investments – and hsd margins in the longer term. However, they note that GP margins in Sweden are only 13%, while in the UK they are 29%, or as high as 47% in the UK vaping market. In other words, can margins be higher if Haypp has 90% market share and sells NP for $4 if brick-and-mortar stores sell it for $7 or $8?

Spencer Cibelli's from Robotti Securities is the real axe on this name. His podcast from last November discusses the company in more detail and also addresses the complicated regulatory framework. His firm makes a market in this security and could probably help you find liquidity in this somewhat illiquid name.

Devin Lasarre also wrote a recent post on Haypp that is worth checking out.

Night Watch Investment Management is a recently launched global value fund with a focus on securities that have an identifiable catalyst for rerating. Haypp is a core position of strategies managed by Night Watch. Check out NightWatchIM.com for more info. This is no investment recommendation. Night Watch might change its shareholding in any securities without informing the public.

DNO ASA (DNO Norway – $860m). We highlight our recent write-up on DNO. DNO is an oil & gas production and exploration company. Despite a long history of relatively successful operations and balance sheet discipline, DNO has often traded at relative large discount to peers given its historically relatively risky portfolio of assets: while the company has production, exploration and development assets in the North Sea, most of its production assets are located in Kurdistan (North of Iraq), a region that is prone to experience some (political) turbulence every now and then. DNO has been accelerating its pivot away from this region since 2019 and made significant discoveries in the North Sea. We believe that the company’s market valuation will soon start to reflect this changing asset composition. In addition, the reopening of the Iraq-Turkey pipeline could supercharge earnings and cash flows. Many thanks to Alexander Eliasson for flagging this one. Make sure to given him a follow on X.

II. CATALYST TRADES

Event-driven trades and ideas.

New additions and updates

3M (MMM US). Will spin its health care business into an independent public company ('Solventum'). Spin effective April 2.

General Electric (GE US). GE is set to spin its energy business ('Vernova') on April 2. Will trade under 'GEV'.

AFC Gamma (AFCG US). Intends to spin its commercial real estate loan portfolio into a (to be) REIT, "Sunrise Realty Trust". The separation will create two companies, one focused on the cannabis industry and the other on CRE. Separation expected to be completed 'mid-2024'. Might be interesting given different character of businesses.

Western Digital (WDC US). Western Digital is back to planning the spin of its Flash and HDD franchises after the busted deal talks with Kioxia. Original timing was Q4 2023; now H2 24.

UPDATE: Rumored that talks with Kioxia will resume in late April.

Summit Midstream Partners (SMLP US). Ongoing strategic process. Sale looks most likely outcome. Announcement could be imminent as update on strategic review will be provided on March 15. H/t @AndrewRangeley for the idea.

Hanesbrands (HBI US). Considering selling its Champion brands and strong rumors that it has received multiple bids. As a reminder, HBI is currently exploring strategic options.

VSE (VSEC US). Launched a strategic review of its fleet segment.

23andME (ME US). Evaluating options. Might split the company. Stock price strongly under pressure given continued cash burn. Net cash balance sheet. Split goodco/badco might create an interesting opportunity.

Newpark Recources (NR US). Initiated a strategic review for its Fluid Systems business, with options including selling the entire segment or winding down its working capital. Divestment could generate $200m, and will increase the quality of the business. H/t @ideahive for the idea.

UPDATE: Strategic review expected to be completed mid-2024.

abrdn European Logistics Income (ASLI UK). Launched a strategic review and is considering all options, including full sale. Trading at 30% discount to NAV. Looks like a very good chance for a deal (dividend target will have to be cut, but will reduce the already low liquidity). H/t @Estebanalbanil for the idea.

UPDATE: Received proposals and is in discussions. Seems a matter of time.

Xperi (XPER US). Rubric Capital (7.6% owner) pushing for strategic alternatives for the company's AI unit. Based on Bloomberg ccs, XPER will grow very quickly over the next few years and is trading at <3x 25e ev/ebitda. Co has a solid balance sheet (net cash).

UPDATE: Officially announced to be evaluating strategic alternatives (of Perceive business).

Kinnate Biopharma (KNTE US). And another busted, negative EV biotech reviewing strategic alternatives. $112m market cap (19 Jan.) and -$52m EV.

UPDATE: To be acquired by XOMA. Shareholders to receive $2.335 + $0.253 cash + CVR. Shares trading at $2.62 (01/03).

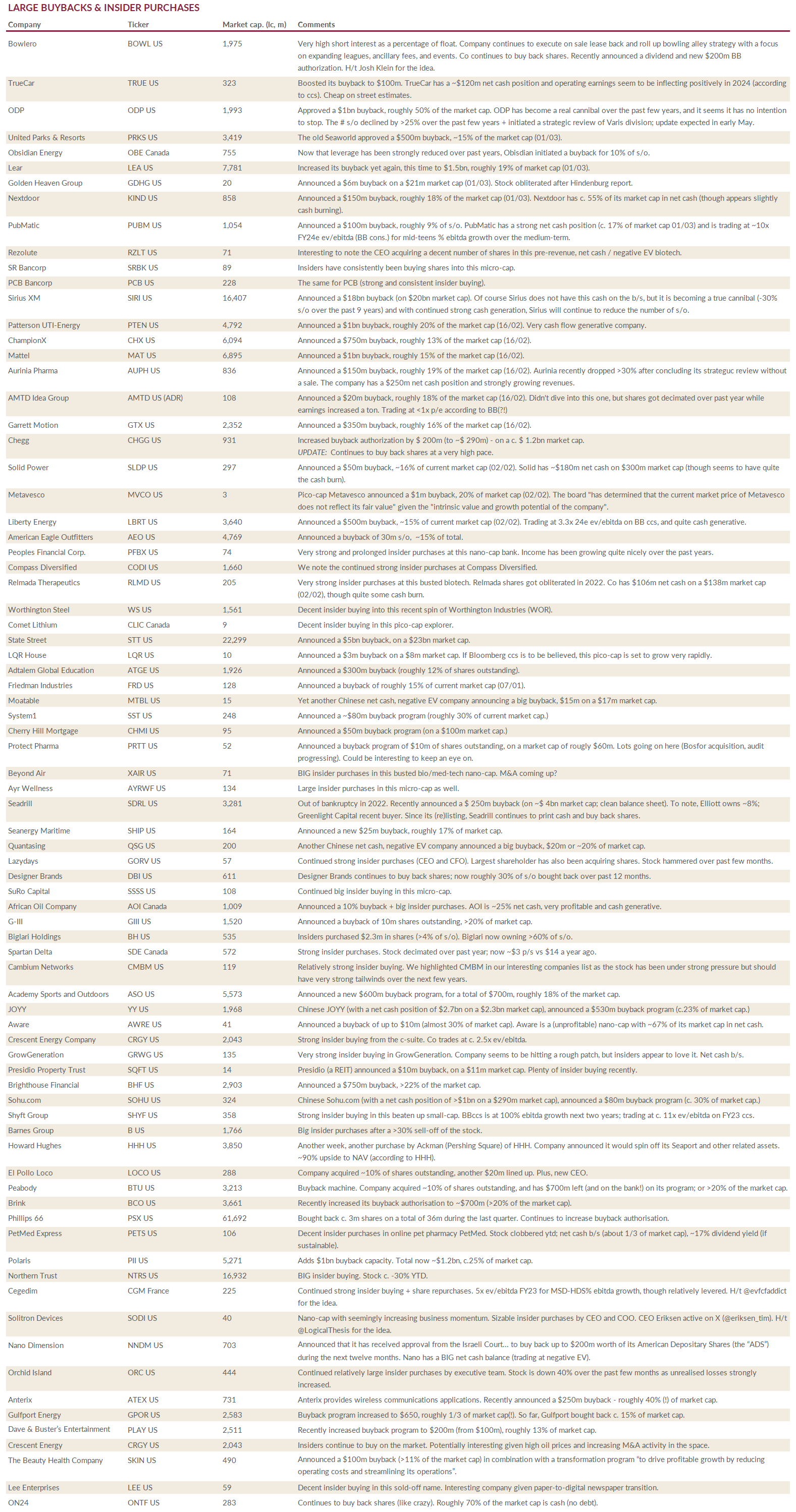

Bowlero (BOWL US). Very high short interest as a percentage of float. Company continues to execute on sale lease back and roll up bowling alley strategy with a focus on expanding leagues, ancillary fees, and events. Co continues to buy back shares. Recently announced a dividend and new $200m buyback authorization. H/t Josh Klein for the idea.

TrueCar (TRUE US). Boosted its buyback to $100m. TrueCar has a ~$120m net cash position and operating earnings seem to be inflecting positively in 2024 (according to ccs). Cheap on street estimates.

ODP (ODP US). Approved a $1bn buyback, roughly 50% of the market cap. ODP has become a real cannibal over the past few years, and it seems it has no intention to stop. The # s/o declined by >25% over the past few years + initiated a strategic review of Varis division; update expected in early May.

United Parks & Resorts (PRKS US). The old Seaworld approved a $500m buyback, ~15% of the market cap (01/03).

Obsidian Energy (OBE Canada). Now that leverage has been strongly reduced over past years, Obisdian initiated a buyback for 10% of s/o.

Lear (LEA US). Increased its buyback yet again, this time to $1.5bn, roughly 19% of market cap (01/03).

Golden Heaven Group (GDHG US). Announced a $6m buyback on a $21m market cap (01/03). Stock obliterated after Hindenburg report.

Nextdoor (KIND US). Announced a $150m buyback, roughly 18% of the market cap (01/03). Nextdoor has c. 55% of its market cap in net cash (though appears slightly cash burning).

PubMatic (PUBM US). Announced a $100m buyback, roughly 9% of s/o. PubMatic has a strong net cash position (c. 17% of market cap 01/03) and is trading at ~10x FY24e ev/ebitda (BB cons.) for mid-teens % ebitda growth over the medium-term.

Rezolute (RZLT US). Interesting to note the CEO acquiring a decent number of shares in this pre-revenue, net cash / negative EV biotech.

SR Bancorp (SRBK US). Insiders have consistently been buying shares into this micro-cap.

PCB Bancorp (PCB US). The same for PCB (strong and consistent insider buying).

Zegona Communications (ZEG UK). Zegona acquired Vodafone Spain and intends to turn it around, do a sale and leaseback and pay a (large) dividend. Interesting as many moving parts, relatively illiquid and you can be sure of volatility. Fwiw, the two analysts covering it are look for ~90% upside. H/t @tacoenthusiast2 for the idea.

Seas Getters (SG Italy). Sold its medtech business for $900m. Tendered for stock (roughly €140m), will pay a €12.5 p/s dividend (on €34 stock price); remaining €350m to be reinvested in business. Roughly €20m net debt position (pre-sale consideration). H/t @tacoenthusiast2 for the idea.

Ambase (ABCP US). Ambase has a an undervalued litigation asset and summary judgement in Sep 2024. This has been going on for quite some time, but there's now better visibility on an outcome. Multi-bagger if good, otherwise a zero. Check out @URadars for more info.

Vaso (VASO US). Micro-cap that will uplist onto Nasdaq via SPAC (Achari). Move will certainly improve liquidity and visibility. Current share price $0.30 (March 1) for implied $0.93 p/s equity post-SPAC. Vaso has ~50% of market cap in net cash. Check out SRK Capital for more info. H/t @ideahive for the idea.

Parkin (n.a.). We note the upcoming IPO of Parkin, which manages parking lots in Dubai. Parkin seems to be massively profitable. IPO around March 21.

Neubase (NBSE US). To liquidate. Neubase had ~$7m net cash back in June.

Ceasars Entertainment (CZR US). Could monetise its stake in Centaur before end of the year, possibly over the next few months.

Vishay Intertechnology (VSH US). Announced a $1bn buyback, roughly 20% of shares outstanding (16/02). VHS has a net cash b/s and is trading at roughly 7x 2024e ev/ebitda.

UPDATE: Will be holding its first capital markets day on April 2. Could be interesting given relatively low valuation and what seems trough earnings. Might be bullish.

Reddit (n.a.). Reddit intends to IPO in March. Will be an interesting one to keep an eye on.

UPDATE: Looking for a $6.5bn valuation mid-range.SoftwareOne (SWON Switzerland). Once again reports that the company is for sale.

UPDATE: Tensions between shareholders (who want to sell the company) and the board (who refuses). Upcoming EGM will be interesting.

BJ's Restaurants (BJRI US). Shareholder Fund 1 is pushing for a sale. The fund is of the opinion that BJ would be of interest to many parties.

UPDATE: Activist continues to pressure BJRI, pushing for cost efficiencies, board changes and stock buybacks. Heat is on.

NGM Biopharmaceuticals (NGM US). Largest shareholder Column Group interesting in taking NGM private. To note is NGM's strong net cash position (roughly $160m).

UPDATE: To be acquired for $1.55 per share.

Overview of ongoing event-driven trades

If you enjoy this service, please like and hit the “share” button below. Thank you.

Great stuff, as always. Thank you.

Add Olink $OLK to the list, 10% for a quarter, Thermo is the buyer.