Revisiting SurgePays

Since the post on Surgepays about six months ago, the stock price is basically unchanged, but experienced plenty of volatility along the way. As I believe that we are on the cusp of a significant acceleration in the company’s earnings, I thought it would be good to revisit the investment case and look at what is making this opportunity today more compelling than ever.

I wrote about Surgepays here and provided a short update here. I suggest anyone not familiar with the investment case to read both posts for background on the revenue model and the story. The very short of it was that while I believed Surgepays would not even come close to hitting its 2022 ebitda guidance, 2023 and 2024 looked very promising – way better than what consensus or the market were considering.

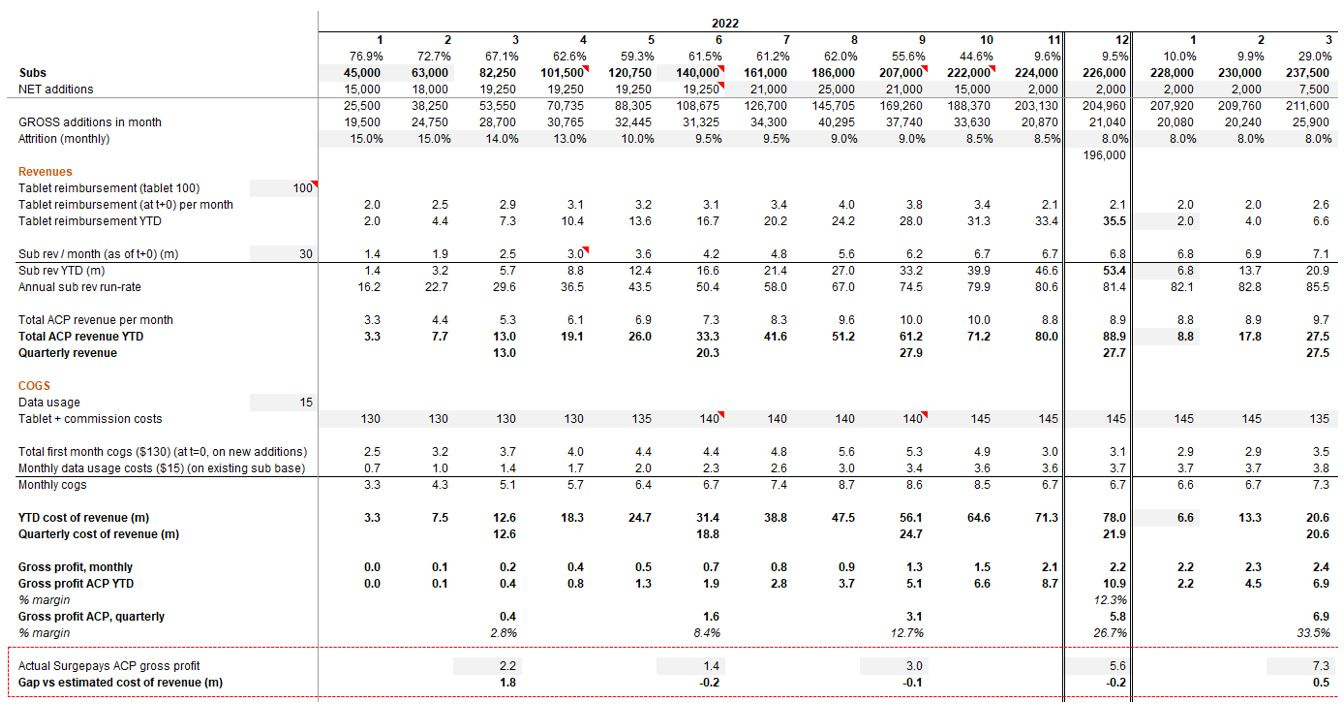

I also presented a back-of the-envelope model to keep track of the story. While the model is simple and rough, it has been more than enough to track Surgepays’ progress; as you can see below, the last four quarters have been tracking relatively well with estimates (it is continuously updated based on company KPIs and info provided in calls).

There are good reasons why the stock has not yet rerated toward its potential:

Uncertainty about the company’s dependence to the ACP program (which I believe is relatively low).

Higher churn than what the company (and the market) was expecting. This also led to fears that the company could not monetize its subscriber base.

Rising customer acquisition costs (tablet prices went up from $80 to >$90 and commissions from $45 to $50).

The company not hitting its ebitda guidance (mainly due to not being able to amortize customer acquisition costs from an accounting perspective).

And finally, the ‘throttling of sales’, the impact of which was not really well explained by the company and caused the shares to drop to <$4 a few months ago.

Despite all this, revenues and gross profit related to the ACP business (I will ignore the rest) have been trending in the right direction. In addition, the past few quarters – which reflected the intentional slowdown in ACP subscriber growth – have clearly shown that the subscriber base is very much monetizable, notwithstanding the relatively high churn rate. All in all, Surgepays’ metrics are moving in the right direction, which bodes well for the quarters to come.

That said, as often mentioned, the past quarters are small compared with what should come next. Importantly, there are two major developments which will have an exacerbated impact of the company’s financials in the quarters to come, and are going to drastically accelerate earnings growth.

The first is the significant savings on the devices the company acquires. Those following the story know that Surgepays’ new financing agreement now allows them to buy tablets in bulk, saving $20-25 per tablet. The company ordered 300,000 devices which have been coming in weekly since March. Just these savings alone will have big impact on earnings.

Based on company guidance of ~500k subs by the end of the year and $20 savings per tablet, we get c. $43m gross profit and $28m ebitda in 2023 (assuming $15m opex, or five times Q1 opex). Dragging these numbers into 2024 and assuming no further improvements other than another +250k net new subs, gives us roughly $70m ebitda (on $20m opex – though no reason why this should increase). Not bad for a company with an enterprise value of $75m.

But the exciting part is the second development: the ramping of the store channel.

So far, most of the ACP subscriber growth was driven by field sales, i.e. Surgepays employees setting up pop-up tents in parking places and handing out tablets. At $50 per subscriber, field commissions have been a big chunk of total customer acquisition costs.

However, Surgepays recently started to use its network of 8,000 stores on the Surgepays network as a point of ACP enrollment. Each store has to be enabled and the store owner has to learn the process, but slowly and steadily Surgepays is providing stores with the ability to sign up people for the ACP program. This is an important development, as the are important advantages to the store channel.

The first is that commissions are much lower, $12 vs. $50 on the field. The second is that with a network of thousands of stores enabled and incentivized to sign-up people, the potential growth of the ACP subscriber base is huge.

Surgepays is currently enabling around 10 stores per day for ACP enrollment. That's about 200 per month. Initial indications are >10 ACP sign-ups per day, per store. Let's say 10 – that’s 40k new (gross) ACP subscribers month, on a base of just 200 stores. And Surgepays intends to have thousands of stores enabled for ACP enrollment by the end of the year.

The implications of this development are astonishing. Let’s be conservative and assume a peak of 80k net new subscribers per month; that’s 110-120k gross, assuming stable churn, or a base of ~600 stores. Let’s also assume $12 store commissions. The store channel will ramp up slowly and in the near term most new ACP subscribers will come from the classic field sales - Surgepays is hoping for ~75% of new ACP subscribers to come from the store channel by Q4. Let’s assume the $50 commissions will decline to $12 by then.

This brings us to the numbers below (please keep in mind this is a back-of-the-envelope calculation – its mainly about directionality):

Based on the previously mentioned opex estimates, that’s potentially $46m ebitda for 2023. What’s more, assuming 300k net new subs for 2024 from the store channel (achievable with just 465 stores and constant attrition), would result in roughly $130m ebitda for 2024. Again, a reminder that the current enterprise value is ~$75m.

If this sounds crazy and makes you dizzy, just try to think that:

Surgepays is targeting for 25,000 stores in 2024.

Churn could be further reduced as the stores provide a contact point for subscribers (i.e. act as service points).

Surgepays is actively ramping up the offering of other products in the stores.

Perhaps now we can understand the CEO’s comments during the latest call:

Of course I prefer to remain conservative and would be more than happy if Surgepays achieved the base case scenario of $28m ebitda in 2023 (and $70m in 2024). Also, keep in mind that ‘constant attrition’ may sound conservative, but the absolute number of subscribers that churn really starts to add if the subscriber base grows rapidly. At some point you just run out of tablets and/or fulfilment capacity, no matter how flexible your financing is.

But a company trading at <3x ev/ebitda on my 2023 (base) estimates, growing very rapidly and already generating positive cash flow is good enough for me.

That said, what if their store channel strategy works?

Thanks for the write-up. The quality of posts here are among the highest I have seen.

Just to add to the dependency on ACP, the most recent 10K says "The SurgePhone and Torch Wireless business segment made up approximately 73% of total consolidated revenue in 2022. Revenues related to this business segment are 100% derived from programs administered by the Federal Communications Commission (FCC), and all funds related to these programs are received directly fromorganizations under the direction of the FCC".

It seems the ACP is a massive overhang, but that's because the funding could run out by the middle of next year (makes sense 1.56bn already spent on devices as of Jan 2023 and 600mn to be spent this year based on adding 500k users total per month) 5.5bn for the current 15.6mn users (as of Jan 2023) + (90mn*12 = 1.1bn) more for users this year currently 7.2bn in expenses this year, 1.6bn already spent on devices and 2.8bn spent on internet last year (thats 11.4 bn total) already out of the budget by this year end. Lets assume they don't add anymore users in 2024 with the current 14.2bn budget the program would last ~5/6 months into 2024 and run out of funds. Could you explain why you think they would deserve 7.5x EBITDA in that case and how you're thinking about that risk?