eDreams ODIGEO

The eDreams story continues to fascinate me. This online travel agency’s transition towards a subscription model has been having a polarising effect on the market. The choices appear to either love it or stay the hell away.

The bears’ arguments mainly relate to the actual discounts earned with Prime, where many don’t believe there to be material savings realised vs. other (discount) platforms. Another point of contention is the churn, with lots of uncertainty about the actual churn and its dynamics, taking into account that the Prime model is often applied as a ‘opt-out’ model.

On the other hand, important KPIs such as subscriber growth, cash EBITDA growth, NPS scores, cash flow, etc. continue to show an impressive development, with eDreams now reaching an important inflection point.

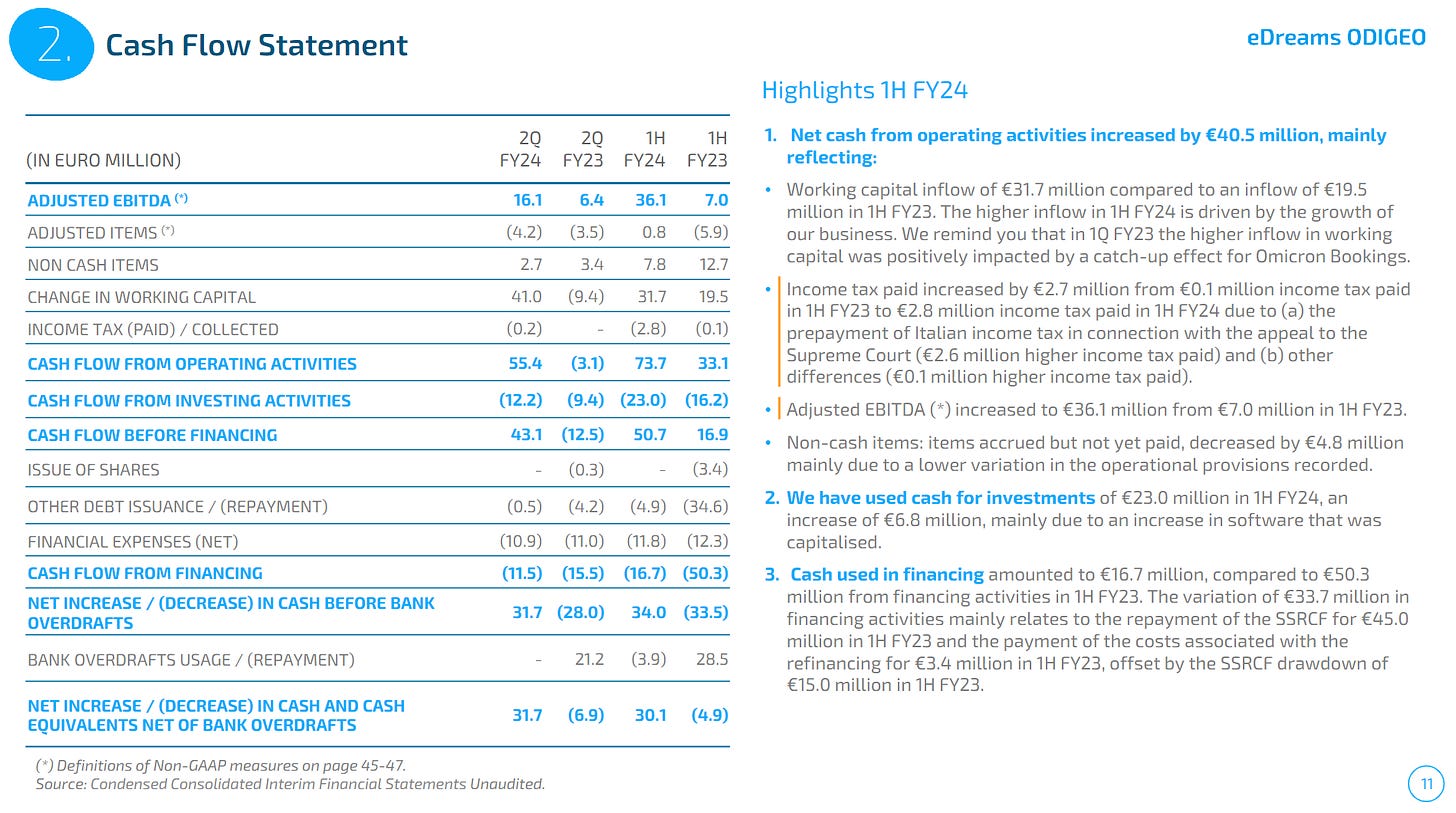

The most recent results were top-notch yet again, with strong growth in cash ebitda. Cash ebitda has now grown from roughly €11m in Q4 22 to €34m in the latest quarter.

Prime subscribers shot up from 3.6m to 5.1m in just a year, a 42% jump (target of 7.25m by March '25 - translating into €180m cash ebitda). More impressively, the slice of marginal cash profit from Prime increased from 54% to 64% yoy.

This growth is translating into serious cash flow. Net financial debt has dropped to €313m and with (recurring) profits climbing at this rate, we're only going to see cash generation pick up speed.

eDreams also hinted that they won't be sitting on their cash pile, eyeing share buybacks and debt repurchases. The specifics are still up in the air, but management's already hinting at capital returns kicking off soon.

The company is trading at roughly 6.5x cash ebitda on its FY25 cash ebitda target (FY ending March 2025), excl. cash generation, which is pretty low given their growth and increasing visibility, plus the looming capital returns. Many are clearly not buying this transition (yet), and there remains a lot of potential upside should the company continue on this growth path.

Thank you for reading. If you enjoy this service, please ‘like’ and hit the “share” button below.