ToffCap's Monday Monitor #20

Your regular monitor for interesting event-driven trades and companies

ToffCap’s Monday Monitor provides a snapshot of interesting potential investments and event-driven trades we find while turning over many rocks, with a special focus on companies that screen cheaply and catalyst trades. The list is dynamic; it continues to grow and change. If you have interesting additions to the list, feel free to contact us at contact@toffcap.com or on Twitter.

Enjoy!

Disclaimer. ToffCap’s Monday Monitor is provided for informative purposes only. No due diligence has (yet) been performed on the names on this list. The list might change strongly on a regular basis. This overview does not constitute advice; always do your own due diligence.

Important notice. We would like to publish the TMM on a weekly basis, but we need a more critical mass. If you enjoy this service, please like and hit the “share” button below. Thank you.

Overview

I. Company watchlist

II. Catalyst trades

I. COMPANY WATCHLIST

Interesting companies with seemingly strong upside potential we have looked at recently.

Additions this week

No ‘interesting company’ additions this week as we’re working hard on a few larger write-ups. One will discuss a net-cash mid-capper in the Energy space, trading at <2x ev/ebitda with a very large (and potentially imminent) catalyst on the horizon that will supercharge earnings. The second is a quality compounder with >30% IRR potential over the next 4-5 years. So keep an eye on the blog over the coming weeks!

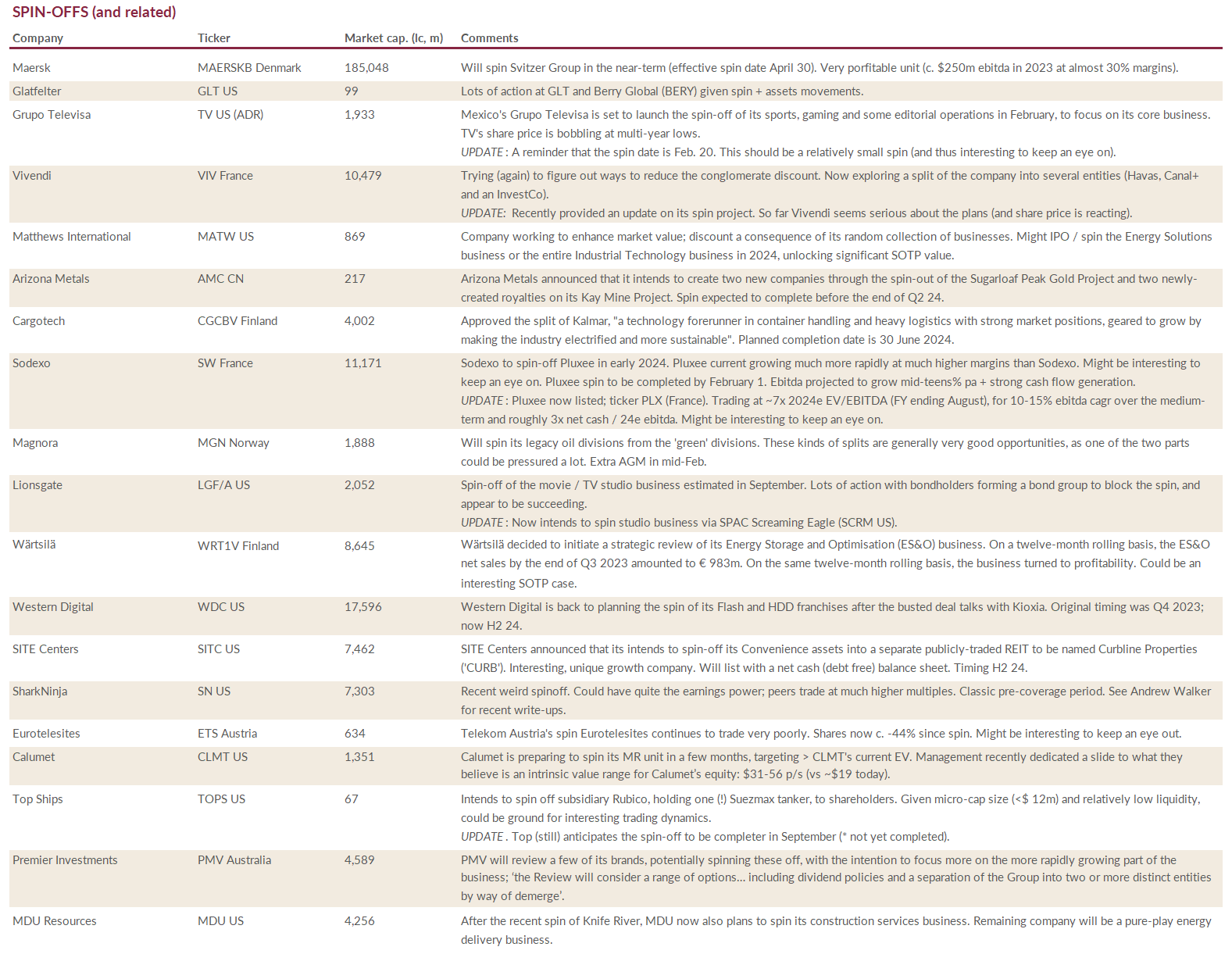

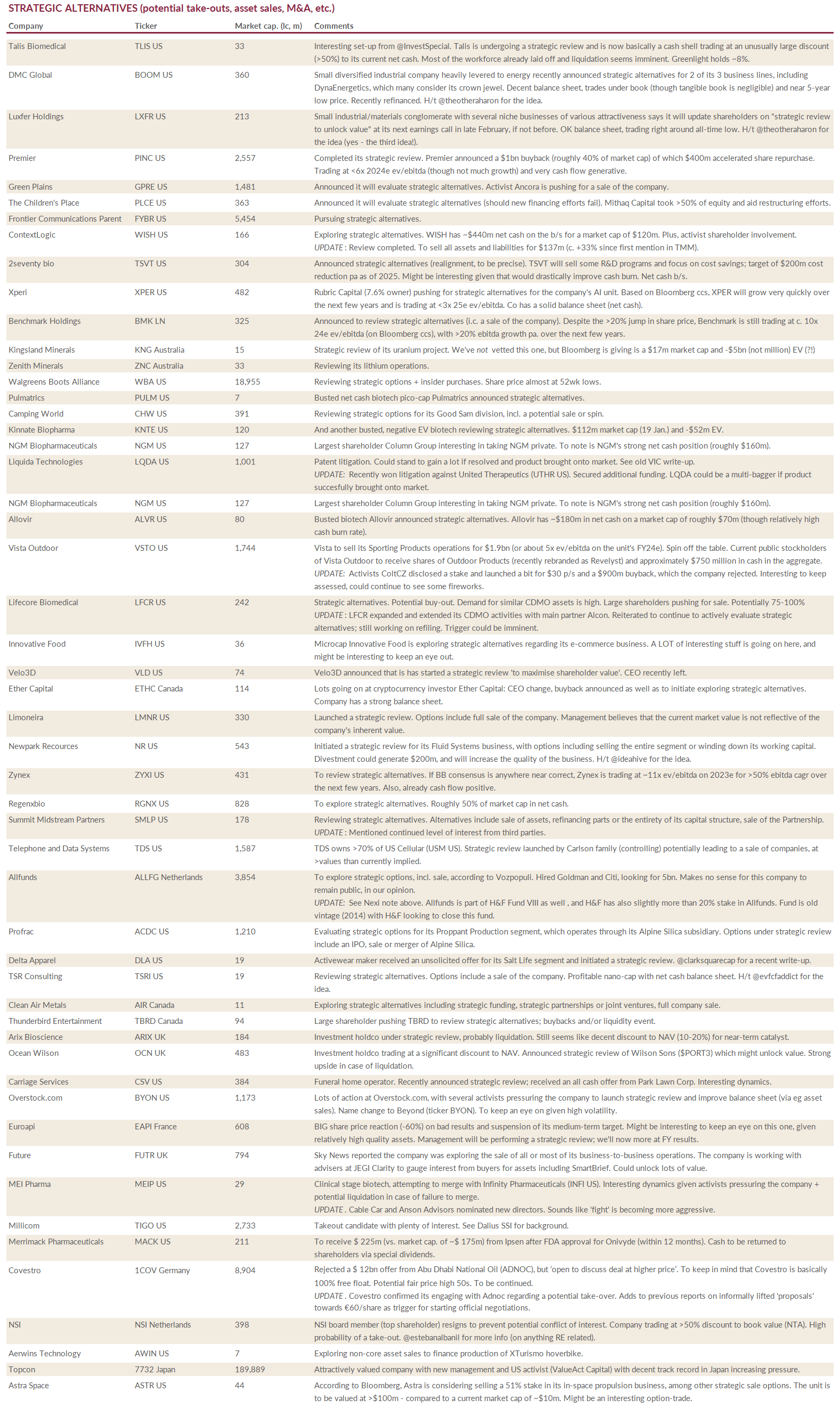

II. CATALYST TRADES

Event-driven trades and ideas.

New additions and updates

Maersk (MAERSKB Denmark). Will spin Svitzer Group in the near-term (effective spin date April 30). Very profitable unit (c. $250m ebitda in 2023 at almost 30% margins).

Glatfelter (GLT US). Lots of action at GLT and Berry Global (BERY) given spin + assets movements. Some comments here on the situation.

Grupo Televisa (TV US (ADR)). Mexico's Grupo Televisa is set to launch the spin-off of its sports, gaming and some editorial operations in February, to focus on its core business. TV's share price is bobbling at multi-year lows.

UPDATE: A reminder that the spin date is Feb. 20. This should be a relatively small spin (and thus interesting to keep an eye on).

Talis Biomedical (TLIS US). Interesting set-up from @InvestSpecial. Talis is undergoing a strategic review and is now basically a cash shell trading at an unusually large discount (>50%) to its current net cash. Most of the workforce already laid off and liquidation seems imminent. Greenlight holds ~8%.

DMC Global (BOOM US). Small diversified industrial company heavily levered to energy recently announced strategic alternatives for 2 of its 3 business lines, including DynaEnergetics, which many consider its crown jewel. Decent balance sheet, trades under book (though tangible book is negligible) and near 5-year low price. Recently refinanced. H/t @theotheraharon for the idea.

Luxfer Holdings (LXFR US). Small industrial/materials conglomerate with several niche businesses of various attractiveness says it will update shareholders on "strategic review to unlock value" at its next earnings call in late February, if not before. OK balance sheet, trading right around all-time low. H/t @theotheraharon for the idea (yes - the third idea!).

Premier (PINC US). Completed its strategic review. Premier announced a $1bn buyback (roughly 40% of market cap) of which $400m accelerated share repurchase. Trading at <6x 2024e ev/ebitda (though not much growth) and very cash flow generative.

Green Plains (GPRE US). Announced it will evaluate strategic alternatives. Activist Ancora is pushing for a sale of the company.

The Children's Place (PLCE US). Announced it will evaluate strategic alternatives (should new financing efforts fail). Mithaq Capital took >50% of equity and aid restructuring efforts.

Frontier Communications Parent (FYBR US). Pursuing strategic alternatives.

ContextLogic (WISH US). Exploring strategic alternatives. WISH has ~$440m net cash on the b/s for a market cap of $120m. Plus, activist shareholder involvement.

UPDATE: Review completed. To sell all assets and liabilities for $137m (c. +33% since first mention in TMM).

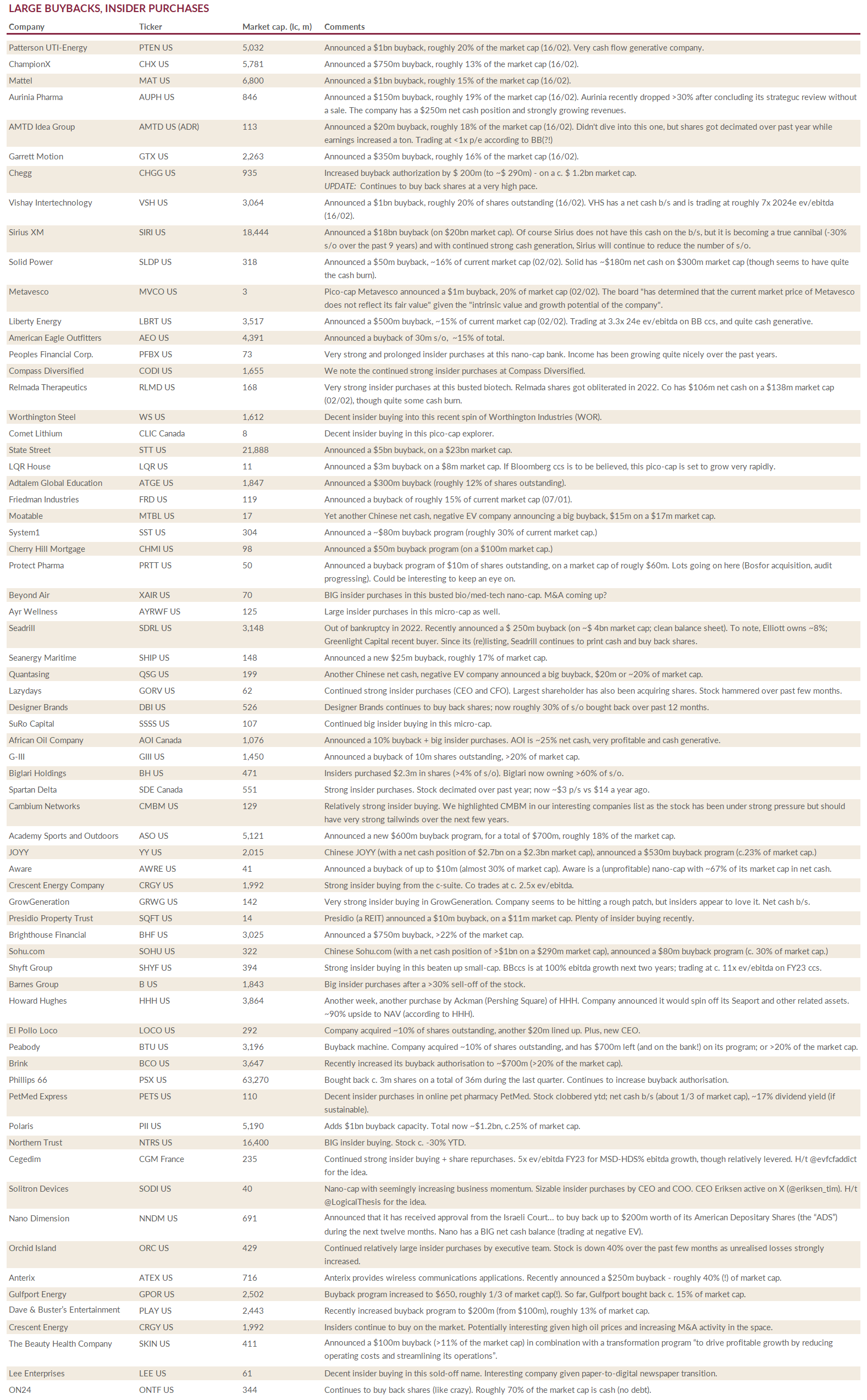

Chegg (CHGG US). Increased buyback authorization by $ 200m (to ~$ 290m) - on a c. $ 1.2bn market cap.

UPDATE: Continues to buy back shares at a very high pace.

ChampionX (CHX US). Announced a $750m buyback, roughly 13% of the market cap (16/02).

Mattel (MAT US). Announced a $1bn buyback, roughly 15% of the market cap (16/02).

Aurinia Pharma (AUPH US). Announced a $150m buyback, roughly 19% of the market cap (16/02). Aurinia recently dropped >30% after concluding its strateguc review without a sale. The company has a $250m net cash position and strongly growing revenues.

AMTD Idea Group (AMTD US (ADR)). Announced a $20m buyback, roughly 18% of the market cap (16/02). Didn't dive into this one, but shares got decimated over past year while earnings increased a ton. Trading at <1x p/e according to BB(?!)

Garrett Motion (GTX US). Announced a $350m buyback, roughly 16% of the market cap (16/02).

Patterson UTI-Energy (PTEN US). Announced a $1bn buyback, roughly 20% of the market cap (16/02). Very cash flow generative company.

Vishay Intertechnology (VSH US). Announced a $1bn buyback, roughly 20% of shares outstanding (16/02). VHS has a net cash b/s and is trading at roughly 7x 2024e ev/ebitda (16/02).

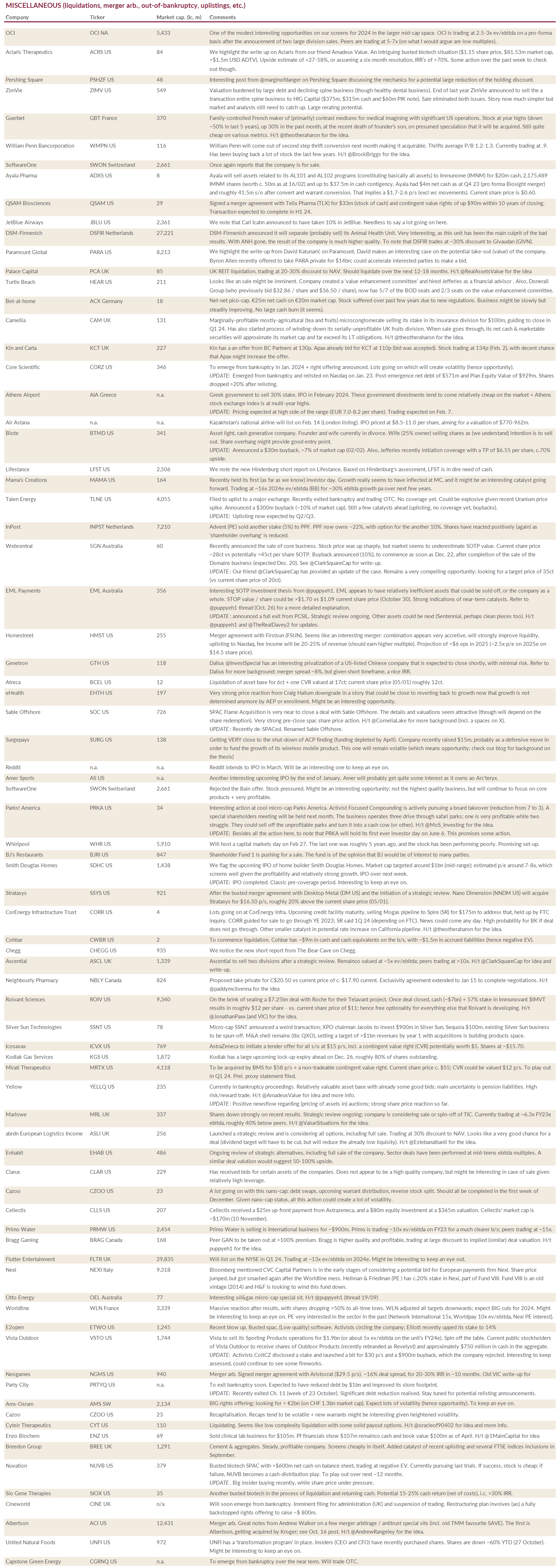

OCI (OCI NA). One of the modest interesting opportunities on our screens for 2024 in the larger mid-cap space. OCI is trading at 2.5-3x ev/ebitda on a pro-forma basis after the announcement of two large division sales. Peers are trading at 5-7x (on what I would argue are low multiples). Our tweet.

Aclaris Therapeutics (ACRS US). We highlight this write up on Aclaris from our friend Amadeus Value. An intriguing busted biotech situation ($1.15 share price, $81.53m market cap, >$1.5m USD ADTV). Upside estimate of +27-58%, or assuming a six-month resolution, IRR’s of >70%. Some action over the past week to check out though.

Pershing Square (PSHZF US). Interesting post from @marginofdanger on Pershing Square discussing the mechanics for a potential large reduction of the holding discount.

ZimVie (ZIMV US). Valuation burdened by large debt and declining spine business (though healthy dental business). End of last year ZimVie announced to sell the a transaction entire spine business to HIG Capital ($375m, $315m cash and $60m PIK note). Sale eliminated both issues. Story now much simpler but market and analysts still need to catch up. Large rerating potential.

Guerbet (GBT France). Family-controlled French maker of (primarily) contrast mediums for medical imagining with significant US operations. Stock at year highs (down ~50% in last 5 years), up 30% in the past month, at the recent death of founder's son, on presumed speculation that it will be acquired. Still quite cheap on various metrics. H/t @theotheraharon for the idea.

William Penn Bancorporation (WMPN US). William Penn will come out of second step thrift conversion next month making it acquirable. Thrifts average P/B 1.2-1.3. Currently trading at .9. Has been buying back a lot of stock the last few years. H/t @BrockBriggs for the idea.

SoftwareOne (SWON Switzerland). Once again reports that the company is for sale.

Ayala Pharma (ADXS US). Ayala will sell assets related to its AL101 and AL102 programs (constituting basically all assets) to Immunome (IMNM) for $20m cash, 2,175,489 IMNM shares (worth c. 50m as at 16/02) and up to $37.5m in cash contingency. Ayala had $4m net cash as at Q4 23 (pro forma Biosight merger) and roughly 41.5m s/o after convert and warrant conversion. That implies a $1.7-2.6 p/s (excl wc movements). Current share price is $0.60 (16/02).

QSAM Biosciences (QSAM US). Signed a merger agreement with Telix Pharma (TLX) for $33m (stock of cash) and contingent value rights of up $90m within 10 years of closing. Transaction expected to complete in H1 24.

JetBlue Airways (JBLU US). We note that Carl Icahn announced to have taken 10% in JetBlue. Needless to say a lot going on here.

DSM-Firmenich (DSFIR Netherlands). DSM-Firmenich announced it will separate (probably sell) its Animal Health Unit. Very interesting, as this unit has been the main culprit of the bad results. With ANH gone, the result of the company is much higher quality. To note that DSFIR trades at ~30% discount to Givaudan (GIVN).

Sable Offshore (SOC US). SPAC Flame Acquisition is very near to close a deal with Sable Offshore. The details and valuations seem attractive (though will depend on the share redemption). Very strong pre-close spac share price action. H/t @CorneliaLake for more background (incl. a spaces on X).

UPDATE: De-SPAC completed. Renamed Sable Offshore.

Overview of ongoing event-driven trades

If you enjoy this service, please like and hit the “share” button below. Thank you.

AMTD Idea Group "The PRC government’s significant authority to intervene in or influence the Mainland China operations of an offshore holding company at any time could limit our ability to transfer or use our cash outside of PRC, and could otherwise result in a material adverse change to our business operations, including our Hong Kong operations, and cause the ADSs to significantly decline in value or become worthless."

Talking about net cash, energy-related businesses at <2x EV/EBITDA

https://jaminvest.substack.com/p/odd-lots-3-dolphin-drilling