This time we’ll be tackling an entire industry: specialty chemicals distributors.

I know that the name might be sleep-inducing, but please bear with me. This is one of my favorite industries, for reasons I’ll explain in detail below. While most of the time investors are focusing on finding the perfect stock to invest in, over the years I’ve found that keeping a few resilient, rapidly growing sectors on my watchlist provides plenty of opportunity for strong returns, particularly if one needs to react quickly when markets sour.

Always be on the look-out for resilient sectors with secular tailwinds. They can be fantastic places to trade and invest.

Specialty chemicals distribution is such an industry. This market is unique, with many attractive characteristics:

It is still relatively small, and driven by big secular tailwinds which provide a pathway for growth for many years to come. Indeed, the complexity of end-markets is just growing, increasing the need for specialty chemicals distributors.

Given the small size and big tailwinds, in combination with the fundamental importance of specialty chemicals, the industry has been very resilient to economic downturns.

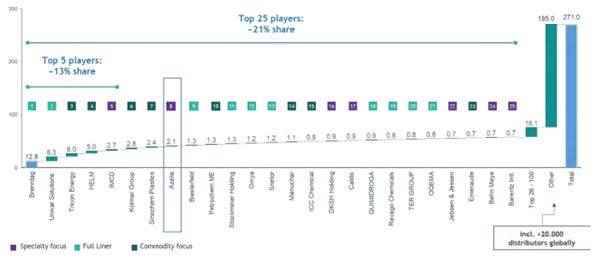

Market fragmentation is huge, with just a few large players. As such, and given the growing complexity of the market, consolidation is a necessity, and has indeed been a large driver of growth for the largest players. This will continue to be the case.

Based on the above, specialty chemicals distributors could easily grow ebitda c.15% p.a. for the foreseeable future. Given their inherently asset light business model, returns and cash flow generation is strong. The fragmentation of the market allows them plenty of room to plow this cash back in the business.

There are just a handful of listed specialty chemicals distribution companies, and even fewer that are pure players. Interestingly, these distributors will often beat consensus estimates – a feat I’ll explain below in more detail.

In short, here we have a young, resilient industry that grows organically at GDP++, with a handful of listed market participants growing even more rapidly given the possibility of ‘plug-and-play’ m&a, and the possibility to continue to do this for a long time.

What are specialty chemicals

Specialty chemicals and ingredients are chemical products that provide a wide variety of specific, targeted effects. These chemicals and ingredients (I’ll skip the ‘ingredients’ part from now on, for the sake of efficiency) form a fundamental part of the end-product, providing it with specific characteristics. Without it, the end-product wouldn’t have important necessary qualities, such as a targeted (enhanced) performance, a specific color, taste or nutritional attribute.

Specialty chemicals, also known as performance chemicals, are used as key ingredients in finished products. Their composition sharply influences the performance and processing of the product. Specialty chemicals are generally applied in customer-specific formulations and are fundamental key inputs; they cannot be easily replaced, except perhaps with other specialty chemicals.

Examples of end-products where specialty chemicals are important inputs are shampoos (with the endless types often differentiated by specific specialty chemicals), medicines (active pharmaceutical ingredients), dishwashing powders (biocides), construction chemicals (additives) and even gummy bears (maintain the sweetness, but reduce the sugar).

What do specialty chemicals distributors do

As explained, specialty chemicals are a fundamental part of the end-product, but just a very small part of the total product. The volumes of the specialty chemicals needed to make the product are generally tiny. To provide an idea, an average customer of a specialty chemical distributor makes less than ten orders per year, with an average order size of no more than $ 10,000.

There are many differences between commodity chemicals and specialty chemicals. Perhaps the most important distinctions are that commodity chemicals tend to be sold in large volumes and their pricing is transparent and market-driven. Specialty chemicals on the other hand are typically sold in small quantities customers, and the pricing is all but transparent. The latter creates a lot more opportunity for enhanced margins.

One key aspect of the end-markets of specialty chemicals is that they are becoming increasingly complex as they mature. Think about the myriad of shampoos, skin care products, medicines, (healthy) foods, performance and construction materials, etc. that we see today, and compare it against a few decades ago. This increasing complexity is global trend. Products need to become better, more customised, more efficient, cheaper, healthier, and so forth.

The combination of small volumes and increasingly complex end-markets are making it increasingly costly for producers to reach manufacturers (i.e. the end-clients who buy the specialty chemicals to produce the end-product). Producers of specialty chemicals are generally larger, traditional commodity chemicals producers such as Solvay, Symrise, BASF, IFF and Givaudan. As a general rule for these large suppliers of chemicals, ~20% of customers contribute ~80% of revenue.

Remember that these are not your standard chemicals; the salesforce requires much more technical expertise, often needed to explain the product’s specifics and alternatives to the client. Imagine the cost of maintaining many small dedicated sales, marketing and distribution arms. Consequently, large suppliers are increasingly happy to outsource the distribution of specialty chemicals.

In addition to providing customers with the necessary technical expertise and services (e.g., warehousing, packaging, labelling, regulatory compliance), specialty chemicals distributors bundle many products and provide customers with formulation advice; they work with clients to develop new, customised formulations. As such, (big) specialty chemicals distributions have many ‘innovation labs’, creating a strong value-add for costumers (and hence higher margins).

In short, specialty chemicals distributors are a platform, linking many large suppliers (often hundreds or even >1,000) to many small manufacturers that generally target specific regions and products. They provide a much needed, and overall cheaper, service to the big suppliers, while making life easier for the manufacturers.

A small market, with plenty of tailwinds rapidly

It is difficult to accurately estimate the size of the specialty chemicals distribution market. According to the largest listed pure players – IMCD and Azelis – the market of specialty chemicals is about $ 800bn. Of this, $ 650bn is still insourced by the big players themselves; the residual $ 150bn is the specialty chemicals distribution industry.

A big driver of growth will continue to be the outsourcing of the sales, marketing and distribution activities of producers to pure play distributors. Outsourcing is estimated to be roughly 18%, growing ~0.5% per year – that’s about $ 3bn extra revenues per year to be divided amongst specialty chemicals distributors. As a comparison, the largest pure play specialty chemicals distributor (IMCD) generates less than $ 5bn revenues (!).

Furthermore, the pace of outsourcing has been increasing; as distributors grow, so does their network and formulation knowledge, which increases their attractiveness to producers.

Besides outsourcing and increasing complexity of end-markets, there are other factors that will continue to drive specialty chemicals distributors’ growth:

As end-markets and geographies mature, customer needs become more differentiated, increasing demand for (more) customised solutions, and thus specialty chemicals.

Increasing complexity also increases regulation and the need for suppliers to focus on efficiency (hence more outsourcing).

The above also leads to increasing investments in product and formulation expertise – an area of expertise of specialty chemicals distributors.

Importantly, end-markets are incredibly fragmented. A BIG part of growth is via acquisitions, where larger players acquire smaller, local players, targeting a specific geography, product and/or supplier relation. As they grow, so does the dependence of larger suppliers to distributors.

As a consequence of all the above, specialty chemicals distributors have very strong, resilient financials, and the inherent ability to grow earnings in the mid- to high-teens % range for at least a decade. As a back-of-the-envelope calculation: GDP+ industry growth (4-5%) + acquisitions (4-5%) + outsourcing (1-2%) + operating leverage (10-20bps p.a.) = ~mid-teens % ebitda growth p.a.

Gross margins and the conversion rate are key

To be clear, specialty chemicals distributors don’t produce anything themselves. They buy the chemicals from the big suppliers and distribute them. They don’t even change labels; an acquired Symrise chemical is sold with the same brand.

The pricing mechanism is simple. A distributor of specialty chemicals, such as IMCD, regularly receives lists from producers of specialty chemicals with prices for these items. IMCD takes that price – there’s (generally) no bargaining or volume discount whatsoever. IMCD then passes these prices on to clients, adding whatever margin it is able is able to get. That margin is a function of the availability and demand for the product, cogs (logistics, warehousing, etc), and other important value-added services such as formulation advice.

Consequently, gross profit (margin) is of great importance in the specialty chemicals distribution industry, rather than overall revenues. Another key metric is the conversion ratio – ebita / gross profit – and an indication of the efficiency of the business.

Given the vast amount of acquisitions, amortisation of intangibles is a sizeable expense. As such, specialty chemicals distributors generally base their operating profit proxy on ebita.

As a consequence, one has to be careful when looking at the return these companies report, which are generally returns on tangible assets. These are often extremely high – as in, >50%. While this is technically correct, a few things have to be kept in mind. Remember, specialty chemicals distributors acquire a LOT.

Distributors acquire other smaller distributors. What do they buy? Well, as mentioned, its mostly supplier relationships, access to local market and/or salespeople, and perhaps specific formulations or know-how.

Also, as you probably noticed, these assets are all intangibles. When a company acquires another company, accounting standards require a purchase price allocation (PPA) to be performed. In a PPA, the purchase price is allocated to all the acquired assets. Fixed assets and working capital are generally taken as-is, and intangibles are valued with some prescribed valuation methodology. The rest is assumed to be goodwill.

While supplier (and client) relationships are separately valued and recognised on a balance sheet, intangibles such as networks and know-how are subsumed into goodwill directly.

So, while distributors have asset light models, and their return on tangible assets is sky-high, keep the above in mind. The ‘true’ returns on capital lie somewhere in between ROCE incl. intangibles (incl. goodwill) and ROCE excl. intangibles.

Just a handful of listed distributors of specialty chemicals

While there are many listed companies globally active in the distribution of specialty chemicals, there are just a handful that solely focus on distribution of chemicals (instead of e.g. production and trading as well). And there are even less that are pure play distributors of specialty chemicals.

IMCD ($IMCD – The Netherlands ) and Azelis ($AZE – Belgium) are dedicated distributors of specialty chemicals, and considered to be the best in the sector. Brenntag ($BNR – Germany) and Univar ($UNVR – US) are so-called full-liners, distributing both commodity and specialty chemicals.

Don’t make the mistake of believing that there isn’t a big difference between commodity and specialty chemicals distribution. There is, and the impact on the financials is material. Given the lower price transparency, the importance of specialty chemicals and formulation advice, IMCD and Azelis’ businesses are much more profitable, resilient and generate higher returns.

Why specialty chemicals distributors often beat the street

Another interesting fact about this industry is that the few listed players will generally beat consensus estimates.

Growth from acquisition is in the DNA of specialty chemicals distributors. Integration is very easy and dyssynergies are generally non-existent. Remember what we just discussed regarding the assets that these distributors target; supplier and client relationships, network, salespeople and know-how. All these acquired assets can easily be added onto an existing network and (larger) chemicals distributors have done it hundreds of times already throughout their history.

Interestingly, it is somewhat of an unwritten rule of sell-side analysts to exclude inorganic growth in their models. The reasoning is obvious: the exact impact on the financials is hard to estimate (how much is paid and acquired, the timing, the recognising of the assets on the balance sheet, etc). Bottom line, most analysts don’t do it.

That is all fine for most industries where acquisitions are infrequent, but you’re venturing far off the trail in the case of specialty chemicals distributors if you don’t include some estimates of inorganic growth. As mentioned, m&a is an integral part of the business model – it has to be taken into account.

To give you an idea about how far off the street is, consider Bloomberg 2023 consensus for IMCD. Analysts estimate ~€ 4,750m revenues for 2023. However, assuming a full year impact of the acquisitions over 2022, the company estimates that the consolidated 2022 revenue would have been c. € 4,730m. Cleary IMCD can beat it, if just for new acquisitions alone.

How much are you willing to pay for a company with a sticky, high-return business, with a pathway to grow ebitda in the mid-teens % range p.a. over the next decade?

The point is that one cannot look at specialty chemicals distributors and not take growth from acquisitions into account. Just assuming organic growth and excluding inorganic growth will lead you to underestimate growth, big time. And this is exactly what most sell-side analysts do.

Lastly, keep in mind that this error compounds looking out a few years. 2025 estimates might be off by as much as 20%, assuming average historical inorganic growth.

Where’s the rub

By now you might be thinking based on this writing that there doesn’t seem to be much downside to this industry. This is of course not true, as it is for all industries. The biggest risk (specialty) chemicals distributors are currently facing, in my opinion, is a potential normalisation to the long-term growth trend. As a consequence of supply chain disruptions, the industry has massively over earned over the past few years, as reflected by the strongly increased gross profits and conversion margins. Now business is normalising and the question is: will there be a hard landing or a soft landing? Based on what we have seen so far from the companies, the latter seems to be the case. But the jury is still out.

That said, keep in mind what I’ve previously explained: m&a is a BIG part of the growth in this sector. One important question that needs to be assessed when looking at specialty chemicals distributors, is how much room there is for acquisitions. Because even if organic demand slows down, a lot of growth can still be acquired.

As always, this is for informational purposes only - no advice!

Great article!

Great description. Very insightfull. Thanks for sharing.