HighCo

Yes, that's actually the name

I was planning on writing about a few large(r) companies and provide a general update for the many companies discussed, but the recent set of results of today’s company made us finally take a serious look.

Although we’re still doing the works, I jotted down the case.

In short:

A sleepy French promo outfit finally finding its way up operationally.

The domestic engine (France) is back to double-digit growth; international noise fades into the background. The mix finally works again.

Two bolt-ons that matter, tipping the business toward scalable, recurring activation and giving real critical mass.

Guidance is actually going up. Margins hold >12% while the Casino overhang recedes.

Still mispriced: ~5x forward ebitda, double-digit fcf yield and >6% dividend yield for a business that’s starting to look like a platform, not an agency.

Many thanks to Lux Opes research for this one. We found HighCo thanks to their great highlights. If you’re not yet a subscriber, I highly recommend that you check them out.

Finally some stabilisation

For years HighCo (HCO France, €82m market cap) sat in our ‘why bother’ bucket. A French micro in couponing, some agency work and assorted retail services (yuck) - it looked frozen since circa 2015.

2025 seems to have finally snapped the spell. The French core is growing again, the Activation rails are doing real work, and management stopped promising ‘transition’ and actually pulled levers: they sold stray assets, lined up two sensible bolt-ons, nudged guidance up, and put idle cash to use.

HighCo’s turnaround began after a rough 2023-24 period dominated by the loss of its largest client, Casino (the French grocer, and another yuck). Casino’s implosion led to asset sales, restructurings, store disposals. That blew a hole in HighCo’s revenues (especially in France) and forced cost cuts and divestments.

Through 2024/early 2025 the ‘Casino comp’ was the drag on every quarter. Now most of that impact is lapped, HighCo has re-signed practical cooperation (incl. retail-media/Monoprix screens), and the exposure has shrunk enough that France can grow again without Casino dictating results.

The print that changed the tone

If you follow this blog, you’ll know that I have no problem swinging from high quality companies to absolute garbage. But on the latter, price is often not enough; we also like to see an inflection in fundamentals.

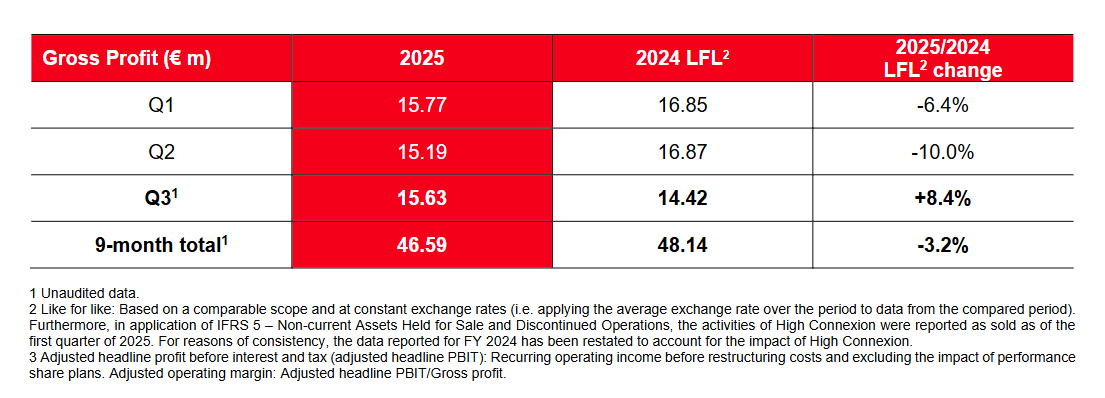

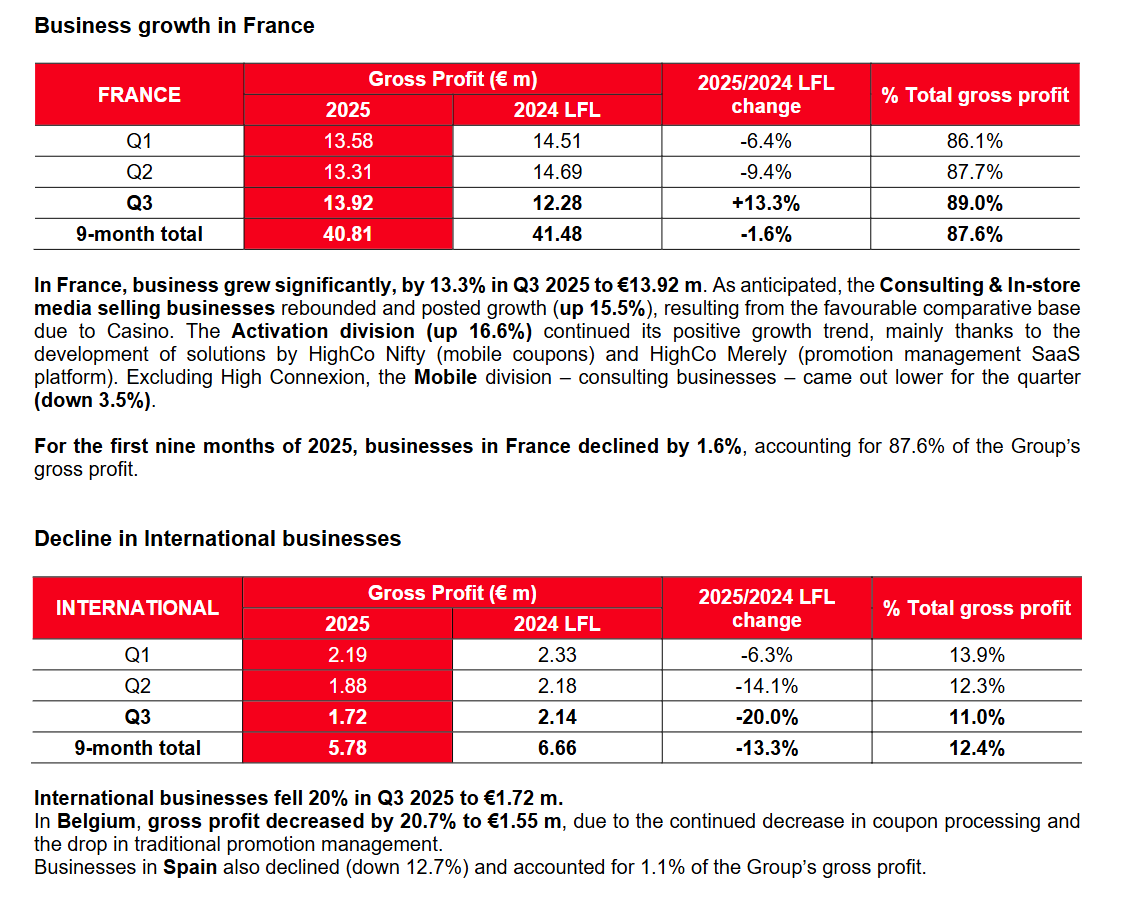

After quarters of hand-wringing about Casino, HighCo recently put up roughly 8% organic gross profit growth at group level, with France up double digits and Activation doing the heavy lifting.

The rebound was cleanest where it matters: domestic retailers shifted more budget toward omnichannel, data-driven formats, and HighCo’s platforms were actually there to catch it. tThe mix flipped back to something functional: France carrying the results, Activation setting the pace, and the group moving from ‘defensive’ to ‘rebuilding’.

France, which now accounts for roughly 85-90% of profit, has stabilized, with double-digit growth in Q3. Belgium remains weak, but the international drag is now small enough not to dictate group results. The Activation division (home to HighCo Nifty, its digital couponing platform, and Merely, its loyalty and data analytics tool) grew high-teens in Q3.

International remains a small drag (Belgium still digesting the legacy couponing slowdown), but it’s now 12% of total gross profit; not big enough to derail group-level progress.

Overall, France is once again the profit engine, representing ~90% of gross profit, with a 17.4% operating margin (at H1) even after the Casino chop and the HighConnexion deconsolidation.

Building the activation stack: Sogec and BudgetBox

Importantly, management has begun to move decisively away from legacy marketing services toward scalable digital models.

Two deals announced in June, Sogec and BudgetBox, mark a strong change. Both are being acquired from La Poste’s marketing subsidiary and together add roughly €27m in revenue and €17m of gross margin, equivalent to 30% of HighCo’s standalone base.

Sogec is one of France’s best-known coupon and cashback specialists, managing everything from digital discount campaigns to loyalty programs and promotional games. Sogec brings the full couponing/cashback/loyalty toolkit (including the Quoty app).

BudgetBox, is squarely retail media and in-store/on-site personalized activation, building personalized activation campaigns for over 200 partner brands and several large supermarket chains.

Folding these into HighCo gives the group a clear critical mass in activation - over 60% of gross margin post-acquisition - and transforms it into a strong independent player in France’s fast-growing digital promotion niche.

We still need to confirm the acquisition price, but we’re guesstimating ~€20m, likely fund this through a mix of existing cash and modest debt. 2025 should see about three months’ contribution (~€4m gross margin) and 2026 the first full year from with some modest synergies.

Integration risk appears manageable: the businesses are entirely French, culturally similar, and already operate in adjacent segments to HighCo’s existing platforms.

Product-market fit

The bigger picture is that HighCo is finally playing offense again.

Generally, the digital shift in consumer promotions (from paper coupons to real-time, data-led loyalty) has been underway for years but fragmented across small, undercapitalized players. Retailers now want integrated platforms that can issue, distribute, and analyze offers across online and in-store channels.

HighCo’s collection of Nifty, Merely, Sogec, and BudgetBox fits that bill: it can design campaigns, deliver them to shoppers’ apps or loyalty cards, and track redemption data back to brands. In a market where Carrefour, Intermarché, and Leclerc are all ramping up digital engagement budgets, having these end-to-end capabilities is a genuine competitive moat.

There’s also a structural tailwind from consumer behavior. Inflation and tighter household budgets are driving shoppers to seek savings, and brands to push more personalized promotions. In that context, couponing - long dismissed as old-fashioned - is suddenly relevant again, especially when digitized.

HighCo’s edge is its combination of long-standing retailer relationships and (now more) modern data architecture. The company processes millions of coupon redemptions each month, feeding a data loop that powers its loyalty algorithms. Few local rivals can match this scale.

A few numbers

Management’s updated 2025 guidance reflects this new momentum. They raised guidance again, now calling for slight growth in gross profit (around €61m) and operating margin above 12%. They did it after printing a bruising first half, which suggests real confidence in the exit run-rate and in the Activation mix that’s doing the heavy lifting.

We’ve got Casino impact fading, Activation momentum, and Sogec/BudgetBox consolidating from Q4.

Gross margin is now expected to fall only 1-2% this year, and operating margin should hold around 12% excluding exceptional items. For a company that just went through a major client collapse and divestiture (High Connexion was sold in early June), maintaining double-digit profitability is actually a victory.

With some back of the envelope math, we’re looking at roughly €13-15m in adjusted ebitda this year, rising to €18-20m next, supported by growing free cash flow generation and a still healthy balance sheet. Even after the acquisitions, net leverage will remain well below 1x ebitda, leaving room for further bolt-ons.

The consolidated cash picture is also pretty decent; while net cash at end-June was roughly €90m, stripping out the working-capital activity you’re at ~€40m, still up nicely versus year-end. That gives HighCo room to close the La Poste assets without financial contortions and keep the balance sheet conservative.

At roughly €4 per share, I estimate that the company trades around 5x 2025e ebitda (pro-forma) and a low double-digit free cash flow yield – and this is taking H1 25 current assets - total liabilities (mostly WC).

Looking out a few years, I could easily see HighCo trading at hsd multiples on (much) higher ebitda and a sizable cash position.

And did I mention the >6% dividend yield, offering some comfort while we wait for the story to compound.

What to keep an eye on

Still, this remains a small-cap in transition, not a finished (digital) deal.

Growth is lumpy, the international operations are marginal, and the group’s dependence on a few large French retail clients means concentration risk.

Execution on the Sogec and BudgetBox integrations will be crucial, both for realizing cost synergies and for showing that HighCo can operate a multi-platform SaaS-like model rather than an old-school service agency.

Last housekeeping point that’s easy to miss: the 2025-30 free-share plan (1.9m shares) is being done entirely out of treasury stock (no dilution) but will drag the P&L by ~€1.8m of non-cash expense this year. It’s why you’ll see 10-11% margin reported.

The near-term test

The next few quarters will test whether the recovery sticks.

The Casino fallout will finally wash out by early 2026, freeing up commercial and development resources that were stuck firefighting for the past two years. The Activation mix should rise further as the new assets contribute fully, and gross margin could return to expand.

If management keeps the cost base tight and executes on digital rollout, HighCo could exit 2026 with operating margins approaching mid-teens - not a stretch.

HighCo is an illiquid French micro-cap with a business that reminds me of past headaches. But I can’t ignore the morphing into a more modern, cash-rich digital activation platform with tangible leverage to structural retail shifts.

A steady normalization of growth, consistent margins, and disciplined capital allocation could easily support a continued re-rating.

If you value this post, please like and hit the “share” button below. Thank you.

tbh quality of these write ups could be improved vs the original monitor imo. From reading the frist 2-3 paragraphs I get nothing around why you think it is interesting vs market consensus. There are many companies at 5x EBITDA. Why this business model in particular what is clearly the bet here, and why / what data you have that confirms this is a good bet to make?

Thanks for sharing this idea. Curious, how is the 'dividend adjusted value' of the security shown on the chart calculated?