ToffCap's Monday Monitor #22

Your regular monitor for interesting event-driven trades and companies

ToffCap’s Monday Monitor is our overview of interesting event-driven trades and companies we find while turning over many rocks. The list is dynamic; it continues to grow and change. If you have interesting additions to the list, feel free to contact us at contact@toffcap.com or on Twitter.

Enjoy!

Disclaimer. ToffCap’s Monday Monitor is provided for informative purposes only. No due diligence has (yet) been performed on the names on this list. The list might change strongly on a regular basis. This overview does not constitute advice; always do your own due diligence.

Important notice. We would like to publish the TMM on a weekly basis, but we need a more critical mass. If you enjoy this service, please like and hit the “share” button below. Thank you.

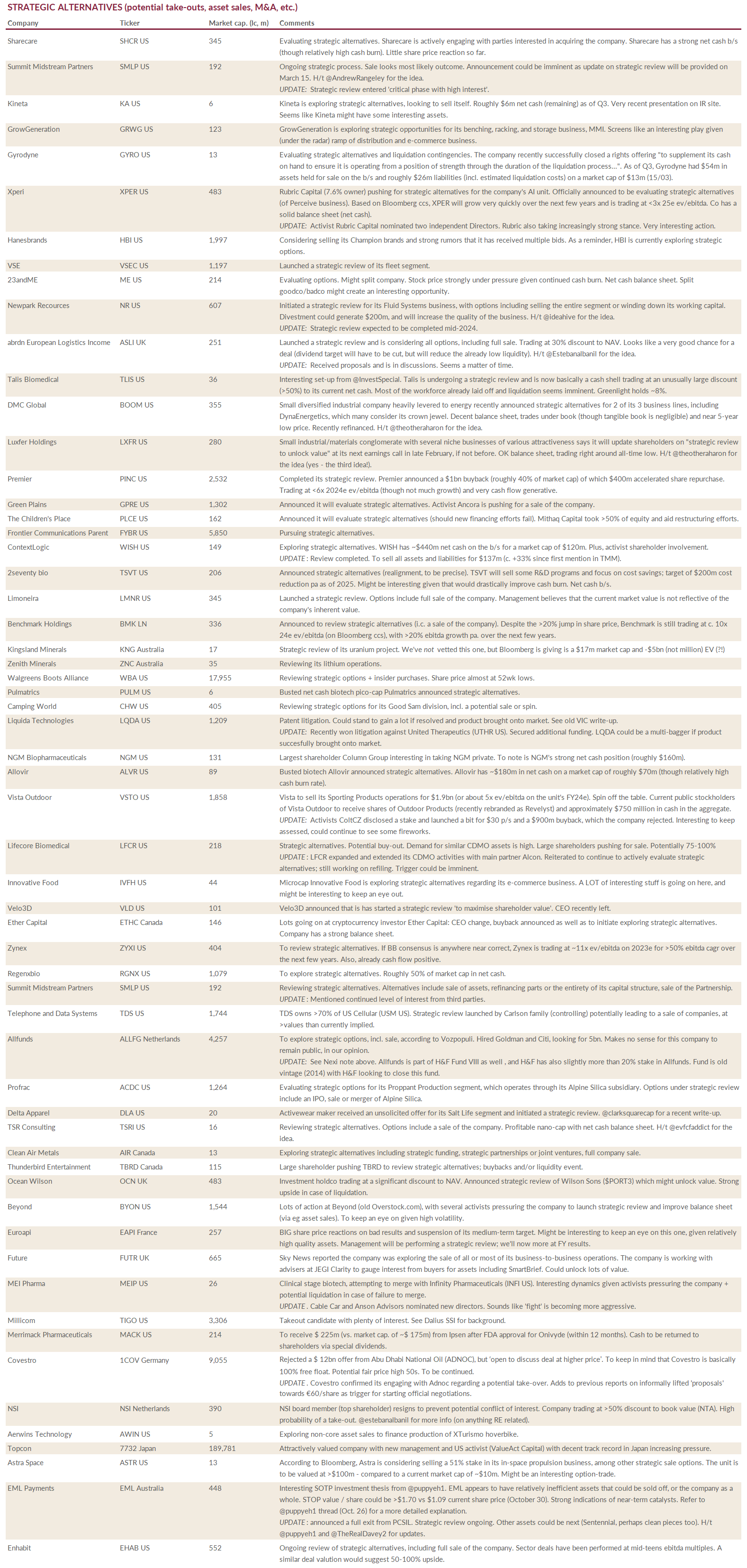

Overview

I. Company watchlist

II. Catalyst trades

I. COMPANY WATCHLIST

Interesting companies with seemingly strong upside potential we have looked at recently.

Additions this week

4Mass Spolka Akcyjna (4MS Poland – PLN 153m). We flag this interesting pitch on X from @Floebertus. 4Mass produces hybrid nail polish, a blend of salon-grade gel and traditional lacquer. The product is a hit with consumers as it stays 2-3x longer than lacquer (resin components make it less brittle), and given its applicability at home it reduces the need for a visit to a nail salon. 4Mass has shown very good progress over the recent years and the future looks just as bright (perhaps even more). 4Mass plans to introduce a full range of cosmetics for the face, eyes and lips, continue to build scale and develop internally owned and produced formulas, and expand into international markets. Continued growth and multiple expansion provide for multi-bagger potential.

Pioneer Power Solutions (PPSI US – $55m). PPSI is an electrical-power management company. Topline growth inflected strongly in 2022 and earnings seem to have done that in 2023. The company has a strong backlog which bodes well for continued growth on the back of secular (EV) tailwinds.

Revenues could grow >30% pa for the foreseeable future, pushing earnings much higher as operating leverage kicks in. Pioneer has a net cash b/s, the CEO owns ~20% and the company is trading at ~7-9x my (back of the envelope) ebitda estimate. If strong growth continues, cash flow should be mitigated in the near term as expansion capacity is needed. Nonetheless, a single-digit multiple seems way too low for what could be >50% ebitda growth for the foreseeable future. To keep in mind though that the risk in these cases is most often related to scaling. Might be interesting to keep assessed. H/t @DeepValuePlay for the idea.

II. CATALYST TRADES

Event-driven trades and ideas.

New additions and updates

3M (MMM US). Will spin its health care business into an independent public company ('Solventum'). Spin effective April 2.

UPDATE: Solventum to trade under SOLV. An investor day is scheduled for March 19 to provide an overview of Solventum's business and value creation opportunities.

General Electric (GE US). GE is set to spin its energy business ('Vernova') on April 2. Will trade under 'GEV'.

UPDATE: GE dove deep into the medium-term expectations of the upcoming spin-offs during the recent investor day.

MDU Resources (MDU US). After the recent spin of Knife River, MDU now also plans to spin its construction services business. Remaining company will be a pure-play energy delivery business.

UPDATE: MDU provided an update of its intended spin of the construction business 'Everus'. Link here. Spin expected 'late 2024'.

Summit Midstream Partners (SMLP US). Ongoing strategic process. Sale looks most likely outcome. Announcement could be imminent as update on strategic review will be provided on March 15. H/t @AndrewRangeley for the idea.

UPDATE: Strategic review entered 'critical phase with high interest'.

Sharecare (SHCR US). Evaluating strategic alternatives. Sharecare is actively engaging with parties interested in acquiring the company. Sharecare has a strong net cash b/s (though relatively high cash burn). Little share price reaction so far.

Kineta (KA US). Kineta is exploring strategic alternatives, looking to sell itself. Roughly $6m net cash (remaining) as of Q3. Very recent presentation on IR site. Seems like Kineta might have some interesting assets.

GrowGeneration (GRWG US). GrowGeneration is exploring strategic opportunities for its benching, racking, and storage business, MMI. Screens like an interesting play given (under the radar) ramp of distribution and e-commerce business.

Gyrodyne (GYRO US). Evaluating strategic alternatives and liquidation contingencies. The company recently successfully closed a rights offering "to supplement its cash on hand to ensure it is operating from a position of strength through the duration of the liquidation process...". As of Q3, Gyrodyne had $54m in assets held for sale on the b/s and roughly $26m liabilities (incl. estimated liquidation costs) on a market cap of $13m (15/03).

Xperi (XPER US). Rubric Capital (7.6% owner) pushing for strategic alternatives for the company's AI unit. Officially announced to be evaluating strategic alternatives (of Perceive business). Based on Bloomberg ccs, XPER will grow very quickly over the next few years and is trading at <3x 25e ev/ebitda. Co has a solid balance sheet (net cash).

UPDATE: Activist Rubric Capital nominated two independent Directors. Rubric also taking increasingly strong stance. Very interesting action going on.

Victoria's Secret (VSCO US). Announced a $250m buyback, roughly 17% of the market cap (15/03). The share price recently dropped >30% following horrible earnings.

Patterson (PDCO US). Approved a $500m buyback program, roughly 20% of current market cap (15/03).

Eventbrite (EB US). Announced a $100m buyback program, on a current market cap of $560m (15/03). According to BB, Eventbrite has $280m net cash and operating earnings are on the verge of inflecting positively, with strong growth ahead. EB is trading at c. 5x ev/ebitda on 2024e.

AMN Healthcare (AMN US). Strong insider buying by the CEO and CFO. Shares recently dropped almost 30% on earnings miss.

FMC (FMC US). Strong insider buying action. If you follow us you'll know we keep close tabs with chemicals. Agri had (in our opinion) a classic cyclical downturn; markets seem to be moving in the right direction. Might be interesting to keep FMC assessed as earnings inflect.

Innovid (CTV US). Quite some insiders buying activity. Innovid is a classic busted SPAC, but has a net cash balance sheet and seems to be inflecting on earnings. Based on street estimates. Innovid is trading at ~10x ev/ebitda on 2024e for ~30% ebitda growth over the next few years.

AerSale (ASLE US). We note the relatively large insider purchases in this battered stock.

NanoXplore (GRA Canada). Continued (very) strong insider purchases in this very interesting company. After years of losses, NanoXplore seems on the verge of strong profitability growth. Might be interesting to keep this one assessed.

Signature Bank (SBNY US). Very attractive liquidation, with many assets already liquidated and CRE portfolio remaining. Significant upside to equity (as in, multiples). Will take some years to play our, but seems nice IRR potential.

Olink (OLK US). Merger Arb. Olink is being acquired by Thermo Fisher. Seems to be an 'easy' deal. Roughly ~9% spread for a few months. H/t Jason (TMM comments section) for the idea.

Paul Mueller (MUEL US). Launched a tender offer to repurchase shares at a purchase price of $80 per share (up to $10m). PM shares closed at $70 on Friday. Tender will expire May 7.

JAMF (JAMF US). Jamf hosted an Investor Day on March 13 reviewing the company's business, strategy, and long-term financial targets. The company seems ready to scale profitability targeting accelerating top-line growth, and resp. 25% and 26% operating income margin and unl. FCF by 2026. If achieved, JAMF will trade at c.12x ebit and plenty of growth potential left (>80% GMs).

Veradigm (MDRX US). Recently delisted, with strongly pressured stock price. Growth has been declining but stability looks ahead. Strong share price potential if Veradigm can indeed get back to growth (and uplist again). Good cash flow generation. H/t @EgweneAlVer for the idea.

Bally's (BALY US). Merger arb. Takeover bid from Standard General at $15 p/s. Set up a special committee to evaluate the offer. Roughly 13% spread (15/03).

HashiCorp (HCP US). Looking to sell itself. Held exploratory talks with several players (according to BB).

Parkin (PARKIN UAE). We note (again) the upcoming IPO of Parkin, which manages parking lots in Dubai. While not extremely cheap, Parkin is massively profitable. Multiple should reflect solid and very visible cash flow generation and returns. Good dividend stock. IPO date March 21.

Modern Mills (MODERNMI Saudi Arabia). We flag the upcoming listing of Modern Mills, another SA privatisation. Final offer price SAR 48. Might be interesting.

WonderFi (WNDR Canada). Interesting action at this crypto trading platform. WonderFi is (finally) starting to show some revenue generation. Might be interesting to keep assessed as crypto moons once again. Also, decent insider purchases.

Lincoln Educational Services (LINC US). Lincoln Edu will hold its first (we believe) investor day tomorrow (19/03). Might be interesting to keep an eye on.

Turtle Beach (HEAR US). Looks like an sale might be imminent. Company created a ‘value enhancement committee’ and hired Jefferies as a financial advisor . Also, Donerail Group (who previously bid $32.86 / share and $36.50 / share), now has 5/7 of the BOD seats and 2/3 seats on the value enhancement committee.

UPDATE: Announced a very interesting deal (DPD). Company 'incredibly optimistic on 2024 prospects'.

Vista Outdoor (VSTO US). Vista to sell its Sporting Products operations for $1.9bn (or about 5x ev/ebitda on the unit's FY24e). Spin off the table. Current public stockholders of Vista Outdoor to receive shares of Outdoor Products (recently rebranded as Revelyst) and approximately $750 million in cash in the aggregate. Activists ColtCZ disclosed a stake and launched a bit for $30 p/s and a $900m buyback, which the company rejected. Interesting to keep assessed.

UPDATE: Recently rejected a bid from MNC Capital. Share price moved >$30.

Surgepays (SURG US). Getting VERY close to the shut-down of ACP finding (funding depleted by April). Company recently raised $15m, probably as a defensive move in order to fund the growth of its wireless mobile product. This one will remain volatile (which means opportunity; check our blog for background on the thesis)

UPDATE: Shares (finally) back down to earth after company acknowledged that ACP funding is drying up. Expect horrible Q2 and Q3.

Overview of ongoing event-driven trades

If you enjoy this service, please like and hit the “share” button below. Thank you.

Great stuff as always

Have you tracked the share px performance post-announcement of large buybacks? Lets say, on same day, 3- and 6-months after? tx