This write-up was first published in A few micro-caps I'm looking at. We present it here separately to improve its visibility. Also, we just don’t like the old ‘lumped’ format anymore. Going forward, we’ll be publishing write-ups more separately instead of lumping them together as we have done recently. This will improve the timeliness of the ideas and the readability of the posts.

I’ll be shorter on this one, as it shouldn’t be a difficult thesis.

Butler provides aircraft modification, maintenance, repair and overhaul as well as gaming management services. The company operates two segments, Aerospace Products and Professional Services. Both are roughly evenly split in revenue generation.

The Aerospace segment focuses on aircraft modifications, avionics and regulatory-driven solutions. Think design, engineering, manufacturing, installation and repair of aircraft products and systems, both for commercial and military markets. Services range from special mission modifications to avionics upgrades and FAA-compliant installations.

The Professional Services provides management services in the gaming industry, including casino operations, through Butler National Service Corporation. It also offers architectural, engineering and management support services.

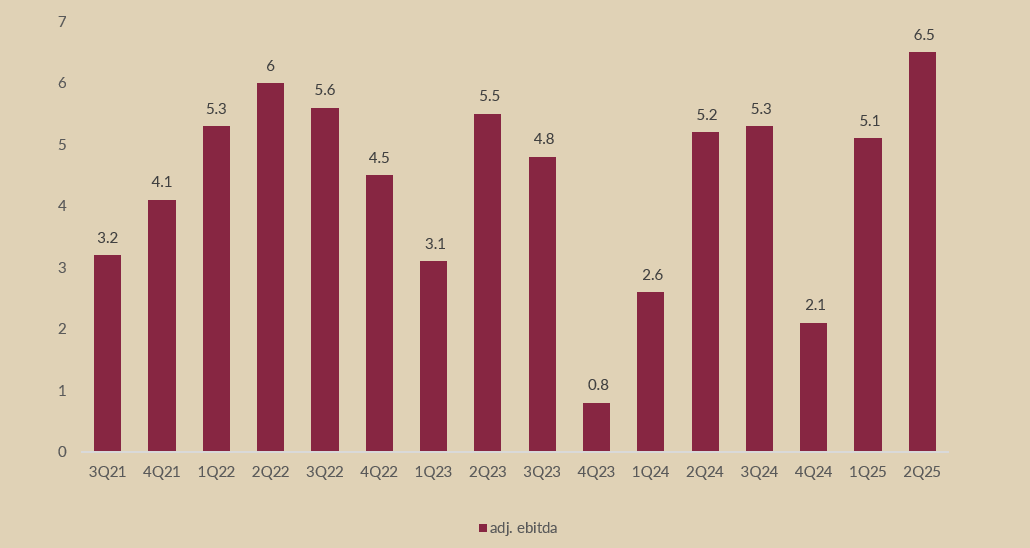

End markets have been pretty strong in both segments, and the company has done a good job in harvesting these tailwinds along with expanding its operations. As a results, Butler showed some good earnings, and the share price moved up strongly.

But despite the shares returning already +120% over the past year, Butler hits a few key items that make it still interesting to assess.

First of all, the stock popped up in our systems as insiders, in particular Joseph Daly (Director) - continue to scoop up shares despite the share price hitting new highs. This is one of the things we like to see when looking at insider transactions.

Also, the combo of what I believe could be stronger for longer end-markets, driven by enhanced investments in the defense sector as well as continued secular growth in sports wagering, should further drive demand for Butler’s products and services. This, combined with new product development, some targeted operational efficiencies and increased marketing efforts should be a driver for continued earnings growth over the next quarters.

The progress is also clearly visible in the company’s order backlog (mostly relating to Aerospace Products), which has moved to record levels. (Q2 25 ending Oct. 2024.)

Combined with what the company expects will be continued growth of the Professional Services segment – in part due to a contract with DraftKings to provide mobile and interactive sports wagering – this bodes well for the next few quarters’ earnings, particularly as the company will come up on easier comps (mainly Q4 25, ic the quarter ending April 2025).

Lastly, Butler mentioned that a top priority of the company’s cash management targets (as it expects to continue to generate healthy cash flow in the near term) will be to reduce the number of shares outstanding (i.c. buybacks).

All this makes it an interesting case.

As always there are some things to watch out for. At Butler I’m getting the feeling that now that some good times are rolling and the share price is moving strongly, insiders are starting to compensate themselves a bit too well. One example is a board member being granted 300k shares recently for ‘investor relation services’… 300k shares for investor relations stuff at a company like Butler? Where do I sign?

So that’ll be something to watch.

Nonetheless, annualizing the recent quarter, Butler is trading at ~5.5x ev/ebitda for >25% ebitda growth. Talking to the company and watching the backlog I get the feeling that at least a few good quarters are ahead. Should these continue to show the same growth dynamic, I believe the shares still have plenty of room to go.

But this one needs to be watched more carefully. At the moment I think it’ll make for a good trade, though I’m not yet convinced it will be a good investment.

If you value this write-up, please like and hit the “share” button below. Thank you.