If you follow this blog, you might be inclined to believe that we mainly focus on event-driven and special situations. But while that is certainly an important part of the portfolio, by far the largest amount of time is devoted to searching for good, growing and cheap companies with large and secular tailwinds. The kind of companies that one buys for the long-term and just adds as the story gets better.

We believe to have found a few companies that fit this description and might be interesting to share.

Let’s start with the first one, Australian DGL Group (AUD 148m market cap). We’re excited about this one, because it provides the promising killer-combo of long-term earnings growth and strong multiple expansion.

For this write-up we’ll be taking a slightly different approach than the usual bottom-up when discussing companies. In this case it’s the sector that’s interesting, and DGL is a very levered way to play it (in the sense of growth and potential multiple expansion).

The setting

Some time ago we published a general write-up on the specialty chemicals distribution market, a great industry with long-term tailwinds. This is a unique market, with many attractive characteristics.

To name a few:

It is still relatively small and evolving, driven by big secular demand tailwinds which provide a pathway for growth for many years to come.

Increasing global demand combined with a very local character results in a large market fragmentation. Indeed, the complexity of end-markets is just growing, thus increasing the need for chemicals distributors.

A rapidly growing complexity in regulations at a local level drives demand for suppliers and distributors with expertise in local regulatory settings. Many chemicals are classed as hazardous products or dangerous goods, and businesses with expertise and certification in handling, transporting and storing such products and goods have an advantage.

Both suppliers (the chemicals producers) and end-clients (the manufacturers of the final products) are strongly pushing for outsourcing, as the market is becoming increasingly more complex. This adds another layer of growth.

As mentioned, market fragmentation is huge, with just a few large global players. As such, and given the growing complexity of the market, there is a strong push for consolidation. This has and will continue to be a very large driver of growth for acquisitive players.

Given the small size and big tailwinds, in combination with the fundamental importance of these chemicals, the industry has been very resilient to economic downturns.

The value of the global chemicals and ingredients distribution market is estimated at US$500-550bn. However, the share of third-party distribution in total global chemicals sales (excluding non-distributable products) is relatively low at less than 15%. This compares to industries such as steel (~65%), building materials (~75%) and pharmaceuticals (~80%), leaving significant room for growth in the share of chemical sales taken by suppliers and distributors.

We won’t delve much more into the market and strongly suggest to dive into our general market write-up which explains a lot.

But in short: chemicals distribution is a young, resilient industry that grows organically at GDP+, with a handful of listed market participants growing even more rapidly given relatively ‘plug-and-play’ m&a, and the potential to continue to do this for a long time. Active players within the industry could easily grow ebitda >10% p.a. organically through the cycle for more than a decade, with another 5-10% on top from acquisitions.

The players

Now, the companies active in the distribution of chemicals are not all similar. Some are very asset light, like IMCD and Redox, and provide only chemical formulation, warehousing and logistics services. Others, like DKSH, Brenntag, Ixom, Caldic or Barentz (the last three are private companies) do the same but also provide some basic production (mixing, blending, etc.) and other services (e.g. labelling, packaging).

Some players are more exposed to the more resilient Life Sciences segments (such as personal care, pharma, food & nutrition), others to the more cyclical Industrials (such as coatings & solutions, construction, advanced materials). Some own the logistics and basic production assets, other outsource it. There are players focused on more niche, specialty chemicals, while others focus on more commoditized products. You get the gist.

But generalizing, all companies are exposed to the previously strong industry tailwinds, which should drive earnings growth for years to come; end-markets are growing and becoming more complex, the pressure on producers to outsource is growing (stemming from the need to reduce business complexity) and distributors are increasingly driven to consolidate the fragmented market.

Keep in mind that these are very localized markets. Non-commodity chemicals don’t travel much given the relatively high freight / volume costs and local market differences. This is a major reason for the extreme market fragmentation. ICIS estimates that there are over 20,000 chemical distributors globally, with smaller regional and local players representing 87% of the market (2023). Redox, one of the largest Australian chemicals distributors, estimates that it has less than 3% of the Australian chemicals, raw materials and ingredients market, DGL’s core markets.

A consequence of the rapid development and local character of the industry is that there are still only handful of public pure play chemicals distributors, with many of them just having listed over the past few years.

IMCD is considered the industry leader in the market of specialty chemicals distribution. It’s the company with the longest public record and with the ‘model to follow’, i.c. a very integrated, asset light and diligent consolidator. Companies such as Brenntag and Kolmar are party similar but also distribute (more) commodity chemicals and own relatively more assets.

DGL is taking a different approach

But while many distributors look at companies like Redox and IMCD with envy given their efficient and asset light models, someone needs to actually own the assets. This is where DGL comes in with its relatively asset heavy character. If a company like BASF or Azelis wants to operate in Australia and wants to remain ‘asset light’, how does it achieve this? It’ll pay a company such as DGL to do the heavy lifting.

So while many companies prefer to go the asset light way, DGL leaned to the other side of the spectrum. It wants to own the assets.

Besides logistics, DGL has a relatively large basic production footprint and owns chemical waste recycling assets as well. It is also relatively more exposed to the Industrial (and hence more volatile) side of the industry.

In short, DGL consists of three units, Manufacturing, Logistics and Environmental:

Chemical Manufacturing. As a specialized manufacturer, DGL offers procurement, formulation, compliance, production (mixing, blending), labelling, packaging and other such services across many sectors such as crop protection, automotive, construction, mining, and water treatment. This segment is a great beneficiary of the secular outsourcing trend as producers benefit from reduced risks, lower capital expenditure and the ability to focus on their core activities (innovation, marketing).

Logistics include transportation and freight management, inventory management, packaging and warehousing of dangerous and specialized goods for the agricultural, automotive, mining and building sectors across Australia and New Zealand.

Environmental Services undertakes resource recovery and hazardous waste management activities. Its core activities comprise of liquid waste treatment, recycling end-of-life lead acid batteries (ULAB), lead smelting and refining of recovered lead. Someone has to do the dirty work.

All this doesn’t necessarily make DGL a lower quality company compared to the pure play asset-light distributors, but it does make it less operationally flexible. It also raises the barriers to entry: once the regulatory and operational connection with the principals (e.g. BASF, Azelis, Redox) and customers is locked in, it is generally hard to change or disrupt these operations.

The main consequence is that in good times margins and profits will be relatively higher than other pure play distributors, but in bad times relatively lower.

And this brings us to the opportunity.

So what happened

Chemicals distributors had a golden period in 2021 and 2022 on the back of covid induced disruptions, with basically all players enjoying tremendous growth. But that time is over and the entire industry has been experiencing a big hangover, particularly on the Industrial side. The good times made way for a prolonged period of destocking and low end-market demand, globally.

Every player has been feeling this. And while this is a healthy and expected normalization after a period of supersized growth, it introduced a prolonged period of uncertainty and low visibility. THE big questions within the space were not if results would normalize, but when, and what will they look after? No industry participant escaped this period of normalization (mainly within the Industrial side of the industry).

DGL felt the hurt too, but with an even more magnified effect on the share price.

DGL IPOed during these very strong few years for the entire global chemicals distribution industry. It then used a combo of debt and a bit of equity to pursue a string of acquisitions. Nothing wrong with this – remember our prior discussion on the fragmentation of the market and the push to consolidate. But this was at the peak of the covid induced bull cycle. When DGL during the summer of 2022 ‘suddenly’, but rightfully, disclosed that earnings growth would flatten after a period abnormal growth, the market adjusted - aggressively.

Many companies in the space saw their valuation corrected, though DGL’s relatively elevated valuation, lower(ed) growth forecast, relatively higher debt levels and lower liquidity provided for a much more extreme effect on the share price. Add to that the fear that the company would continue to aggressively pursue inorganic growth funded with equity at a much lower valuation (it didn’t) and we can understand the market’s reaction.

The share price continued to correct over 2023 as end-markets deteriorated and visibility decreased. The last hit was more recently at H1 24 results where DGL posted relatively stable yoy revenue and ebitda growth, as well as lower net income following higher depreciation charges (due to acquisitions) and financing expenses. The market was once again disappointed as it anticipated growth and the shares collapsed 40% (roughly in line with the yoy decline in net income).

What now?

As a consequence of all the above the current valuation has been pushed to extremely low levels, giving DGL no credit of a potential return to growth. We believe that the market’s view is extremely myopic and ignoring the overall big picture as described previously.

While end-markets are still relatively soft, the long-term trends remain intact. DGL will continue to benefit from increasing demand, further outsourcing and market consolidation.

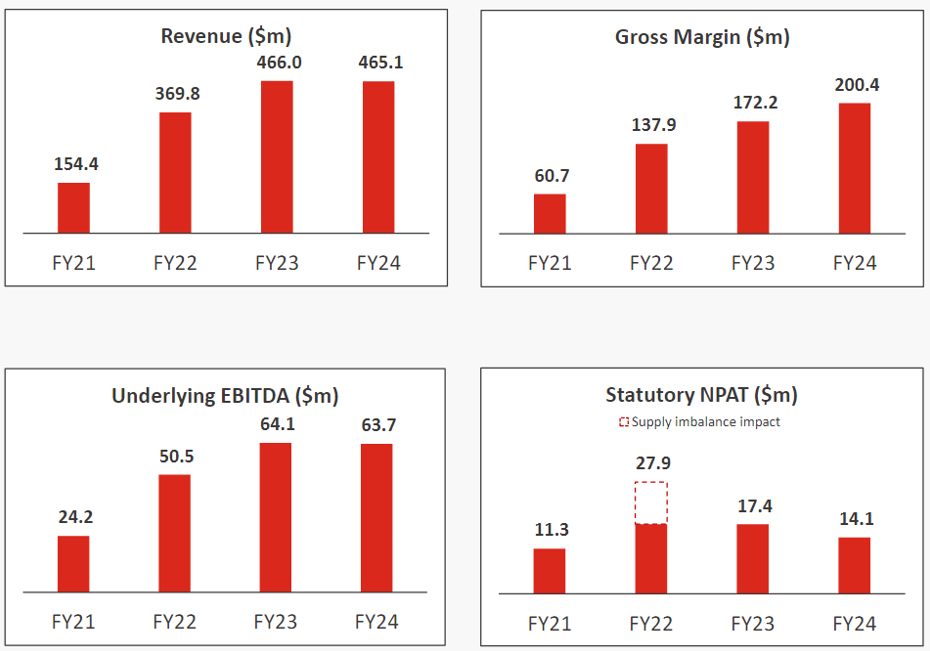

The company recently published its FY24 results (fiscal year ending in June). Do these look like the financials of a company that is suffering a lot as reflected by the share price? To us they don’t. They actually look pretty resilient given the strong market normalization.

While organic growth slowed down, it was compensated by inorganic growth. Income was pressured by higher depreciation and financing expenses. Compare these results with many of the larger players, and you’ll notice a very similar trend.

The big question in the industry is when will end-markets improve? This, nobody knows. Be very careful with sources that claim they do. Look at all the producers – they’ve been telling us for almost two years that growth is around the corner, but it still has to materialize. Often the best they can do is guess. And these people supposedly have the best visibility.

This is why chemicals are cyclical – if we knew how the markets would gyrate, they wouldn’t be cyclical. This is also a big reason behind the relatively low valuation.

However, some things we do know.

First of all, many producers and larger distributors have been reporting over the past few quarters that destocking trends are (mostly) over and that end-market demand has stabilized, albeit the latter at a relatively low level. Again, we don’t know when the cycle will turn, but it seems that it isn’t deteriorating either. Add to that the improving comparable base and organic growth will look better going forward.

DGL’s FY24 results have been pressured by relative high investments in organic and inorganic growth initiatives, such as big site and warehouse expansions, new plants and processes, related personnel as well as significant investments in internal systems (new ERP, payroll, integrated warehouse management systems, etc.). A big part was expensed throughout FY24 and will provide a positive contribution over this year, even more so as utilization rates increase.

DGL will also continue to pursue accretive m&a, which, together with recent acquisitions closed at low-single digit ev/ebitda, will add to results.

Bottom line, we don’t need much volume to come back to growth and achieve operating leverage. A reminder that while the relatively asset heavy character of DGL is a drag in bad times, margins expand much more rapidly in good times compared to for example a Redox or IMCD.

The potential

Can end-markets get worse? Sure they can. But sooner or later they will normalize and growth will resume. As the company grows (organically and inorganically), its earnings volatility will be reduced given continued end-market and product diversification. DGL is basically where the big guys were 10-15 years ago, and these market slowdowns happen every once in a while.

But the consequence of all this is that DGL is now trading at less than five times ev / FY24 underlying ebitda - a very low level for a company that should be able to grow ebitda solidly for a long time. Perhaps we’re not there yet. That’s why DGL is a ‘looking out five+ years’ investment. It must be truly viewed for the long term.

We believe that ebitda could grow organically and via acquisitions at >20% p.a. over the longer-term (it grew ebitda almost 40% p.a. since FY21). As DGL grows, its earnings and liquidity profile will improve, pushing the valuation upwards. Looking out five years it is not unreasonable to estimate that DGL could generate over $130m ebitda – which would just reflect the absolute growth over the past years. At 7.5x and two turns of net leverage, that’s almost 40% annual return over a period of five years. On relatively conservative estimates.

Indeed, the big guys (IMCD, Redox, Brenntag) will tell you that acquisitions of ‘platforms’ (such as DGL) are generally done at high single-digit to low-double digit multiples. The larger players themselves are currently trading at 10-17x, depending on their growth, industry and geographic exposure; DGL should be able to eventually command more than 7.5x if it continues to execute.

A few risks to note

The main risk to the thesis is off course macro related. We just cannot know when the market will turn. But while this remains an inherent risk, we once again point to the relatively resilient earnings character of DGL and the rest of the industry, combined with the secular trends driving this industry.

Another few risks that have been vented to us relate to CEO Simon Henry (who owns 53% of the company). Mr. Henry had an unfortunate mishap with the media in the past which did not reflect well on DGL. This remains a non-controllable risk. Nonetheless, it seems that he learned from his experience given the relative silence over the past few years.

Another risk related to the CEO is that he might aggressively continue to pursue acquisitions, potentially at the expense of shareholders. We don’t believe that this will be the case as the company repeatedly disclosed that it will be more selective with acquisitions, at least until the operational footprint has been optimized and leverage is reduced. While we don’t necessarily agree on the latter (leverage is not elevated in our opinion - chemicals distributors can easily work with higher debt levels), DGL’s intentions should provide some reassurance.

Many thanks to Alexander Eliasson who brought DGL to our screens over a year ago.

As always, this is solely our opinion and does not constitute advice. Always do your own due diligence.

If you liked this write up, please like and hit the “share” button below. Thank you!

Excellent post. Thanks for surfacing! A comment on the logistics component. If you listen to Buffett talk about their BNSF railroad there are many times he discusses how much he dislikes and fears transporting chemicals. He then discusses how all the railroads are required by law to transport chemicals. The environmental and damage potential of a chemical spill or accident is high and the rates to transport them are capped to a level that does not make it worth it for them to do the work, but they are legally required to do so. This is a different country however, I’d have to imagine the liability of transporting chemicals is asymmetric. Accidents absolutely happen and it’s a matter of when not if. Ideally they have excellent insurance and it covers such liabilities, though that might not be enough. In any event this looks very interesting but will have to dig in more on the logistics arm.

in the meantime .... DGL at 0,36 AUD ... time to answer your question 'Are we there yet?' with yes?