DNO

Ready to supercharge earnings

DNO is an oil & gas production and exploration company listed on the Oslo stock exchange ($830m market cap). Despite a long history of relatively successful operations and balance sheet discipline, DNO has often traded at relative large discount to peers. The main reason is its historically relatively risky portfolio of assets: while the company has production, exploration and development assets in the North Sea, most of its production assets are located in Kurdistan (North of Iraq), a region that is prone to experience some (political) turbulence every now and then.

Given its asset base, a discount compared to (better geographically positioned) peers is obvious, but I deem the current discount extremely unwarranted. DNO is trading at <2x 2024e ev/ebitda on very depressed earnings, while sporting a solid net cash position (c. $150m, or ~17% of current market cap) and continuing to generate solid cash flow.

This is in itself compelling, but the most interesting point of the thesis is a very large and potentially imminent catalyst which could supercharge an already attractive earnings profile: the reopening of the Iraq-Turkey pipeline.

Moving away from its core geography

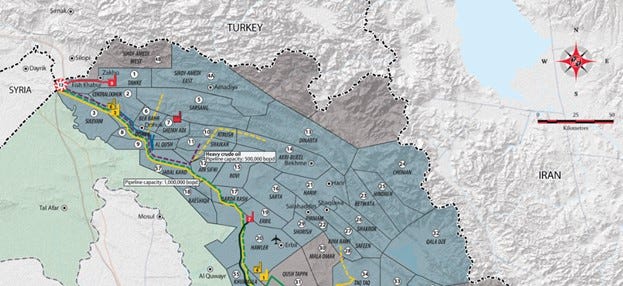

DNO has assets in the North Sea, Kurdistan and West Africa (total 2P + 2C reserves roughly at 540 mmboe – that is, million barrel of oil equivalent), but the company is mostly exposed to the semi-autonomous region of Kurdistan, holding the operatorship and working interests in the Tawke license (75%) and the Baeshiqa license (65%). Production from Tawke and Baeshiqa is transported via the Iraq-Turkey (Ceyhan) pipeline, a very important conduit for oil transport in the region, which provides Iraq access to the international oil markets (which means more volumes and better prices).

While DNO has been able to successfully operate in the region for quite some time, the region has a history of (political) volatility. And as a consequence of this volatility, DNO decided in 2019 to accelerate its pivot away from Kurdistan towards the North Sea. The company has so far been successful in its efforts, with 2023 a pivotal year including discoveries adding 100 mmboe to DNO in the North Sea. Exploration (and discoveries) will continue in the North Sea and the future is promising. At the moment I estimate c.17% of 2024 projected production to come from the North Sea.

This exposure to the North Sea is still relatively small, but not to ignore. The strong success of DNO in the region is very promising for future growth and we can expect DNO to add more resources in the region. Estimates vary, but based on the current discoveries, production in the North Sea will grow strongly as of 2027 up to >50,000 boepd (barrels of oil equivalent per day) by the end of the decade.

Over time, I expect the market to apply a higher valuation as the company’s asset exposure to this region continues to grow. Indeed, DNO is currently trading as such a large discount, that I estimate the current share price to reflect only the NAV valuation of its North Sea assets (more on this later).

Earnings strongly pressured by the closing of the pipeline

But that is a longer-term story. DNO is interesting today because of the potential (and probable, in my opinion) reopening of the Iraq-Turkey pipeline which was shut down in March 2023.

As mentioned, the Iraq-Turkey (Ceyhan) pipeline is a critical vein for the regions providing oil with access to international markets. The pipeline was shuttered following a dispute tipped in Iraq's favor against Turkey. Ankara shut down the pipeline following a court order to pay Iraq $1.5b to compensate for transporting oil through the pipeline without Baghdad’s approval.

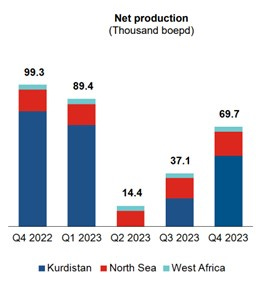

Following the sudden closure, DNO’s net production in the region dropped precipitously. DNO was quick to react and was able to shift transport of oil to local markets (i.c. local brokers, not local consumption). Despite by the closure of the pipeline and the consequent shutdown of DNO’s fields for the majority of the second quarter, the company managed to achieve a remarkable annual production of 35,000 boepd from Kurdistan, with a surge to 80,000 by the end of the year. This shows DNO’s flexibility and resilience.

The company expects to maintain Kurdistan production around 80,000 boepd throughout 2024 (hence excluding any reopening). While pricing is not ideal – it is selling the oil in the mid-$30s per barrel, or more than 50% discount – operational spending is down 65% and DNO will generate $10m free cash flow per month. In addition, it will receive payment in advance, ensuring strong payment certainty. This approach not only secures financial health (given the circumstances) but also guarantees that the operational expenses in the region are promptly recuperated the following month.

The shutdown in Q2 23 and the ‘restructuring’ clearly impacted results, but DNO was nonetheless able to generate roughly $380m ebitda in 2023, compared to $1,020m in 2022. Free cash flow (net cash flow from operations less capex) was -$82m ($620m in 2022), a very decent result given the circumstances. DNO maintains a healthy net cash position and will be able to easily fund its planned capex as well as dividends.

The risk is very much to the upside

But 2024 is looking much brighter, not only because DNO is now generating decent cash flow in Kurdistan despite the lower realized prices, but mainly because a reopening of the pipeline seems imminent.

Since the shutdown in March 2023, Turkey reached an agreement with Iraq (no details provided) and said that the pipeline is ready to be used. The issue has since morphed into discussions between the federal government of Iraq and the Kurdistan Regional Government (KRG) regarding who should control the oil sales and how compensation is to be structured (between Iraq, the KRG and the international oil companies).

This is an old discussion, as the federal government of Iraq claims the right to sell all oil from Kurdistan while the oil companies like DNO have production agreements with the KRG and had been selling it a majority of their supply before the halt (Iraq never passed a law governing the oil industry and regulating sales). It seems that the federal government of Iraq deemed the shutdown of the pipeline as a good moment to rediscuss the old ‘agreements’ and see if it can get a better deal.

Importantly, discussions between the KRG, the Iraqi government and the international oil companies have been progressing and accelerating since Q4 of last year. Ongoing negotiations in Iraq hint at a possible reopening of the pipeline as early as Q2.

In December, Bloomberg reported that Iraq is studying a change to its federal budget that would eventually result in the resumption of exports. Just a few weeks ago, there were reports that the KRG and Iraqi authorities are getting closer to a deal that would allow exports to restart at a new agreed selling price. These are just a few examples, and one can find numerous recent articles discussing how all parties are sitting at the table, discussing a potential solution.

It cannot be understated how important the pipeline is for all the players involved, but particularly the KRG and Iraq (and Turkey, as it is easy money basically). It is estimated that the shutdown of the pipeline has cost governments and producers billions of dollars, with losses increasing daily as exports remain vastly reduced. This is a significant source of income.

The bottom line here is: if these diplomatic efforts bear fruit, a reopening of the pipeline would effectively double DNO’s per barrel revenue and supercharge earnings.

Lastly, and important to keep in mind: should discussions falter (an unlikely scenario), there’s a 100% certainty that the pipeline will reopen within the next two years as the current contract between Turkey and Iraq for the use of the pipeline will expire. This will give Turkey the freedom to operate the pipeline however it wants without facing legal repercussions. And being it an easy and lucrative source of income, it is basically certain that Turkey will reopen the pipeline.

>50% upside today, 100-200% upside should the pipeline reopen

In short, in the current situation DNO is generating roughly $120m free cash flow per year from its Kurdistan assets while very successfully pivoting away towards the North Sea and building a first class portfolio in this region. Should the pipeline reopen, earnings will explode.

I won’t bore you with lengthy calculations – and it is more important here to try to be directionally right rather that precisely wrong – but based on today’s oil and gas prices and excluding all Kurdistan net 2P reserves and 2C resources (basically all Kurdistan assets), I estimate the NAV of DNO’s remaining assets (mainly the North Sea) to comprise c. 90% of the company’s current enterprise value (of ~$700m). Taking also the net cash position into account, I believe the downside is strongly protected. And keep in mind that DNO continues to make significant progress in the North Sea.

Furthermore, assuming 2024 North Sea production of 15,500 boepd, 3,500 for West Africa and 80,000 for Kurdistan (on the pricing in the low-$30s), I estimate DNO will generate roughly $400m ebitda this year, giving DNO a valuation of 1.8x 2024e ev/ebitda.

This is far too low for the current situation, as it already reflects a much lower risk environment – Kurdistan’s cash flow stream are now massively derisked – and ignores the company’s very strong progress in the North Sea. Free cash flow should be $100-150m in this situation (as capex in Kurdistan is lower).

But should the pipeline reopen, I estimate DNO could generate $800-900m ebitda (on a full year basis), reflecting <1x ev/ebitda. That’s $450-600m free cash flow before financing and dividends (including higher capex for Kurdistan).

Finally, as a cherry on the cake, DNO has a receivable outstanding of >$300m – on a market cap of $830m – from the KRG. Current discussions are also taking the payment of these arrears into account. There’s a good chance a deal will be struck before the pipeline reopens and that DNO will recover these receivables in one form or another.

We don’t know which scenario will play out (though I suspect the latter), but the current valuation is by far not reflective of DNO’s potential. Even if a deal is not reached, DNO is performing remarkable well in the North Sea while mid-teens FCF yield from its Kurdistan assets. Whatever happens, I believe that the next few years will be quite interesting.

If you enjoy this post, please like and hit the “share” button below. Thank you.

As always, this is solely our opinion and does not constitute advice. Always do your own due diligence.

Great post, what is the main risk, could management waste cash flow or could North Sea assets have lower than expected reserves?

I wrote a whole write up on GKP, but couldn't bring myself to post it, and actually quickly sold my shares again. Seems to be too many moving parts. And even before closing it, GKP was trading at only 2-3x earnings, despite being an extremely high quality and long lived asset. Full cycle break even costs of <$10/barrel! So clearly there is a lot of risk there beyond the pipeline.

These two posts go in a lot more detail btw (not mine or affiliated with the writer) and are recommended reading for anyone interested in this situation:

https://zerogcos.substack.com/p/pipelines-courts-and-politics-opportunities

https://zerogcos.substack.com/p/pipelines-courts-and-politics-opportunities-ce9

Some interesting data points, HKN has purchased a block in Kurdistan since closing:

https://www.hknenergy.com/wp-content/uploads/2024/01/HKN-Gemini-Press-Release-012224.pdf

And Forza was bought out by its controlling shareholder for 1x 2022 EBIT recently.