ToffCap’s Monday Monitor provides a snapshot of interesting potential investments and event-driven trades we find while turning over many rocks, with a special focus on companies that screen cheaply and catalyst trades. The list is dynamic; it continues to grow and change. If you have interesting additions to the list, feel free to contact us at contact@toffcap.com or on Twitter.

Enjoy!

Disclaimer. ToffCap’s Monday Monitor is provided for informative purposes only. No due diligence has (yet) been performed on the names on this list. The list might change strongly on a regular basis. This overview does not constitute advice; always do your own due diligence.

Important notice. We would like to publish the TMM on a weekly basis, but we need a more critical mass. If you enjoy this service, please like and hit the “share” button below. Thank you.

Overview

I. Company watchlist

II. Catalyst trades

I. COMPANY WATCHLIST

Interesting companies with seemingly strong upside potential we have looked at recently.

Additions this week:

Solvay (SOLB Belgium – € 10.5bn). We focus this week a lot on Solvay. Solvay is holding its anticipated capital markets day this week where it will dive into the upcoming separation of its business units into a legacy Solvay (commodity products) and Syensqo (specialty chemicals). The split is to be effective in December, with interesting dynamics. Solvay will split into a high(er) quality and low(er) chemical company, while currently trading at ~5x ev/ebitda on 2023e (given challenging market conditions, mainly on the commodity part of the business). Guidance for the new specialty co is HSD-LDD% ebitda growth pa until 2028. Uncertainty remains regarding natural recourse damages to be paid. Upcoming split probably volatile, potentially providing interesting trading dynamics.

Primo Water (PRMW US – $ 2.3bn). After going nowhere for several years, Primo Water might finally be poised to rerate. The company is selling its International business for ~$900m. The non-US businesses generate ~$95mm ebitda; the remaining business is expected to generate c. $380m ebitda in 2023 and have a net debt position of around $450m (pro-forma the deal). Growth seems to be picking up again, and with a much cleaner balance sheet Primo might rerate towards peers. Primo is trading ~10x ev/ebitda on FY23 for a much clearer b/s; peers trading at ~15x.

FTC Solar (FTCI US – $ 55m). Speculative micro-cap. Stock suffered a lot recently following poor results (residential solar weakness and uncertainty around IRA related subsidy/tax credit information), management changes and overall poor sentiment in the cleantech sector. FTC has a $55m market cap and ~$30m in net cash on the balance sheet, for a total backlog of $1.6bn. Company might be pushed to a sale.

II. CATALYST TRADES

Event-driven trades and ideas.

New additions and updates

Solvay (SOLB Belgium). Will split in EssentialCo (commodity products) and Syensqo (specialty chemicals-real name, not a joke). Split to be effective in December 11. Interesting to keep an eye out given large differences in quality and growth of both companies.

UPDATE: Solvay is hosting its CMD today, and provided 2028 targets for both companies.

Wärtsilä (WRT1V Finland). Wärtsilä decided to initiate a strategic review of its Energy Storage and Optimizations (ES&O) business. On a twelve-month rolling basis, the ES&O net sales by the end of Q3 2023 amounted to € 983m. On the same twelve-month rolling basis, the business turned to profitability. Could be an interesting SOTP case.

Telephone and Data Systems (TDS US). TDS owns >70% of US Cellular (USM US). Strategic review launched by Carlson family (controlling) potentially leading to a sale of companies, at >values than currently implied.

Cellectis (CLLS US). Cellectis received a $25m up-front payment from Astrazeneca, and a $80m equity investment at a $365m valuation. Cellectis' market cap is ~$170m (10 November).

Primo Water (PRMW US). Primo Water is selling its International business for ~$900m. Primo is trading ~10x ev/ebitda on FY23 for a much clearer b/s; peers trading at ~15x.

Bragg Gaming (BRAG Canada). Peer GAN to be taken out at >100% premium. Bragg is higher quality and profitable, trading at large discount to implied (similar) deal valuation. H/t puppyeh1 for the idea.

Ascential (ASCL UK). Ascential to sell two divisions after a strategic review. Remainco valued at ~5x ev/ebitda; peers trading at >10x. H/t

for idea and write-up.Worthington Industries (WOR US). To spin Worthington Steel (ticker WS). Record date 21 November, 1-1 share ratio.

PetMed Express (PETS US). Decent insider purchases in online pet pharmacy PetMed. Stock clobbered ytd; net cash b/s (about 1/3 of market cap), ~17% dividend yield (if sustainable).

Cohbar (CWBR US). To commence liquidation. Cohbar has ~$9m in cash and cash equivalents on the b/s, with ~$1.5m in accrued liabilities (hence negative EV).

Shyft Group (SHYF US). Strong insider buying in this beaten up small-cap. BBccs is at 100% ebitda growth next two years; trading at c. 11x ev/ebitda on FY23 ccs.

Western Digital (WDC US). Western Digital is back to planning the spin of its Flash and HDD franchises after the busted deal talks with Kioxia. Original timing was Q4 2023; now H2 24.

SITE Centers (SITC US). SITE Centers announced that its intends to spin-off its Convenience assets into a separate publicly-traded REIT to be named Curbline Properties ('CURB'). Interesting, unique growth company. Will list with a net cash (debt free) balance sheet. Timing H2 24.

Howard Hughes (HHH US). Ackman (Pershing Square) continues to buy HHH; added >650k shares since last TMM. Company recently announced it would spin off its Seaport and other related assets. ~90% upside to NAV (according to HHH).

National Bank of Greece (NAGF Germany, FF listing). The Greek government is about to sell a 20% stake in the National Bank of Greece. Could be interesting buying opportunity; NAGF has been doing very well operationally.

Flutter Entertainment (FLTR UK). Will list on the NYSE in Q1 24. Trading at ~13x ev/ebitda on 2024e. Might be interesting to keep an eye out.

Zynex (ZYXI US). To review strategic alternatives. If BB consensus is anywhere near correct, Zynex is trading at ~11x ev/ebitda on 2023e for >50% ebitda cagr over the next few years. Also, already cash flow positive.

ON24 (ONTF US). Continues to buy back shares (like crazy). Roughly 70% of the market cap is cash (no debt).

ContextLogic (WISH US). Exploring strategic alternatives. WISH has ~$440m net cash on the b/s for a market cap of $120m. Plus, activist shareholder involvement.

REGENXBIO (RGNX US). To explore strategic alternatives. Roughly 50% of market cap in net cash.

El Pollo Loco (LOCO US). Company acquired ~10% of shares outstanding, another $20m lined up. Plus, new CEO.

Peabody (BTU US). Buyback machine. Company acquired ~10% of shares outstanding, and has $700m left (and on the bank!) on its program; or >20% of the market cap.

Brink (BCO US). Recently increased its buyback authorization to ~$700m (>20% of the market cap).

Phillips 66 (PSX US). Bought back c. 3m shares on a total of 36m during the last quarter. Continues to increase buyback authorization.

Barnes Group (B US). Big insider purchases after a >30% sell-off of the stock.

Summit Midstream Partners (SMLP US). Reviewing strategic alternatives. Alternatives include sale of assets, refinancing parts or the entirety of its capital structure, sale of the Partnership.

UPDATE: Mentioned continued level of interest from third parties.

Overview of event-driven trades

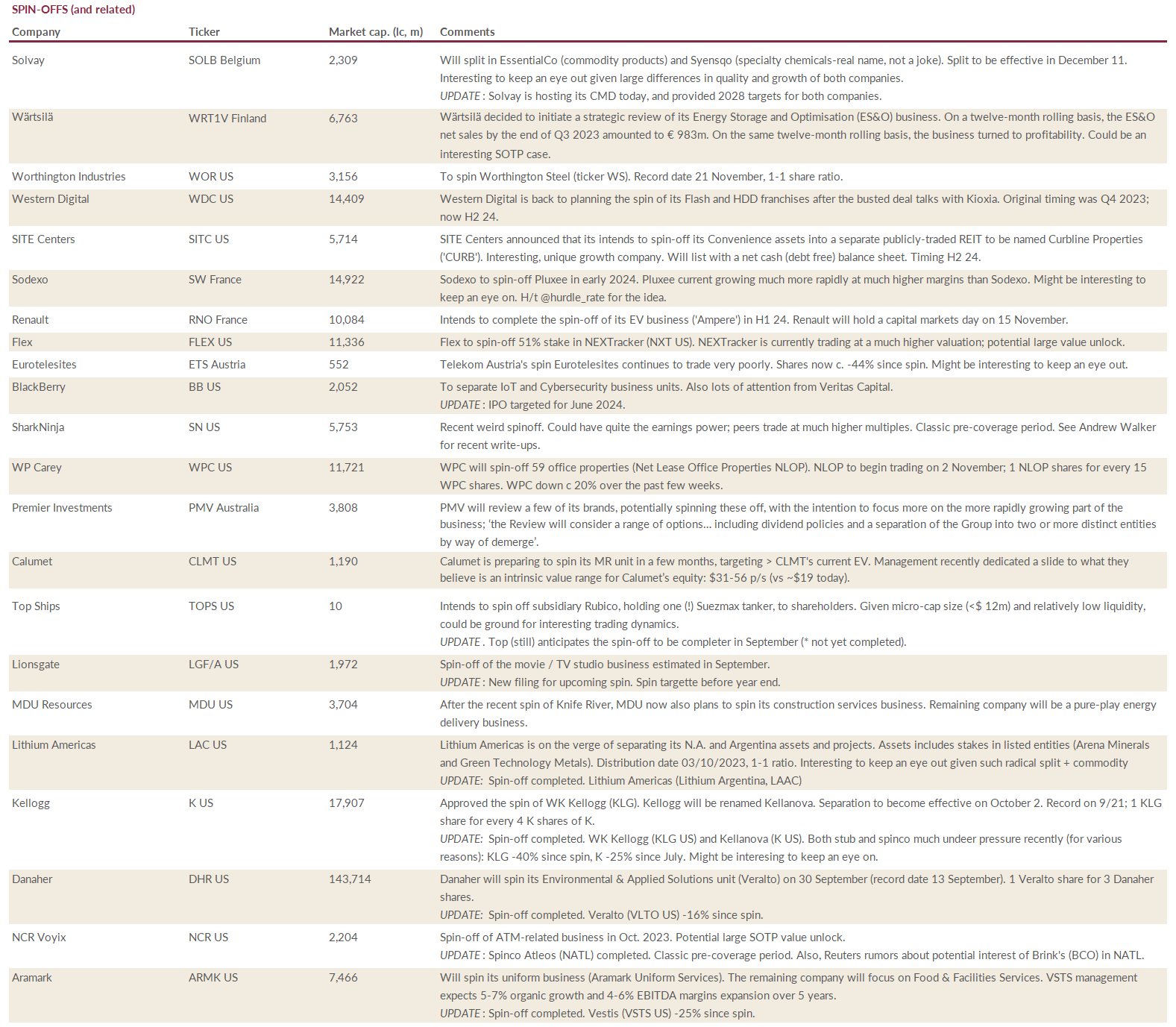

SPIN-OFFS (and related)

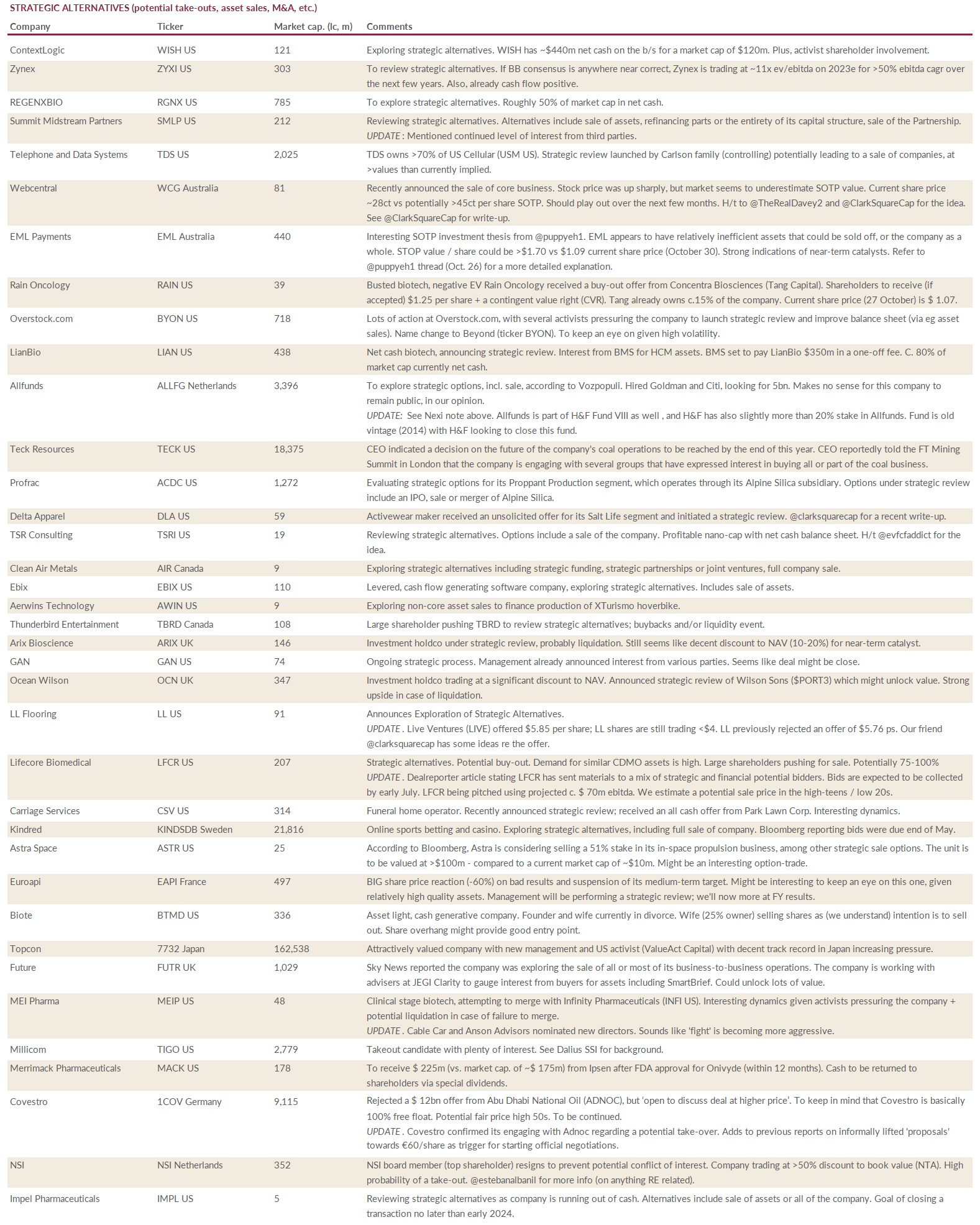

STRATEGIC ALTERNATIVES, POTENTIAL TAKE-OUTS, ASSET SALES, M&A, etc.

LARGE BUYBACKS, INSIDER PURCHASES

MISCELLANEOUS (liquidations, merger arb., out-of-bankruptcy, uplistings, etc.)

If you enjoy this service, please like and hit the “share” button below. Thank you.

Top-notch work, my fav series to read. Could you recommend any further reading/share more insights on CWBR?

Great work.Maybe I missed it but $GAN looks compelling 1.46. compared to offer 1.97