I admit this is an odd one for me. I normally have a strong bias against investing in funds or similar vehicles. As a professional stock picker, why should I hand over money to someone who does the same work as I do, particularly if I believe that I can do better. Most fund managers nowadays are not in a position (anymore) to beat the market and / or are managing funds that are increasingly burdened by ever stricter investment guidelines (think ESG) leading to what I call ‘structural negative alpha’ funds.

However, I’ve nonetheless reasons to sometimes invest in a (listed) fund. One reason is if you (as an active investor) find someone who has more or less the same investment philosophy and is looking at specific markets / instruments that you find attractive but cannot invest in or are too complicated to access. As such, a position in the fund might be a good complement to your portfolio.

Another reason is if you have the possibility to invest alongside a great investor. There are some great investors out there. However, most of them manage private funds, and I prefer the liquidity of a listed instrument. Also, it’s very hard to find funds that resonate with my investment philosophy, are not too large (thus flexible) and are unconstrained. So, as you might imagine, I very rarely invest in listed funds.

This brings me to Harris Kupperman, mostly known as Kuppy. Kuppy manages a fund called Praetorian Capital, and has been having great results over the past few years, up 8x net since early 2019 (not a typo). I consider Kuppy an ‘old style’ hedge fund manager: benchmark agnostic, unconstrained, focussed on finding multi-baggers and not afraid to take on volatility.

Kuppy is well-followed on Twitter and if you do not follow him, you should. My guess is that most of Kuppy’s followers are relatively new, i.c. since the past few years. As such, most might experience him to be a macro / energy specialist, focusing on big themes. And while that’s currently indeed the case, it’s not the whole picture. I’ve followed his work for quite some years now and what most resonated with me was his willingness and ability to invest in anything that shows strong asymmetry – low probability of losses, high multi-bagger potential – no matter the quality of the underlying asset, as long as the price makes up for the inherent risk (and some). Kuppy is not afraid to run a concentrated portfolio, which might entail a relatively high level of volatility. And if you’ve followed this blog a bit, you’ll probably know that this kind of investment philosophy very much resonates with me.

Given Kuppy’s success, it’s also no wonder many would want to co-invest and would be willing to hand over a big check in order to do so. Unfortunately, his fund is not available (nor suited) to the average investor.

So why this long introduction? Because Kuppy is also the founder and CEO of a listed company called Mongolia Growth Group (MGG, ticker YAK Canada).

What is MGG? The original mandate of MGG was, as the name indicates, to invest in (at the time) one of the most rapidly growing economies in Asia – Mongolia. The country had a promising outlook at the time, and MGG invested primarily in real estate to profit from the economic tailwinds. However, bad government policy basically killed off the promise of Mongolia and the country has been having a hard time since, along with MGG’s property portfolio.

Since then, MGG has been selling properties and reinvesting the proceeds in marketable securities and stock buy-backs. In addition, over 2021, MGG incubated a new subscription service for investors, KEDM. This service has been growing rapidly at healthy margins, though it kind of stagnated now. Subscription revenue alone is able to stem opex and it looks like MGG will be roughly break-even operationally going forward.

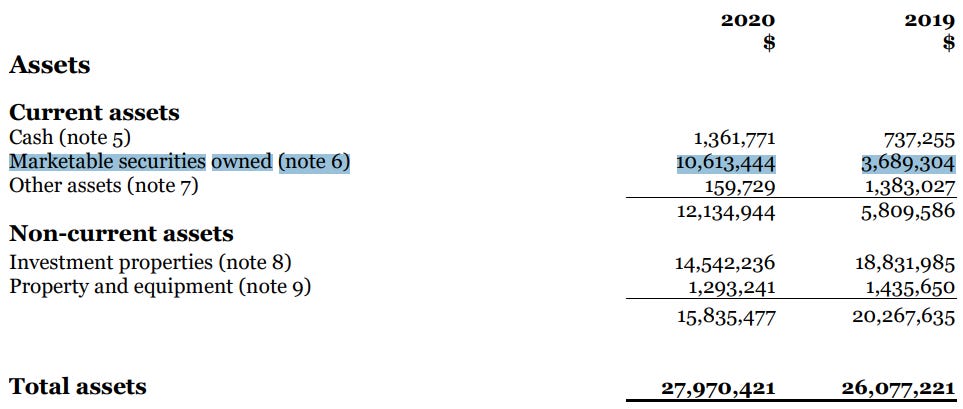

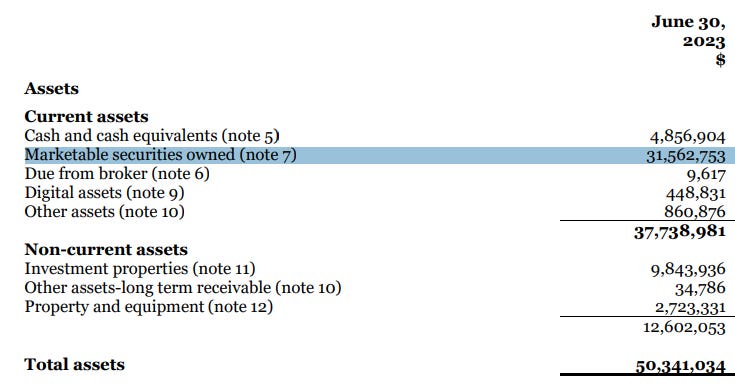

Kuppy being Kuppy, he was able to generate quite strong returns on the investment portfolio, which as of Q2 23 comprises of a significant part of total assets.

Currently (Q2 23), based on 27,307,799 shares outstanding, marketable securities have grown to roughly C$ 1.16 per share and NAV stands at C$ 1.62 per share. This compares to a current share price of MGG of C$ 1.42, or a discount of roughly 12%.

The latter of course assumes that the Mongolian assets of roughly C$ 10m can be sold, and MGG is working on that. There was a bid in June 2022 of ~C$ 12m, but was never realised. I don’t know what the current status is of a potential sale of the Mongolian real estate portfolio, though I noted Kuppy being in Mongolia recently, which might indicate something is coming up.

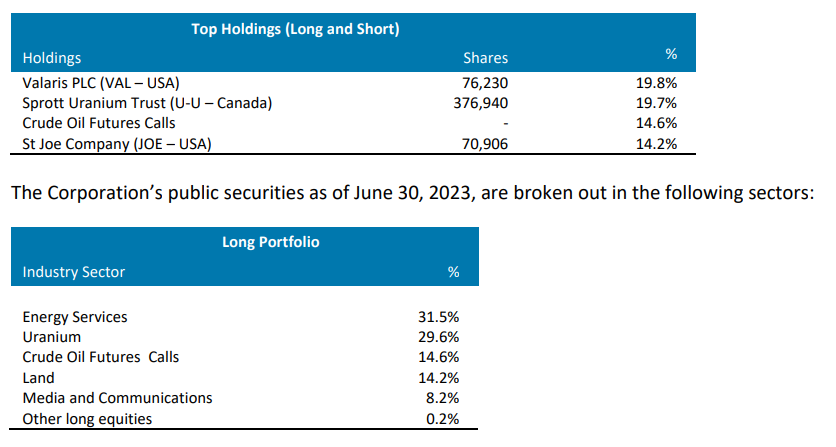

However, that’s not the entire story. Looking at the most recent composition of the investment portfolio, we get an interesting picture.

If you follow Kuppy, you won’t be surprised by the composition; Kuppy loves his uranium and oil. But the main point is that all top-4 positions have performed quite nicely so far in Q3, and I estimate a current NAV of roughly C$ 1.80 per share, which brings the discount to >20%.

But the story continues.

Another important dynamic with MGG is a potential liquidation.

Given the investment success of recent years and consequently the bloating of the balance sheet, MGG is running the risk of being labelled a Passive Foreign Investment Company (PFIC). I won’t delve into the characteristics of a PFIC, but the bottom line is that PFICs are subject to cumbersome tax guidelines. As such, MGG will have to focus on avoiding being branded a PFIC. One way to do that, is to acquire ownership of operating assets – which is exactly what MGG was aiming for. As discussed in MGG’s 3Q 2021 letter:

‘…there are regulatory and tax reasons why we cannot be a publicly traded vehicle composed primarily of non-controlling minority interests in public securities. Our expectation is that the composition of our balance sheet will migrate towards both minority and controlling positions in various businesses—public and private, where we can influence the outcome of events.’

So MGG will have to buy (a stake) in an operating company, which is of course something of a black box. We have no idea what MGG could do and this clearly creates uncertainty. But keep in mind that if MGG is able to acquire an operating asset, with Kuppy we should see proper capital allocation; (excess) cash flows to be reinvested in assets with high ROICs and/or other instruments with multi-bagger potential. Successfully playing the arbitrage between public and private markets can be a lucrative endeavour.

That said, I believe there’s a bigger chance that part, if not all, of MGG’s portfolio will be liquidated and capital returned to shareholders. Indeed, it increasingly seems that MGG is unable to find interesting opportunities at an attractive price. From a 2022 letter to shareholders:

‘Unfortunately, we have something of a ticking clock on our business as we have to eventually own more private business assets or large stakes (25% or more) in public companies. Unfortunately, during 2023, hard decisions must be made. I refuse to make a bad investment decision simply to check a regulatory or tax box. As a result, if we cannot find anything intelligent to do, we’ll be forced to begin returning capital to shareholders.

… [] if we start the process of returning capital, we’ll likely end up returning a majority of the excess capital. I want to make it clear that we are not going to be forced sellers of any securities. If we do take the route of returning capital to shareholders, we’ll only do so after individual investments have matured.’

So, in short, either MGG finds something interesting to acquire and transforms itself or it will return capital. At the current share price we are only paying for roughly MGG’s listed investment portfolio and not much for the rest. Furthermore, if you like uranium and oil, you have a chance to gain exposure to the sector - and Kuppy's investment skills - via YAK at roughly the prices of before the recent run-up.

This investment is clearly not for everyone. As mentioned before, if you’re an unconstrained investor and share Kuppy’s views, you could just as well follow the underlying theses and buy exposure yourself. However, if Kuppy’s investment philosophy resonates with you and would like some (small) exposure to his investment skills – at a nice discount to NAV – than it might not be so bad to take a look at MGG.

Clearly the first step here is to get comfortable with Kuppy’s investment style and current views. So, if you’re mildly interested, start with learning more about Kuppy. There are plenty of podcasts and youtube videos out there of him discussing his views and investments. Read his old blog post at Adventures in Capitalism LINK. And even if you conclude MGG isn’t something for you, at the very least you will have a few good chuckles.

As always, this is not investment advice and you should do your own research.

From their latest MD&A : "It should be noted that due to income tax considerations, we’ve made the difficult decision to no longer actively trade the portfolio. While active trading was a huge boon to our returns previously, we believe that the tax consequences of earning profits from trading don’t outweigh any benefits that we’ll receive from trading the portfolio. Therefore, it’s likely that overall returns will be dictated primarily by the returns of our existing portfolio. This was a difficult decision as active trading has been so accretive, but the math is the math"

In the Q3 letter they reported that the property assets have been sold for 10m CAD. This has derisked the investment case somewhat, yet the discount is probably still around 20% considering the strong price increase in Sprott and Yellow Cake.

From their Q3 letter: "We have started to lose confidence that we will be able identify an opportunity that is sufficiently attractive. If we cannot find a suitable acquisition in the near future, we will likely choose to liquidate this Company."

So liquidation seems more and more likely, any idea on how they would return capital to shareholders in such a scenario?