Our first guest post is from Under the Radars, author of one of our favorite blogs (Under the Radars). We’ve followed his work on Ambase Corp. (ticker ABCP) since the first post on Substack as well as on Value Investors Club. Ambase continues to present an interesting, highly convex opportunity with a clear path to potential value creation. Under the Radars was kind enough to provide an update to the thesis.

We strongly suggest to check out Under the Radars’ previous write-ups as well as the old VIC posts for more background information. You can learn more about the legal case on Under the Radars, or connect with the author on Linkedin or Twitter for further discussion.

In short: why invest in Ambase now?

Legal Payout: If the court finds a verdict in Ambase's favor, the company could rake in up to $160m (before tax and litigation funding agreements) relative to Ambase’s market cap today at only $9m.

Low collection-related risks: Collection-related risks may be mitigated by the sale of US assets and the relative ease of collecting legal payouts from US entities vs foreign entities. All parties involved are well-established NY real estate players.

High insider ownership: Litigation has been funded by personal capital from Ambase CEO Richard Bianco, who supported the early rounds of litigation with over $7m of his private capital. He owns 40% of shares and has gifted Ambase shares to his grandchildren, demonstrating his unwavering belief in Ambase’s litigation potential.

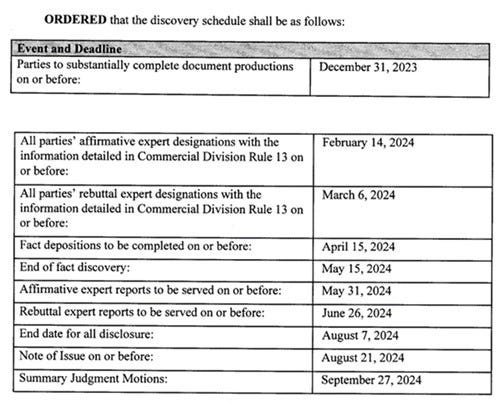

Timeline: A discovery order was filed on November 3, 2023. This order laid out the roadmap for information gathering. The timeline covers the period from December 2023 to the expected judgment in September 2024.

Background to the Litigation

The lawsuit is centered on claims of contract violations by the developers that resulted in significant financial damages to Ambase’s shareholders.

In 2013, Ambase joined JDS Development Group and Property Markets Group to purchase the former Steinway Hall building and its ground lease for $132m. Ambase provided $65m equity – or 50% – of the acquisition price.

The developer secured a $725m construction loan from Apollo Global Management and AIG, but amid delays and cost overruns, the group ultimately defaulted on loan repayments. As loan payments approached in March 2017, Apollo sold a junior mezzanine stake to Spruce Capital Partners, who swiftly foreclosed on the project. Ambase equity value was whipped out to near zero.

Ever since, Ambase has sought to reclaim its stake in the building, while the developers JDS and PMG were brought back into the project to complete the tower.

Ambase argues that there are undisputed breaches of contract law by the developers. Violations include 1) Failing to provide timely and accurate budgets, 2) Inflating the 2015 construction costs to invalidate the Equity Put Right, and 3) Withholding information from Ambase, which allowed Spruce Capital to foreclose on the project.

However, a crucial provision secured by Ambase CEO Bianco during initial negotiations could offer a lifeline to Ambase shareholders. Bianco secured an Equity Put Right clause in the contract. This clause allows Ambase to sell its initial $65m investment back to the developers, plus a 20% annual rate of return if the project's development costs rose by 10% or more. The true value of this equity put right is the centerpiece of this investment.

Valuation and Expected value

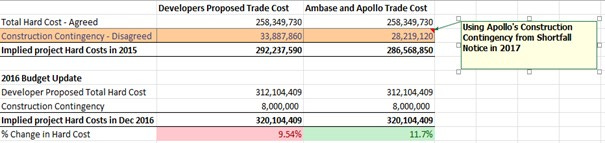

The trigger for Ambase to exercise the put right depends on “hard costs” increasing by 10% or more from the 2015 budget to the proposed budget in 2016. Ambase and the developers disagree on the budget-to-budget hard cost growth in 2016.

Ambase claims the developers inflated the contingencies for the budget in 2015 to avoid triggering the equity put right. The developers believe the contingency amount agreed in 2015 was $33,887,860.

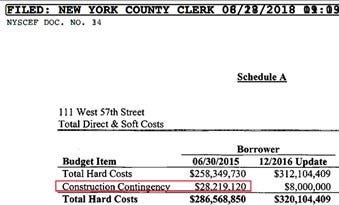

However, public information from a payment notice issued by Apollo in 2017 indicates that the construction contingency agreed in 2015 was $28,219,120. See below:

Using the construction contingency amount implied from the project’s primary lender, Apollo’s 2017 notice above would trigger the exercise of the equity put right. In the table below, “Hard Costs” increased by 11.7%, according to information from Apollo - the JV's largest lender!

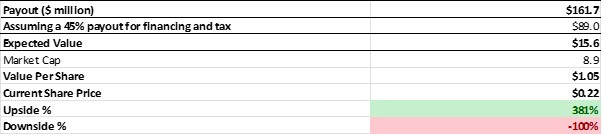

The value of the Equity Put Right, if exercised and upheld in court, is straightforward to calculate. If Ambase can put its $65m investment in the project back to the developer for an amount equal to a 20% annual return from 2013 through 2017, then the payout is roughly $161,740,800 (65*(1+0.2)^5). Ambase’s market cap today is $8.5m (06/03/24).

Assuming a 25% probability of an +$89m payout (assuming a 45% payout for litigation financing payouts, equity offerings and tax), which are very conservative estimates, and a 75% probability of losing -$8.9m, the expected value of the equity is still positive, at $16m. 1.8x the current market cap.

Assigning probabilities to events is difficult, but the point is that the market is currently pricing in less than a 30% probability (using conservative assumptions) that Ambase can prove “hard costs” increased by 10%. Despite public information from related court cases showing construction contingencies that trigger the Equity Put Right, and undeniable evidence that the developers failed to provide timely and accurate budget cost. I think Ambase has a higher probability of proving its claim than the market is currently pricing in.

Risks

Bianco’s loan and litigation agreement dilute shareholders' interest in the final litigation payout. Ambase launched an $8.8m equity offering on 28 February 2024 at $0.2/share, with Ambase’s CEO guaranteeing to buy any unsold shares. The CEO acting as the backstop investor could be seen as a sign of the CEO's optimism about the litigation outcome, as it further aligns his interests with those of the minority shareholders.

Under the terms of the equity offering Ambase will issue 44m shares and also mentioned it will continue to consider litigation funding agreements with third party litigation funders for up to $5m of funding. In general, litigation funding agreements are structured so that the litigation funder would receive back their initial funding amount first (i.e. before any recovery is received by the company), plus an additional multiple of 1.0 times to 3.5 times the amount funded. This would equal ~14% of the total $160m payout and has been factored into the value per share above.

Collection-related risks: the ability to collect legal payouts from JDS and Property Markets Group is unknown.

Ambase has no additional asset or business model other than the Equity Put Right. If the claim is dismissed, Ambase equity would be worth zero.

Summary

If the courts uphold Ambase's Equity Put Right and the counterparties pay the debt, the total proceeds could be $160m relative to Ambase's market cap of c. $9m at the time of writing. The net payment to Ambase could exceed $89m (or $1.05 per share v ~$0.21 share price today), tax-sheltered at least in part by NOLs, and following a split of proceeds with the CEO's earlier litigation funding agreement.

Ambase shareholders may receive additional proceeds if the other claims against the foreclosing lender and the Senior Mezzanine lender are successful in court. There is also the possibility for pre-judgment interest. The statutory rate in NY state is 9% and is mandatory in breach of contract cases. Despite the additional upside, the asymmetry is attractive at today's prices.

Simply put, Ambase represents a unique opportunity with a timeline- passionately backed by its CEO, Richard Bianco. Visit my previous blog post, Ambase Corp: Mispriced Penthouses, for further background on the legal case or feel free to connect on Linkedin or (X/Twitter).

Estimated next steps: Document productions - On December 1, 2023, the Developers submitted incomplete payroll records. Ambase responded by requesting additional documentation or clarification for missing information. Developers, however, refused to address these deficiencies. Due to the lack of cooperation, Ambase requested the Court enforce a subpoena to obtain the complete payroll records for the project.

Disclaimer: The information and opinions expressed on this blog are for informational and educational purposes only and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities.

If you enjoy this service, please like and hit the “share” button, and give Under the Radars a well-deserved follow. Thank you.