Is 2CRSi really becoming an AI infrastructure play?

We need your help on this one! (no paywall)

2CRSi is one I’m going to need your help with.

Despite having done little work on the industry, we took as small position a few months back with the intention to scale it up as we did the works. I figured that the current order momentum was still not nearly being reflected in the price, and we could at least play this one for a short rerating.

Well, the market clearly woke up on this one. Our smallish position is up +160% and we’re hitting ourselves for having postponed the hard work to today.

In short, 2CRSi seems to be successfully transforming itself from a forgotten player in the server world into a pretty interesting player in the global AI infrastructure race.

Today, 2CRSi is notable for three things:

The company has an ugly name (2CRSi??) and an annoying ticker (AL2SI France). I still often confuse ticker and company name.

It’s order book is on fire. A nice string of massive order wins is transforming the company’s outlook over the next years.

Not expensive at all given what’s already in the pipeline; <7x ev/ebitda looking out a few years, for >100% growth p.a.

Despite the recent move, the valuation does not seem right given the ongoing transformation, growth and hype potential.

That said, we’re doing work on it but we are still uncomfortable sizing this one up properly; it’s an industry that is changing rapidly, with a lot of moving pieces.

With our still sub-par understanding of the industry and the story moving fast, I felt it would be good to put this one out there, asking knowledgeable people for their input.

So, in short: Is 2CRSi a hidden gem or not??

Any help at this stage is appreciated!

The basics

2CRSi designs and manufactures high-density, energy-efficient servers—the kind used in data centers, cloud computing, and increasingly, to power artificial intelligence workloads.

As far as my understanding goes at the moment, these aren’t generic racks you can pick up from any hardware vendor. 2CRSi builds tailored machines engineered for the demands of hyperscalers and high-performance computing environments; think bleeding-edge GPUs, immersion cooling, and custom configurations designed to keep up with the surging compute demands of large language models and generative AI.

What makes the story compelling is not just the product, but the trajectory.

Just a few years ago, 2CRSi was in rough shape. The acquisition of Boston Limited—a UK-based hardware company—proved to be a misstep. Integration headaches and a lack of focus left the company bloated, with declining profitability and rising debt. By early 2023, the company had nearly €50 million in net debt and had burned through years of goodwill with investors.

But the company then went through a pretty hard reset. 2CRSi sold off Boston, trimmed fat, and zeroed in on its core competency: building powerful, energy-efficient computing infrastructure.

Back-to-basics basically, and perfectly timed it seems. As generative AI began capturing global attention, the company emerged with the right product at the right time.

The turnaround in the numbers has been pretty remarkable.

Standalone revenues jumped from €35 million to €167.6 million in just over a year—a nearly fivefold increase. Ebitda, which had been deeply negative, rebounded to €6.4 million. Net income turned positive for the first time in years. Net debt dropped from €30 million to just over €9 million. Textbook financial clean-up.

This momentum has carried into the latest fiscal year, with July 2025 results showing revenues of €220.8 million for FY 2024–25—a 31% jump yoy—while net income climbed to €2.4 million, further reducing leverage.

Definitely aided by the AI Boom

2CRSi’s resurgence isn’t happening in a vacuum. It’s being carried by one of the most powerful secular trends in technology today: the AI infrastructure buildout. The surge in generative AI has unleashed a race to deploy compute capacity at scale, and the companies making the servers behind the scenes are being pulled into hypergrowth.

2CRSi appears to have the right toolkit. Again, as far as my current understanding goes, its immersion-cooled servers—like the Godì 1.8 and upcoming Atlas 1.8—are purpose-built for AI workloads. These machines are packed with the latest NVIDIA GPUs (think H200 chips), also providing a stamp of approval from NVIDIA and a ticket into enterprise AI deployment budgets.

The order book is on FIRE

The past months have seen some serious traction in winning contracts:

In June, 2CRSi announced a $100 million deal in the US, supplying AI-optimized servers to a client in New York. The systems are being delivered as we speak and are configured with top-tier NVIDIA hardware. This marks a major strategic entry into the North American market and validates 2CRSi’s capability to serve demanding enterprise clients on a global stage.

Shortly after, the company followed with a $54 million order from the UK. Once again, the machines are geared for AI workloads, equipped with NVIDIA’s HGX H200 GPUs. Deliveries are set for this month.

And the momentum continued in this month with a €47 million AI-server contract in Malaysia, set for delivery by year-end—a deal secured despite what seems newly tightened local export controls.

With these deals 2CRSi is looking at almost €200 million in higher-margin orders hitting the books over the next fiscal year.

I know that one swallow doesn't make a summer, but these are three pretty fat swallows and perhaps indicative of a deeper trend—2CRSi’s hardware is maybe not that crappy (anymore) and is actually able to win against some pretty large players in competitive markets. And these are production-scale deployments.

Hardware + Services

While the hardware business is clearly humming, what’s coming next might be as or even more important.

2CRSi is steadily building out a services layer around its infrastructure offering. The shift is anchored by the so-called “610 contract”—a long-term, multi-stage project that involves not just server sales but also design, deployment, and maintenance of full-scale data center infrastructure.

Although the bulk of the revenue from the 610 contract has been delayed to next year, it’s expected to have a material impact. Not only does it introduce recurring revenue, but it also moves 2CRSi up the value chain—from being a product supplier to becoming an infrastructure partner.

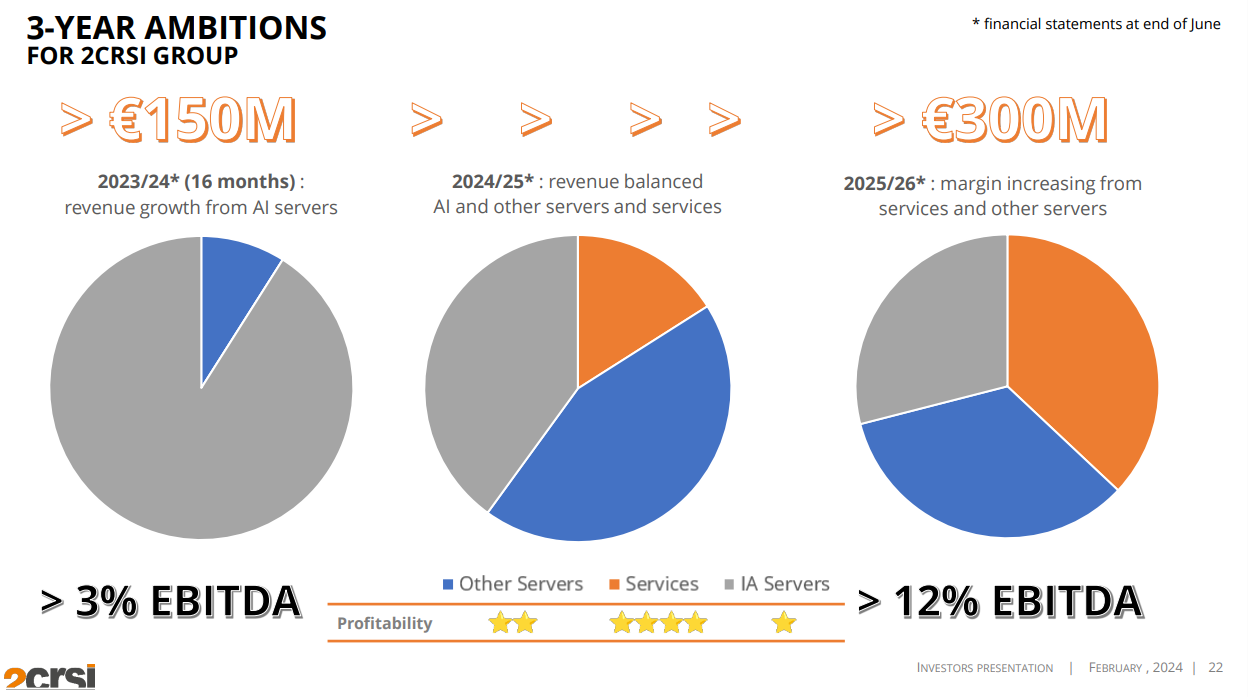

According to management, this transition should push ebitda margins above 12% over the next few years, up from under 4% just 12 months ago. With services contributing more meaningfully to the revenue mix, there’s a clear path to margin expansion and cash flow stability.

This looks all pretty cheap

The investment case boils down to 2CRSi (apparently) embarking on a strong growth path which will lead to record profitability, with a chance of hypergrowth on the back of the AI capex craze, all on the cheap.

2CRSi reported FY 2024–25 revenues of €220 million, and management is guiding toward over €300 million revenues at over 12% margins. That’ll be over €36 million, putting the company at <7x forward ev/ebitda for >100% yoy ebitda growth, and probably less given the current run rate (and the company’s confidence it can beat this target).

This would make for a pretty interesting risk/reward despite the recent move if strong growth continues.

Importantly, the company is guiding for this growth based on booked orders and strong client pipelines.

The usual risks

The business still hinges heavily on NVIDIA chips, which means it’s subject to the geopolitical winds swirling around US export controls. In early 2024, 2CRSi saw a Singapore-bound server shipment worth €90 million face delays due to such restrictions. The company managed to navigate the situation, but the risk is real.

There’s also the challenge of execution at scale. Delivering hundreds of millions worth of AI infrastructure across two continents, while simultaneously building a services arm, is a lot for a company of 2CRSi’s size. Any slip in delivery timelines or quality could dent customer trust.

Still, for all the complexity, the reward here seems outsized. The combination of revenue acceleration, margin expansion, and global validation has taken 2CRSi from being a speculative turnaround to seemingly a real player in the AI infrastructure game.

A hidden gem??

What makes this story compelling is how under-the-radar it remains.

2CRSi is not a household name. It’s not included in most institutional AI plays. But it is sitting on a set of contracts and (apparently) a technology stack that position it for explosive growth just as the market demand is taking off.

The company’s evolution—from a scrappy server vendor into a global AI hardware and services provider—is well underway. The financial inflection is here. And the market is beginning to notice.

2CRSi offers a rare combination of operational momentum, sector tailwinds, and valuation disconnect. A small-cap story with big-cap potential.

But again, I need your help figuring this out!

Great analysis, just one thing to add, the AETHER project, led by 2CRSi. MASSIVE optionality there too, will know further details before year end. Not the base of the thesis, but free optionality is always well received

would appreciate some opinions as well. at least at the moment it looks attractive. moreover low float may give a good return (in both directions :-D)